PREFACE

This Guide has been produced as an aid to those seeking general information on charitable structures in Bermuda.

The information contained in this Guide is for information only and should not be considered as constituting legal advice. Readers are encouraged to consult their professional advisers before making decisions or taking actions on the numerous and complex issues involved in the establishment of a charitable structure.

It is recognized that this Guide will not completely answer the detailed questions that clients and their advisors may have. It is intended to provide a sketch of Bermuda's legal and regulatory environment in relation to charitable structures. This Guide is, therefore, designed as a starting-point for a more detailed and comprehensive discussion of the issues.

While we have made every effort to ensure the accuracy of the statements made herein, we accept no liability for any errors. In all cases expert legal advice from a qualified practitioner of Bermuda law should be obtained.

We acknowledge that certain sections of our Guide make reference to material appearing in the "Ready! Set! Go!" handbook produced by the Centre on Philanthropy with the assistance of Appleby.

1. INTRODUCTION TO CHARITY AND PHILANTHROPY IN BERMUDA

Bermuda has become an increasingly attractive jurisdiction for the establishment of trusts and charitable structures. Charitable and philanthropic structures commonly found in Bermuda include charitable trusts, purpose trusts and companies limited by guarantee.

Unincorporated associations and charitable entities incorporated by way of private act of parliament are also possible, but for the purposes of this Guide we will focus on the use of trusts and companies limited by guarantee in charitable structures.

There are over 420 registered charitable organizations in Bermuda, some large, some small, reflecting a wide diversity of purpose. Between them and their unregistered counterparts, they make a vital contribution to society in their efforts to respond to the many needs of the local and international community.

A. Meaning of "Charity" and "Charitable"

In a legal context, charity is usually referred to in relation to a trust or organisation established for charitable purposes. Putting aside for a moment definitions contained in the Charities Act 1978 (the "Act"), Bermuda's notion of charity derives primarily from English case law. The English courts have traditionally looked to an Elizabethan statute of 1601 for guidance as to what purposes should be regarded as charitable in law, but the bedrock of any discussion on the subject is found in the judgment of Lord Macnaghten in the 19th century case of Income Tax Special Purposes Commissioners v. Pemsel. In the light of that judgment, charity in its legal sense comprises four principal divisions:

- trusts for the relief of poverty;

- trusts for the advancement of education;

- trusts for the advancement of religion; and

- trusts for other purposes beneficial to the community not falling under a), b) or c).

B. Meaning of "Philanthropy"?

This is not a legal term. "Practical benevolence" is a good working definition. In a legal context, while what is charitable will be philanthropic, the reverse is not necessarily the case. A trust for a philanthropic cause which is not deemed charitable will, unless established as a non-charitable purpose trust (as to which see below), have to conform to the criteria applicable to a private trust. We refer you to our "Guide to Trusts in Bermuda".

2. CHARITABLE TRUSTS

These are trusts established for exclusively charitable purposes, which may be designed to continue indefinitely. Generally the sole trustee, or one of the trustees, will be a Bermuda licensed trust company.

A. Are Charitable Trusts Specially Regulated?

Not unless they fall under the Act, which maintains a regime for the control of charitable organisations registered under the Act. Here we have some statutory definitions: a "charitable organisation" for the purposes of the Act is a person (which includes a company) or body of persons having charitable purposes and relying for its funds substantially upon contributions from members of the public in Bermuda. "Charitable purposes" means purposes which are beneficial to the public in general or to a certain section of the public, whether in Bermuda or elsewhere. It follows that charitable trusts set up by international clients who are non-residents of Bermuda will not normally be concerned to seek registration under the Act or be affected by it.

Trustees are regulated by the Bermuda Monetary Authority under the Trusts (Regulation of Trust Business) Act 2001. Regulation of trustees is also achieved through the medium of the Proceeds of Crime Act 1997 and the Proceeds of Crime (Money Laundering) Regulations 1998. Professional trustees are required to have strong "Know Your Customer" procedures, which may be subject to regulatory inspection. Trustees will conduct extensive investigations to ensure that funds to be contributed to the charitable trust come from legitimate sources, that the purposes of the trust are genuinely charitable and that the funds are intended to be applied for those purposes.

B. Do Charitable Trusts Pay Any Taxes or Governmental Charges in Bermuda?

For all practical purposes the answer to this question is no. Bermuda has a stamp duty regime, but there is no duty on the document creating a trust, charitable or not, where the trustee is a Bermuda licensed trust company and the trust property is non-Bermuda property (which includes foreign securities and foreign currency bank balances) or where the trustee is an exempted company.

Furthermore, except in the case of a charity registered under the Act (which is required to file its accounts on an annual basis with the Charity Commissioners), there is no requirement to make any periodic or other filings with any governmental or regulatory authority.

C. Is Any Governmental Permission Required to Set Up a Charitable Trust?

No, but this is true of trusts (other than unit trusts) generally. However, if the trustees want to incorporate a company in Bermuda (for the purpose of, for example, holding investments) it will be necessary to submit an application for consent to incorporate to the appropriate agency. That would be the Bermuda Monetary Authority (the "BMA") in the case of a company with standard business objects, or the Ministry of Finance in other cases. For further details of the process, please refer to our "Guide to Companies in Bermuda".

D. Who Enforces a Charitable Trust?

The responsibility for enforcement rests with the Attorney General, acting in the public interest. In contrast to a private trust, there are no beneficiaries who can apply to the Court for enforcement.

3. PURPOSE TRUSTS

The concept of the non-charitable purpose trust (commonly referred to simply as a "purpose trust") was introduced in Bermuda in 1989 and has since been copied in several other offshore jurisdictions. It satisfies two quite different needs: one, where the purposes of the trust or some of them do not meet the criteria for what is charitable under Bermuda law (for example, to further the cause of a political party or to promote a non-charitable ideology); the other, for use in commercial situations where one is looking to achieve insulation or bankruptcy remoteness and the trust performs the role of owner. Such a trust has no beneficiaries, only purposes, and has been successfully used (in the present context) in the formation and ownership of private trust companies. For more on this subject, please refer to our "Guide to Trusts in Bermuda" and our Brief on "The Private Trust Company".

A. Characteristics of a Bermuda Purpose Trust

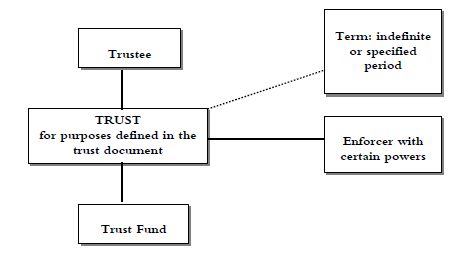

Here is a summary of the principal characteristics of a Bermuda purpose trust:

B. Typical Purpose Trust Structure:

Note:

(a) the Trust Fund may, for example, comprise of the share capital of a private trust company or other special purpose vehicle;

(b) the appointment of an enforcer is optional. Sometimes the enforcer is given additional powers e.g. the powers to appoint and remove trustees.

4. TRUST CONSIDERATIONS

There are many advantages and considerations of using a charitable or purpose trust structure. The following list is by no means exhaustive:

- Regulation – trusts are unregulated unless registered (optional) in Bermuda and therefore have fewer regulatory requirements than charitable companies limited by guarantee which are subject to the requirements of the Bermuda Companies Act 1981 (as amended and hereinafter the "Companies Act"). Where a trust is registered as a charity under the Act, the trustees must keep proper accounts and submit them to the Charity Commissioners on an annual basis.

- Formation time – with the correct legal assistance a trust can generally be established very quickly (this assumes that the provision of compliance related information is delivered in a timely manner).

- Flexibility – where trust instruments provide for variation, trusts can be very flexible vehicles that can adapt to changing circumstances and stay current.

- Costs – No annual Government or licence fees make trusts relatively inexpensive options. The costs to administer may vary.

Beneficiaries – trustees of a discretionary trust have full discretion as to which beneficiaries receive

which capital or income, if any.

- Liability – to avoid personal liability issues trustees should ensure that the trust instrument provides for trustee indemnification for breach of trust.

- Privacy – Bermuda does not require registration of trusts in any way, and parties to a trust are not listed in any register of trusts in Bermuda.

- Duration – generally speaking a Bermuda trust which does not hold Bermuda property can last in perpetuity or for some specified period.

5. COMPANIES LIMITED BY GUARANTEE

A. What is a Guarantee Company?

A company limited by guarantee (or "guarantee company") is formed by one or more persons (the "members") who subscribe their names to the memorandum of association and fullfill the other related requirements under the Companies Act. The Companies Act stipulates that the guarantee company shall only be formed if its purpose is to promote art, science, religion, charity, sport, education or any other social or useful purpose, it is a mutual company or a private trust company. A pre-condition of incorporation is that the profits, if any, and other income must only be used in promoting its purposes, and no dividends are to be paid to its members.

B. How is a Guarantee Gompany Formed?

The procedure for incorporating a guarantee company begins with the reservation of a name with the Bermuda Registrar of Companies. The reservation of a name is free. It is then necessary to advertise the intention to incorporate through a local newspaper. Once the memorandum of association is agreed by the members Ministerial approval is sought. Once approved the organisational meetings are held, at such time the bye-laws of the guarantee company are formally approved and the officers are appointed. Companies limited by guarantee are exempt from all annual taxes.

The memorandum of association for a guarantee company must state, amongst other things, that:-

i) the liability of its members is limited; and

ii) each member undertakes to contribute to the assets of the guarantee company in the event of it being wound up while he is a member or within one year after he ceases to be a member, for the payment of the debts and liabilities of the company contracted before he ceases to be a member, and of the costs charges and expenses of winding up, and for the adjustment of the rights of the contributories amongst themselves, such amount as may be required, not exceeding a specified amount.

The amount specified to be contributed by the members is referred to as the "guarantee fund". The Act does not specify a minimum or maximum amount for the guarantee fund and, in fact, we have seen a guarantee fund set as low as $100. However, it is recommended that consideration be given to an appropriate amount at which to set the guarantee fund.

The following are also provided for in the memorandum of association:

i) The objects of the guarantee company which may include any objects that are already contained in the existing organisational documents or mission statement of the foundation and, to the extent they are not provided for already, other standard objects for a company of this nature.

ii) All income of and property of the guarantee company must be applied solely towards the promotion of its objects as set out in the memorandum of association and that no portion thereof shall be paid or transferred directly or indirectly by way of dividend, bonus or otherwise by way of profit to the members of the guarantee company.

iii) If upon winding up there remains, after the satisfaction of all debts and liabilities of the guarantee company, any property, it shall not be paid to or distributed to or among the members of the guarantee company but shall be given to or transferred to some other charitable body or bodies having objects similar to those of the guarantee company.

C. Who are the Members?

Those persons who subscribe their names to the memorandum of association will be members of the guarantee company for the purposes of the Act and subject to liability to contribute to the assets of the guarantee company, but only to the extent of the guarantee fund.

In addition, the bye-laws of the guarantee company will provide that such other persons, who are approved by the board of directors, may be admitted to membership of the guarantee company. Such members will also be subject to liability to contribute to the assets of the guarantee company, but again only to the extent of the guarantee fund.

Admittance to membership of the guarantee company will necessarily involve the notification of the members' liability under the Act to contribute to the assets of the company to the extent of the guarantee fund. Alternatively, the foundation could have a separate category of membership, which does not attract liability under the Act. Persons falling into this separate category would be called something other than "members" (such as "friends of the foundation") and could continue to be associated with and contribute funds to the guarantee company, without attracting liability. Any differentiation in membership would be provided for in the bye-laws of the guarantee company.

D. Guarantee Company Considerations

- Participation – involves officers, committee members and members appointed democratically.

- Flexibility – company structure provides for flexibility and growth. Where provided in the company bye-laws, amendments to governance can be straight-forward and relatively inexpensive.

- Formation time – a company limited by guarantee can be incorporated in a matter of days (providing compliance information is forthcoming on a timely basis).

- Legal powers - a company has its own legal personality and undertakes all acitivites in its own name.

- Privacy – incorporated companies must submit relevant incorporation information to the Registrar of Companies along with an annual updated register of members. While these are unlikely to be overly revealing of any confidential information, this represents (marginally) less privacy than the Bermuda trust.

- Liability – the members of a company limited by guarantee are only liable for the amount contributed in the guarantee fund (usually a nominal sum such as $100), providing robust protection from personal liability for the members and governing board.

- Duration – companies limited by guarantee can exist into perpetuity and must only dissolve by a legal process known as winding up.

6. CONCLUSION

Bermuda enjoys a first-class reputation as an offshore centre for international business, and is increasingly becoming a location known for international charitable and philanthropic endeavours. Registration of a charitable structure is optional in Bermuda if funds are not solicited from the public in Bermuda, which can be a great advantage and provides some flexibility for international structures.

Bermuda has a favourable but well-respected regulatory regime and robust professional services industry. Some of the most well-known legal, accounting and trust administration service providers can be found in Bermuda. Each are highly capable with the set up, management and administration of trusts and limited companies, all of which combine to make a jurisdiction that is highly professional and able to meet the requirements of even the most demanding philanthropist.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.