Corporate Taxation

The standard corporate tax rate applicable to companies registered in Malta is 35% and there are no thresholds for reduced rates of taxation applicable. There are no controlled foreign company, thin capitalisation or transfer pricing rules applicable under Maltese legislation.

Following amendments implemented to the Maltese Income Tax Acts in 2007, in line with an agreement reached with the EU, a revamped system of corporate tax refunds is now available. The agreement that Malta has reached with the EU includes the retention of the full imputation tax system wherein tax paid by a company in Malta is imputed to the shareholder. The refund system was extended to all income derived from Malta and to all shareholders irrespective of their residence among other amendments. A company that is registered and taxable in Malta allocates its income to one of the five tax accounts depending on the nature of the income concerned.

A shareholder who receives a dividend from a company that is registered in Malta from profits allocated to the company's Maltese taxed Account or its Foreign Income Account and which does not consist of passive interest or royalties may claim back a refund of six-sevenths of the tax paid by the company on that income – the effective rate of Malta tax being 5%.

A shareholder who receives a dividend from a company that is registered in Malta from passive interest or royalties may claim back a refund of five-sevenths of the tax paid by the company on that income – the effective rate of Malta tax thereon being 10%.

The above two types of refunds are available in situations where the Maltese company does not claim double taxation relief which includes: Double Tax Relief under one of the Double Taxation Treaties that Malta is a party to, Unilateral Relief or the Flat Rate Foreign Tax Credit. The recipients of dividends distributed from the foreign income account on which the company has opted for double taxation relief will be entitled to a two thirds refund of the Malta tax paid. The former two are dependent on the tax paid outside of Malta and proof thereof is required, however the Flat Rate Foreign Tax Credit includes a mechanism where a deemed tax credit of 25% is given to the company, and two-thirds refund on the Malta tax paid is further provided to the shareholder – with an effective rate of Malta tax being 6.25%.

Shareholders must register with the Commissioner of Inland Revenue in order to benefit from the tax refunds mentioned above. Furthermore, any income or gains derived by a company registered in Malta from a participating holding or from the disposal of such holding, the company need not declare such income or gain in its tax return. Alternatively the company may be subject to tax at the full 35% rate and apply for a full refund of Malta tax paid. This option is limited by means of the introduction of several anti-abuse conditions that have to be satisfied before a holding is classified as a participating holding. Principally the shares held must be of at least 10% of the capital stock in the foreign company; or the value of shares exceeds 1.2 million Euro and is held for more than 183 days. The subsidiary entity must also either be an EU resident entity or is taxed at a rate not lower than 15% or derives less than 50% of its income from passive interest or royalties or is not a portfolio investment and is taxed at a rate of more than 5%. For all other entities that do not qualify as a participating holding under the above conditions, these will not be entitled to the exemption or full refund.

With the introduction of the new refund system available in Malta with effect from 1st January 2007, companies resident in Malta will no longer be able to apply for ITC status (international trading company – this company must be solely engaged in trading with persons outside Malta who are not Maltese residents and the members of such companies were granted refunds with an effective Malta tax burden of 4.17%). ITCs will lose their status by the 31st December 2010 but profits earned by such companies until such date will continue to be governed by the refund regime until 31st December 2014.

Branches that have been registered with the Commissioner of Inland Revenue will be entitled to the same treatment and relative refunds as companies registered in Malta on those profits attributable to the activities performed in Malta.

Fiscal Year

The fiscal/ financial year is defined in the financial year act. It states that the 31st of December shall be the date on which every financial year, subsequent to that ending on the 1st March, shall end.

Normally the fiscal year starts at the 1st of April and ends at the 31st of March, so it takes 12 months.

All tax returns must be filed by April 15th following the close of the calendar year. For Fiscal year taxpayers' returns must be filed within four months from the end of the fiscal year.

Payment of tax

An Individual who is a Maltese Resident pays tax on his income as a wage earner or as a self-employed person. A "permanent resident" will be taxed on his income in Malta and overseas. A foreign resident pays tax only on the income he earns in Malta. An employer is obligated to deduct at source, each month the amount of tax payable on a wage. There is the possibility to deduct certain payments from the taxable income of an individual. Passive income of a couple is attributed to the one, having the higher income.

Individuals have to file the annual return until August 30th. Self- Employed persons must make 3 equal advance payments on April 30th, August 31st and December 31st based on the taxable income for the previous year. Back duty has to be paid by the August 31 following the end of the tax year. Employed persons who are receiving a salary are not bound to file an annual return, but they have to submit a declaration by June 15th.

A similar declaration must be filed by an individual in respect of his income from a pension, dividend from a local corporation and income from an investment in respect of which tax of 15% was deducted at source.

Limited Companies have to submit a report on the date of 30th June. In practice, a report may be submitted up until September 30th. Advance payments for a company are on the dates and in the amounts specified for an individual. Annual tax differentials must be paid by September 30th.

Anti-abuse provisions have been introduced in order to mitigate aggressive tax planning.

Royalties and similar income accruing from patents on inventions to persons undertaking research leading to the development of such patents will be exempt from income tax. This exemption is conditional.

Capital Gains Tax

A tax on capital gains at the rate of 35% for companies is payable on the transfer of ownership of securities, business goodwill, copyrights, patents, trademarks and trade names and on the assignments of ownership rights over such properties. Capital gains by companies are computed separately and added to trading income in the same way as income from investments and non-trading income.

Capital losses may be carried forward and set off against future gains made from capital transfers. The capital gains tax enforcement provisions are integrated within the Income Tax Act. The tax is charged on gains from the sale of assets situated in Malta and on gains from the sale of assets situated abroad by persons domiciled and ordinarily resident in Malta. A provisional payment of 7% must be immediately paid to the Commissioner of Inland Revenue on signing of the deed of transfer.

Dividends

In terms of the full imputation system, resident companies are bound by law to withhold 35% company tax at source, originally paid by the company on all dividend payments made to shareholders. Since the paying company or organisations will have already paid the Government tax at 35% on profits, the company keeps the 35% withheld from dividends paid to shareholders so that in reality, companies in Malta effectively pay no income tax on distributed income. Company tax returns now in electronic format distinguish accounting profits between Foreign Income Account, the Malta Taxed Account and the untaxed account.

Interest Deduction

Interests on loan or other debts are also to be taxed with a corporate income tax rate of 35%. Malta grants a refund on dividends paid to non-residents. A non-resident company gets a refund of generally two-thirds of the Maltese tax paid by the resident company which paid dividends to the non-residents.

Repatriation of Profits

Malta does not levy any withholding tax payments of dividends to non-resident shareholders that facilitate the repatriation of profits to low-taxed jurisdictions.

Tax on the Transfer of Immovable Property

Following amendments to the Income Tax Act implemented in November 2005, transfers of immovable property are no longer subject to the capital gains rules but are subject to a final withholding tax of 12% on the transfer amount. The transferor may in certain circumstances opt to be taxed at standard rates on the gain made on the transfer. Under the old system the transferor would be subject to a 35% tax on the gains made from the transfer. Property that had been acquired through inheritance or partition prior to 1992 is taxed at a final withholding tax of 7%.

The current time window of five years during which taxpayers may opt to have profits or gains from the sale of real estate taxed at 35% rather than by way of the final withholding tax of 12% of the market value, was extended by two years, to seven years as from the year 2010. This option will be available for transfers occurring between 2010 and 2011.

Certain exceptions to the prior rule apply whereby the transferor may opt for the old system to apply (transferor must inform the notary who is publishing the deed). These include the following situations:

- When the property purchased is re-sold within a period of five years (when several transfers form part of a single project the transferor will have to opt under which rules he/she will be taxed at the time of the first transfer);

- Non-residents may opt to be taxed under the old system. A non-resident may only sell their property in Malta to a Maltese citizen. However, if he is not able to find a buyer who is either a Maltese or EU citizen, only then can he make the transfer to another foreign national. To qualify the non-resident has to produce a statement signed by the tax authorities of the country of that person's residence confirming that person's residence in that country and certifying that he is subject to tax in that country on profits derived from the transfer of immovable property situated in Malta;

- Companies that transfer immovable property that has been held for a minimum period of three years with the intention to purchase another property for the same purpose, will be entitled to apply for rollover relief under the old provisions (postponement of tax until second property is transferred).

- When the property transferred is located within a special designated area in terms of the Immovable Property (Acquisition by non-Residents) Act, should the transferor so choose at the time of the publication of the relative deed.

Certain transfers of immovable property are exempt from both capital gains and the final withholding tax, these include:

- The transfer of one's residence owned and occupied for at least three years;

- Transfer of property between companies within the same group.

Inheritance Taxes

There are no inheritance taxes in Malta. However in the event of death, the beneficiary is liable to 5% stamp duty on the value of the immovable property in Malta, as at time of death. If the property is jointly owned and one of the spouses passes away, the 5% is levied on half the value of the property. This tax is not payable upon the transfer of the residential home to the surviving spouse, provided that the surviving spouse does not sell the home during his/her lifetime.

Rental Income Taxes

Letting of property is allowed as long as a letting licence is obtained from the Malta Tourism Authority. Licences will be issued once the property meets first class standard requirements or consists of a villa with a pool. Properties may be rented under a long let or holiday licence.

Annual Property Taxes

There is no annual tax or rates on property.

Value Added Tax (VAT)

The standard VAT rate is 18%. With Malta's membership to the European Union, various changes to the VAT Act have become necessary. The changes relate mostly to Intra-Community and international operations as well as changes to the reporting system. Reduced rates of 5% and 0% apply in certain cases (e.g. food, pharmaceuticals, exports, local and international transport, printed matter and confectionary items. Some transactions are exempt (e.g. banking and insurance services and the sale of immovable property).

Every taxable person that makes intra-Community supplies of goods to businesses registered in other EU Member States is required to make a quarterly recapitulative statement. The information on this statement will be shared with the authorities of other Member States and is designed as a means of controlling supplies that are exempt in one Member State and are reported and taxed as acquisitions in another Member State.

Persons established in the European Union but not established in Malta, may qualify under the Special Refund Scheme. Maltese VAT incurred on services received by persons established in the EU but not in Malta, or goods supplied to persons established in the EU but not in Malta or charged on importation of goods into Malta may be refunded to such persons under the same conditions as those that govern the right of a taxable person registered for VAT in Malta to deduct Input VAT.

There are VAT refunds for research projects, as well as restoration projects and expenses for the construction of Church Schools.

Furthermore, no refund on VAT will be given if there are pending VAT returns.

Eco Contribution

The provisions of the Eco-Contribution Act have come into force as from September 2004. Producers are to charge the ecocontribution when items are first sold or transferred or otherwise disposed of, destroyed or when they are no longer in the manufacturer's possession. The VAT department is the competent authority for the administration of the Eco-Contribution Act. The liability for the payment of eco-contribution lies with the producers and they will be required to pay their dues through an ecocontribution return.

Individual Taxation

Personal income tax is paid on all income tax accruing in or derived from Malta and on income accruing in or delivered from abroad by persons domiciled and ordinarily resident in Malta. Income arising outside Malta to a person who is not ordinarily resident in Malta or not domiciled in Malta will be taxed only if it is received in Malta.

Expatriate employees are not considered to be ordinarily resident in Malta if they do not work or reside in Malta for more than 183 days in any one-year. The term income involves gains and profits from any trade, business, profession or vocation; gains or profits from any employment or office; dividends and interest; pensions, annuities or other annual payments; and rents, royalties or other profits derived from ownership of property.

Personal Income Tax Rates for the Year 2010:

Resident married couples opting for joint computation.

Fringe Benefits Tax

Certain benefits such as use of cars for private purposes, rent, school fees, free meals etc. are added to the salaries and taxed accordingly. All cash allowances paid to employees with the exception of cash allowances paid in respect of the use of employee-owned cars for business purposes are fully taxable. Employees are responsible for the disclosure of fringe benefits provided by third parties over which the employer has no control.

Employers are responsible for reporting the value of fringe benefits provided by them or by associated companies. Employers who fail to report the fringe benefits properly and on time will be subject to penalties. Employers have to keep records that show how the valuation of the fringe benefit was determined.

Residence in Malta

Malta has two most attractive residency schemes, which are probably the most advantageous schemes available throughout the European Union for persons wishing to change their tax residence. Moving your residence from a high-tax country to Malta could make huge savings on tax liabilities Ordinary residence (available only to EU nationals)

- No minimum residence stay requirement - you may even not spend any time in Malta

- No minimum annual tax

- No tax on your world wide wealth

- No tax on your world wide income which is not remitted to Malta

- No investment required

- No Inheritance Tax or Wealth Tax

- Easy qualification requirements

- Low tax rates on remitted income

- No border controls for travel within the Schengen Area (From January 2008 Malta has become a full member)

Permanent residence (available to all nationalities):

- No minimum residence stay requirement - you may even not spend any time in Malta

- Minimum annual tax of just Euro 4,200

- No tax on your world wide wealth

- No tax on your world wide income which is not remitted to Malta

- No investment required

- No Inheritance Tax or Wealth Tax

- Easy qualification requirements

- Fixed tax at 15% on remitted income (minimum as above)

- No border controls for travel within the Schengen Area (From January 2008 Malta has become a full member)

There is no difference in the legal concept of residence in both cases. The distinction between Ordinary and Permanent Residence is merely one of tax rates but the legal effect is the same in that you are deemed to be resident for tax purposes in Malta.

In the case of Ordinary Residents, the applicant must have a Maltese address prior to the application. The applicant will therefore need to buy or rent a property prior to the application being filed. The minimum value on the property being rented or bought must be the same minimums as for Permanent Residents.

Permanent residents must either purchase an apartment for not less than Euro 115,000 or lease/rent property for not less than Euro 4,200 per year within twelve months from the issue of the permit.

The ordinary resident is not restricted in any way as to the extent of income that must be remitted to Malta each year and there is no minimum remittance requirement. On the other hand the Permanent resident would also need to open a bank account in Malta into which account, he must annually deposit Euro 15,000 plus Euro 2,500 for his wife and for each dependant. The Permanent resident can freely use this money for any purpose whatsoever and provided the funds have been remitted to Malta, they need not be kept in the account. Neither is it necessary to keep this sum as a minimum deposit in the Maltese Bank account. All that is required is that over a period of twelve months, the sum of Euro 15,000 plus 2,500 is brought into Malta (for his wife each dependant if applicable).

Employment License

Foreign nationals require an employment license in order to work under employment, in Malta. The requirements for obtaining a work permit in Malta depend greatly upon whether the applicant is an EU citizen or otherwise.

An EU, EEA and Swiss citizen have to apply for their employment license by filling in a standard form provided by the Employment and Training Corporation. As from 2nd February 2009, these applicants will immediately be provided with a Provisional Employment License.

The provisional employment license is valid for 30 days from the date of submission of the application and until such time as another license is issued in respect of the same employee.

EU nationals have a right to reside in Malta if they are exercising any of their Treaty rights as workers, self-employed persons, economically self-sufficient persons or students. EU nationals and their family members can accept offers of work and seek employment in Malta, work (whether as an employee or in selfemployment) and/or set up a business. An employment license is not required in the case of self-employment.

A non-EU/EEA citizen is subject to more stringent conditions than the above. Such citizens must also fill in the requisite application form provided by the Employment and Training Centre. The said authorities generally require other documentation.

Flat Tax Option for Foreign High-Earners

A 15% flat tax on income to attract foreign workers engaged in specialised jobs will soon be introduced to make it attractive for companies to engage experts on a temporary basis.

The legislative move will be in harmonization with the income tax regimes currently in force for foreign workers in Malta and it is intended to help companies attract scientists and experts who may be required for particular jobs.

Currently, foreigners who are resident in Malta are taxed at the same rates applicable to Maltese residents. These are progressive rates of tax with a maximum rate of 35% with different tax rates for single and married individuals.

Income, arising in Malta to non-resident foreigners is also taxed at progressive rates with a maximum rate of 35%. However, the tax bands are significantly different. The first 700 Euros are tax-free while the next 2,400 Euros are taxed at 20% and the next 4,700 Euros are taxed at 35%. The current regime also has a flat tax rate option for foreigners who are registered in terms of the Resident Scheme Regulations. These are taxed at a flat rate of 15% subject to a minimum tax payment of 4,192 per annum.

The proposed legislation will apply to high-income non-resident foreigners engaged on a temporary basis.

Visas

On 21 December 2007 Malta joined the Schengen system at the end of a gradual process of adjusting to the common visa regime provided by the Convention Implementing the Schengen Agreement. While strengthening the common external border, there was a parallel and gradual removal of internal border controls, giving total freedom of movement within all the territories of the Schengen Area.

The right to free movement means that every EU citizen is entitled to travel freely around the Member States of the European Union, and settle anywhere within its territory. No special formalities are required to enter a EU country. This fundamental right extends to members of the EU citizen's family, and applies regardless of their situation or the reason for travel or residence.

The possession of a visa does not give the third country national the automatic right of entry, as bearers must prove that they will meet the conditions of entry.

Visas may be issued to an individual applicant and apposed to an individual passport. Group visas are issued to a group of aliens, all having the same nationality of the passport-issuing country, and provided that the document is expressly and formally recognized by Malta. Group visas cannot exceed 30 days.

Visas are divided into three main categories:

1. Schengen Visas.

These are valid for the territories of all the Schengen Member States and are further classified into the following sub-groups:

- Airport Transit Visa (Type A)

- Transit Visa (Type B)

- Short-Stay Visa (Type C), valid for up to 90 days and for single or multiple entries.

2. Limited Territorial Validity visas (LTV).

These are only valid for the Schengen State whose representative issued the visa (or in particular cases for other Schengen states where specifically named) without any possibility of access to or transit through the territory of any other Schengen States. They are issued solely for humanitarian reasons, or in the national interest, or under international obligations as an exception to the common system. An alien may not directly apply for these visas, which are issued in a few specific cases by the diplomatic or consular representative when it deems it appropriate to issue the visa for the reasons as stated even though not all the conditions are met for the issue of a Schengen Visa, or when the applicant does not hold a validly recognised travel document, in particular emergencies or in case of need.

3. 'Long stay' or "National" visas

These are only valid for visits that are longer than 90 days (Type D), with one or more entries, in the territory of the Schengen State whose diplomatic representative issued the visa, and to transit through the territory of other Schengen States for a period of not more than five days.

Regulations on stays exceeding 90 days fall within the competence of Malta's national authorities and third-country nationals requesting to enter Malta with a purpose of a long stay, will at first be granted a "national" visa in order to receive a residence permit.

Taxations of Trusts

The settlement of an asset on trust falls under the very wide definition of a taxable transfer and therefore subject to capital gains under the Income Tax Act, even if the transfer is made for no consideration. The Income Tax Act provides that gains and profits relating to settlement of property in trust means the difference in the market value of the property at the time of the settlement and the cost of acquisition of the property. The Act however does provide an exhaustive list of transfers that are subject to capital gains, where any transfers that fall outside the list are not subject to capital gains on settlement.

The law provides an exhaustive list of taxable transfers for capital gains purposes. Broadly speaking, these are the transfer of immovable property; the transfer of securities, business, goodwill, copyright, patents, trademarks and trade names, and the transfer of a beneficial interest in a trust (this is subject to certain particular exceptions, however it is not the purpose of this article to delve into the specific details of such exceptions). Therefore transfers that do not fall within these limits are not taxable transfers for capital gains.

It could be that the settlement of property on trust, that although is provided for in the exhaustive list mentioned above would be exempt from capital gains – either because the law provides that no transfer has in fact taken place or else because the law provides no gain or loss has been made on a particular transfer.

The law provides that no transfer has taken place when the three following conditions are satisfied:

- A trust is created by a written instrument

- There exists a sole settlor

- The sole settlor is also the sole beneficiary

The Income Tax Act also provides for an exemption from capital gains where:

- The settlor makes a direct donation of such trust to beneficiaries that are persons other than the settlor himself, and

- The relevant trust instrument specifically provides that the beneficiaries have an irrevocable vested right to receive all the property settled in trust as specified in the said written instrument, and

- The relevant trust instrument specifically provides that the beneficiaries are either the spouse, descendants and ascendants in the direct line and their relative spouses, or in the absence of descendants to his brothers or sisters and their descendants of the beneficiary, or

- Approved philanthropic institutions, and

- The beneficiaries include persons who are in existence at the time of the settlement of such property on trust.

Duty is due on the transfer of immovable property and related rights in accordance with the Duty on Documents and Transfers Act. This is also applicable to the settlement of relevant assets on trust. The Act does however provide certain exemptions. These exemptions include transfers by a settlor to the trustees of a trust which the settlor is the sole beneficiary and where the settlor has an irrevocable vested right to receive the trust property; transfers by a settlor to the trustees of a trust created for the purpose of a designated commercial transaction; and transfers by a settlor to the trustees of a trust created for the purpose of a commercial transaction not being a designated commercial transaction but which has been approved by the Commissioner of Inland Revenue.

Trusts are generally considered to be transparent for tax purposes, meaning that income attributable to a trust is not charged tax in the hands of the trustee if such income is distributed to the beneficiaries. When all the beneficiaries of a trust are non-Maltese residents and when all the income attributable to a trust is derived from sources outside Malta, there will be no tax impact under Maltese tax law. Beneficiaries are then charged tax on income distributed by the trustees. Income attributable to a trust that is not so distributed to beneficiaries is charged tax while in the hands of the trustee at the rate of 35% and there will be no further refunds or reductions.

It may be in the interest of the beneficiaries that any benefit that they receive from the trust is actually taxed in Malta. The Income Tax Acts provide the trustee with the irrevocable option to have a trust treated as a company for tax purposes. This would give the trust the possibility to make use of over forty double taxation treaties that are currently in force and the possibility to enjoy the various tax benefits provided to non-Maltese resident or domiciled shareholders. The non-resident beneficiaries will be eligible to receive the refunds provided under the Income Tax Acts as if they were shareholders; the trustee may also seek to obtain an advance revenue ruling from the Commissioner of Inland Revenue. Effectively this will grant the trust the possibility to be treated as a Maltese registered Company, alternatively the trust could operate what is known as the Foreign Income Account (FIA), where beneficiaries receiving distributions from the FIA are entitled to refunds reducing the effective tax rate to single digit figures.

As the Trust consists of the holding of property and other assets, there is no economic activity carried on and it is therefore outside the scope of VAT. Since the Trustee services essentially consist of management and administration of assets of which the Trustee is the legal owner, it is considered that any sums that the Trustee is entitled to appropriate from the trust assets by way of remuneration do not constitute a consideration for services rendered. Therefore no economic activity is deemed to be carried out, where such remuneration is specified under the terms of the deed of the Trust. However if the Trustee exploits the property of the Trust for a consideration then this exploitation is considered as an economic activity, and if such activity is taxable under Maltese VAT legislation, then the Trustee has to register for VAT in Malta.

Taxation of Partnership

Partnership En-Nom-Collectif is transparent for tax purposes and the partners declare their share of profit in their personal tax returns. Tax is therefore chargeable according to the applicable personal tax rates.

Partnership En-Commandite in terms of the Maltese Income Tax Act, which has its capital divided into shares will be treated as a company for Maltese income tax purposes.

Malta's Double Taxation Treaties

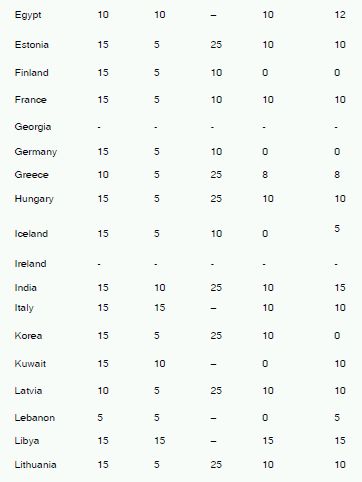

Malta has concluded various treaty agreements with 46 countries so as to avoid double taxation. Not all the agreements are already in force. The table below shows the maximum rates of tax on dividends, interest and royalties paid to residents of Malta.

* Treaty limited to income derived from the operation of ships or aircraft in international traffic.

A full double tax treaty was signed with the USA and is waiting ratification by the Senate.

Other treaties which were signed but are not in force are those with Bahrain, Belgium, Isle of Man, Jordan, Libya, Serbia, Russia, Switzerland and USA.

Treaties which are still being negotiated, or which are simply initialed.

Bosnia and Herzegovina

Serbia

Ukraine

Jordan

Oman

Thailand

Turkey

Saudi Arabia

(A) Rates applicable to minor shareholdings.

(B) Rates applicable to major shareholdings.

(C) Percentage required qualifying for major shareholding.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.