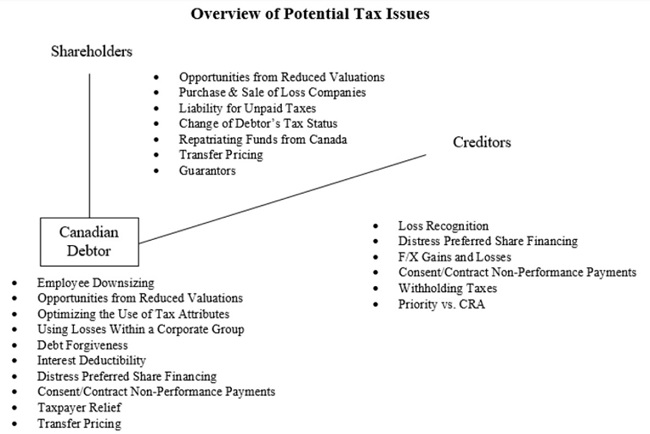

Economic uncertainty produces various challenges for businesses, some of which are more obvious and urgent than others. Whether or not arising as part of a court-based process under the Bankruptcy and Insolvency Act or the Companies' Creditors Arrangement Act, tax pitfalls arising from situations of financial distress (e.g., debt restructuring, cancelling contracts, reducing headcount) are not always easy to spot, and as with most things, to be forewarned is to be forearmed. This paper identifies the most important issues businesses face under the Income Tax Act (Canada) ("ITA") in the context of a challenging economic environment.

To begin with, it is important to note that times of depressed asset values may offer opportunities. One of the principal impediments to transferring assets is the potential taxation of accrued gains on them. A reduction or even elimination of such accrued gains due to adverse economic circumstances may allow an asset transfer that would not otherwise be possible, which can be helpful in various different scenarios. Moreover, one form of tax-advantaged financing ("distress preferred shares") is actually restricted to cases of debtor financial distress and so may be an opportunity not previously considered.

The financially troubled business may find it necessary to reduce its workforce or seek to amend or cancel contracts. Not all termination-related payments by employers are treated the same. Payments to secure the consent of creditors or for non-performance of contracts must also be considered in terms of deductibility to the payer and taxation to the recipient.

A business in a difficult economic situation can make the best possible use of its tax attributes (deductions, losses, credits, etc.) as a form of self-help, minimizing its tax burdens and potentially generating refunds of tax previously paid. Where the debtor is part of a corporate group, planning opportunities exist for optimizing the use of losses and deductions amongst the group members. Under certain circumstances, a corporation with significant losses can be sold to an arm's-length purchaser such that the purchaser can use the losses, but there are very significant limitations on such transactions and careful planning is necessary to achieve the desired result.

Debt restructurings generate various tax issues for both the debtor and its creditors. Debtors will be primarily concerned with managing the rules on "debt forgiveness," which create various adverse tax consequences for a debtor that settles (or is deemed to settle) a liability for less than 100 cents on the dollar. In most cases, any discount (the "forgiven amount") will reduce the debtor's favourable tax attributes or possibly even create an income inclusion for tax purposes, and careful planning is required to manage these complex rules. Debtors should also consider issues such as seeking relief from the Canada Revenue Agency (CRA) for interest and penalties, director liability for the corporate debtor's taxes, and the reversal of deductions taken for expenses accrued but not paid.

Creditors are primarily interested in ensuring that any losses arising in a financial distress scenario are crystallized, properly classified and not denied recognition for tax purposes. Separate rules apply to creditors that acquire a debtor's property on a debt default (i.e., realizing on security). Other creditor tax issues include the tax treatment of payments received for contract non-performance, foreign exchange gains and losses, and priority relative to the CRA's claims for tax debts.

Shareholders of a corporate debtor face tax issues of their own. They may be guarantors of the debtor's obligations or recipients of dividends that the CRA seeks to reclaim if the debtor cannot pay its tax debts. The tax status of a Canadian corporation may change due to it being in financial difficulty, often in a way that affects both it and its shareholders. Non-resident parent corporations and their Canadian subsidiaries should review the Canadian subsidiary's transfer pricing obligations on intra-group transactions and interest deductibility on cross-border debt. Further Canadian tax issues arise where the foreign parent seeks access to the Canadian subsidiary's cash.

To read the full article click here

Originally published 16 May, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.