Welcome to the first issue of Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Significant reduction in number of completed merger reviews by the Bureau during COVID-19 (55 per cent decrease in May to July 2020, as compared to the same period in 2019)

- The Bureau released draft revised Competitor Collaboration Guidelines, welcoming comments from interested parties

- The Bureau announced an intention to begin a market study regarding digital healthcare across Canada

- Effective July 31, 2020, certain time frames under the Investment Canada Act relating to national security review periods have been temporarily extended

Merger Monitor

July 2020 Highlights

- 13 merger reviews completed

- Primary industries: manufacturing (23 per cent), information and cultural (15 per cent), mining, quarrying, and oil and gas extraction (15 per cent), real estate and rental and leasing (15 per cent)

- One consent agreement (remedies) filed ( Elanco Animal Health Inc. / Bayer Animal Health)

- Seven transactions received an Advance Ruling Certificate (54 per cent), while five transactions received a No Action Letter (38 per cent)

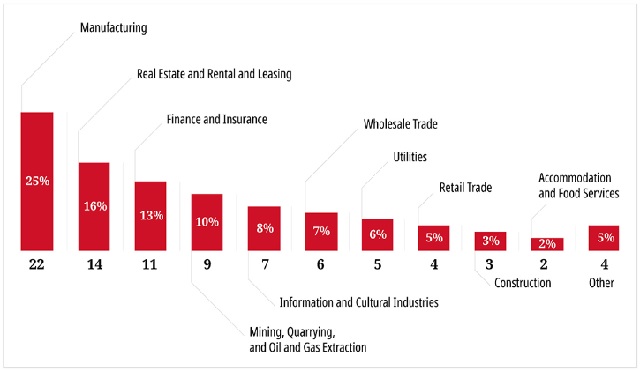

January – July 2020 Highlights

- 87 merger reviews completed

- Primary industries: manufacturing (25 per cent), real estate and rental and leasing (16 per cent), finance & insurance (13 per cent), and mining, quarrying, and oil and gas extraction (10 per cent)

- Two consent agreements (remedy) required

- 43 transactions received an Advance Ruling Certificate (49 per cent), while 42 transactions received a No Action Letter (48 per cent)

Bureau Merger Enforcement

On July 14, 2020, the Bureau entered into a consent agreement with Elanco Animal Health Inc. (Elanco) in respect of its proposed acquisition of Bayer Animal Health (BAH). In its position statement, the Bureau indicated that the transaction would have resulted in a substantial lessening of competition in three areas: the supply of low dose canine otitis treatments, feline dewormers that include tapeworm coverage and poultry insecticides that include darkling beetle coverage. The consent agreement requires Elanco to divest its low dose canine otitis treatment—with Dechra Veterinary Products LLC as an acceptable buyer—and one of BAH's feline dewormers, as well as commit to forego acquiring Bayer AG's Canadian distribution rights to certain poultry insecticides

On August 6, 2020, the Bureau entered into a consent agreement with WESCO International Inc. in respect of its proposed acquisition of Anixter International Inc. In its press release, the Bureau stated that the transaction would have combined the two largest distributors of pole line hardware and data communication products in Canada, and would have resulted in high market shares in various markets in Canada. It also indicated that remaining competitors could not offer comparable product selection, pricing and service, and that barriers to entry or expansion are high. The consent agreement requires WESCO to divest its datacom division and utility division.

Non-Enforcement Activity

Draft Competitor Collaboration Guidelines

On July 29, 2020, the Bureau published a draft version of the Competitor Collaboration Guidelines (Guidelines), requesting comments from interested parties by September 28, 2020. For more information, see our August 2020 Blakes Bulletin: Competition Bureau Releases Draft Competitor Collaboration Guidelines.

Draft Competitor Collaboration Guidelines

On July 29, 2020, the Bureau published a draft version of the Competitor Collaboration Guidelines (Guidelines), requesting comments from interested parties by September 28, 2020. For more information, see our August 2020 Blakes Bulletin: Competition Bureau Releases Draft Competitor Collaboration Guidelines.

Bureau Requests Feedback on Innovation and Choice in Canada's Healthcare Sector

On July 30, 2020, the Bureau announced its intention to undertake a market study to examine how to support digital healthcare across Canada through pro-competitive policies. The Bureau is seeking input regarding factors that may be restricting access to digital care or inhibiting innovation and choice, and proposed solutions to improve virtual health care for Canadians, which will allow the Bureau to make recommendations to decision-makers. The Bureau is accepting input from interested parties until September 27, 2020.

Letters and Submissions

Letter to the Ontario Minister of Government and Consumer Services Advocating for Increased Disclosure in Rental Appliance Contracts

On July 14, 2020, the Bureau published a letter to the Ontario Minister of Government and Consumer Services regarding disclosure of key contract terms in the rental appliance industry.

Submission to the Canadian Radio-television and Telecommunications Commission's (CRTC) Review of Mobile Wireless Services

On July 15, 2020, the Bureau published its submission to the CRTC's review of mobile wireless services.

Submission to the Government of Ontario Regarding Digital Health Interoperability

On July 23, 2020, the Bureau published its submission to the Government of Ontario regarding digital health interoperability.

Investment Canada Act

June 2020 Highlights

- For non-cultural investments: one reviewable investment approval and 61 notifications filed (37 for acquisitions and 24 for establishment of new Canadian business)

- For cultural investments (Q2 2020): zero reviewable investment proposal approvals and six notifications (one for an acquisition and five for establishment of new Canadian business)

- Country of origin of investor (non-cultural): U.S. (45 per cent), France (six per cent), China (six per cent), U.K. (five per cent), Australia (five per cent) and Ireland (five per cent)

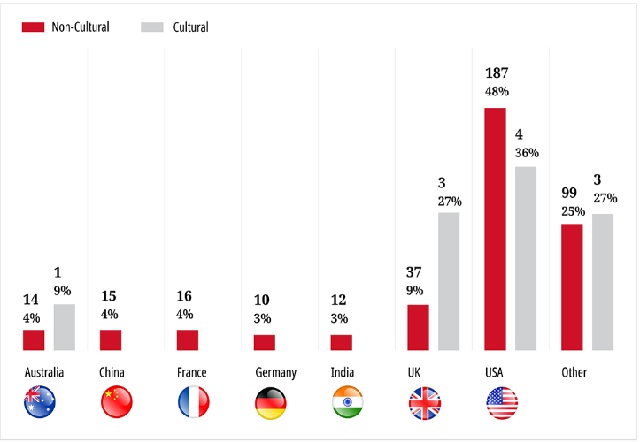

January – June 2020 Highlights

- For non-cultural investments: four reviewable investment approvals and 386 notifications filed (261 for acquisitions and 125 for establishment of new Canadian business)

- For cultural investments: zero reviewable investment proposal approvals and 11 notifications (five for acquisitions and six for establishment of new Canadian business)

- Country of origin of investor: U.S. (48 per cent), U.K. (10 per cent), France (four per cent), China (four per cent) and Australia (four per cent)

Temporary Extensions of Certain National Security Review Periods

Effective July 31, 2020, certain national security review periods under the Investment Canada Act have been temporarily extended in light of the COVID-19 pandemic to allow Canada's security and intelligence agencies to fully review investments that may be injurious to Canada's national security. For more information, see our August 2020 Blakes Bulletin: National Security Review Time Periods Temporarily Extended Under Investment Canada Act.

Originally published 12 August, 2020

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.