This document outlines the Capital Gains Tax implications of transfer of properties in Zimbabwe with emphasis on exemption available between related parties.

Capital Gains Tax

Capital Gains Tax (CGT) is a tax levied on the capital gain arising from the disposal of a specified asset. Specified asset means:

- immovable property (e.g. land and buildings) and

- any marketable security (e.g. debentures, shares, unit trusts, bonds and stock).

CGT Tax Rates

- Where the specified asset being disposed of/sold was acquired after the 1st of February 2009, Capital Gains Tax is chargeable at the rate of 20% of the capital gain.

- Where the specified asset being disposed of/sold was acquired before 1st February 2009, Capital Gains Tax is chargeable at the rate of 5% of the gross capital amount realized from the sale.

CGT Exemptions

Exemptions at a Glance

The Capital Gains Tax Act outlines a number of disposals where capital gains tax may not be payable. These include the following:

- Transfers of any specified assets between spouses.

- Transfer of principal private residence between former spouses in pursuit of a divorce order

- Transfer/disposal of a specified asset by a deceased estate

- Transfer/disposal of a principal private residence by an individual who is of or above the age of 55 as at date of sale/transfer.

- Disposal of a principal private residence by an individual where all the sale proceeds are used to acquire/construct a new principal private residence.

- Transfer of business property used for the purposes of trade by an individual to a company under his/her control where such company will continue to use the property for the purposes of trade.

- Donation of housing units to a local authority, approved employee share ownership trust or community share ownership trust or scheme.

Tax deferments

The various taxing Acts carry provisions for deferment of tax where companies under the same control are involved in a merger, scheme of reorganisation or reconstruction.

This can involve the whole or part of the business or businesses of one or more companies being transferred to another company ordinarily under the same control. For companies to be under the same control, the shareholding should not necessarily be 100% controlled, just merely majority control should be evident. Section 2(2) of the Income Tax Act provides that a company shall be deemed to be under the control of a person if the majority of the voting rights attaching to all classes of shares in the company is controlled, directly or indirectly, by the person and a person and his nominee shall be deemed to be one person.

Ordinarily these arrangements are framed as elections to be made by the taxpayer but in practice it is necessary to seek pre approval from the Zimbabwe Revenue Authority ( ZIMRA) not only to avoid disputes at a later stage but for cases involving say items subject to CGT so that a tax clearance certificate can be obtained to discharge the respective responsible parties of their obligation to withhold Capital Gains Witholding Tax.

Income Tax Act

The Act allows under a scheme of reconstruction of a group of companies or a merger or other business or operation which in the opinion of the Commissioner is of a similar nature for transfer of assets at their tax value. This implies that there is no taxable recoupment at the point of transfer. Tax is deferred until the assets are sold outside the group. Cash flow problems are avoided under the circumstances.

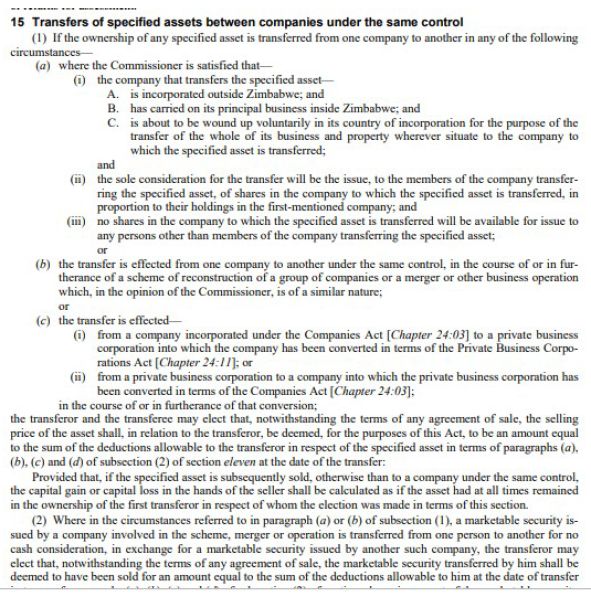

Capital Gains Tax Act

The same provisions as contained in the Income Tax Act are available in Section 15 of the Capital Gains Tax Act. The effect is that upon election by the transferor and the transferee regardless of the actual consideration of the specified asset, no capital gains tax arises on transfer of assets between companies under the same control. Full tax liability arises when the company sells outside the group. The Act also allows for individuals who are trading in their personal capacity to reorganise their affairs by granting roll over relief on the transfer of business assets into companies under their control where they wish to carry out their business through the mode of a company.

Finance Act

The Finance Act grants relief from stamp duties on transfer of immovable property that requires registration by the Registrar of Deeds.

Unlike the other provisions this is only availed in circumstances where a company transfers property to its wholly owned subsidiary or vice versa. It requires that the company remains wholly owned for at least 10 years after transfer to avoid triggering the original stamp duties avoided.

It should be noted that other transfer costs such as conveyancing are not relieved.

Valuation of Assets for CGT

Ordinarily the practice is to accept values of properties as declared by clients for Capital Gains Tax purposes. However, in certain circumstances, if in the opinion of the Commissioner, the value declared falls short of and is outside of fair/open market values for similar properties, then the Commissioner may invoke his power under Section 14 of the Capital Gains Tax Act to either uplift the value or call for a valuation report from a property valuer registered with the Valuers Council of Zimbabwe. Such circumstances may include, but are not limited to:

- Sale/transfer of property between related parties where the relationship affects the agreed price of the property.

- Deliberately under-declaring value of a property in order to evade payment of full Capital Gains Tax.

- Sale of a property in settlement of a debt by private treaty where the seller may deliberately under-declare the value of the property to "free" funds to cover a debt.

CGT Tax Clearance Certificate

Both the buyer and seller, or their authorized representatives will be required for separate interviews with ZIMRA as part of the process towards assessment of the Capital Gains Tax due or conclusion of the transaction whether or not Capital Gains Tax is payable.

A Capital Gains Tax clearance certificate will be issued once any amounts due have been paid and the transaction has been finalized by ZIMRA. This clearance certificate will be used to facilitate the transfer of the property to the new owner.

ZIMRA Requirements

The Revenue authority has provided the following requirements for a scheme of reconstruction: NB. Both companies must be registered with Zimra and up to date in all their registered tax heads – if not, they should both register

- CGT1

- Rev1 (if companies are not registered with Zimra already)

- Agreement

- Share certificates

- CR2/share register

- Title deeds

- Organogram before and after reconstruction

- CR14, CR6, Certificate of incorporation for both companies

- Board resolutions for both companies

- IDs for representatives

- Covering letter explaining nature and scope of transaction

- Memorandum and Articles of Association for both companies

A response can be obtained from the Commissioner within 14 days.

Annexure 1: Excerpt of Capital Gains Tax Act. Section 15

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.