As recently as the summer of 2008, many market commentators still believed we were still in a commodity bull market. Yet recent months have seen turmoil in the wider financial markets, significant falls in prices for most commodities and much market comment around liquidity and credit pressures.

Against this background, Deloitte Switzerland conducted a survey on risk management in today's commodity markets, reflecting Switzerland's position as a major world energy and commodity trading centre. Participants from all stages of the energy and commodity value chain took part and were predominantly, but not exclusively, Swiss-based.

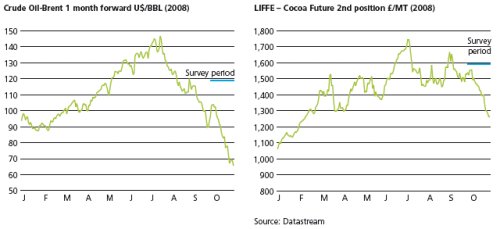

The survey took place between 22 September and 24 October 2008. This was a period of immense financial market turbulence including the launch of the US and European bank rescue schemes and significant government investment in various European banks.

The downward spiral of prices continued in this period, as illustrated in the graphs below and overleaf. This price decline coincided with, and was exacerbated by, slowing worldwide demand (impacting on many commodities), an uncertain investment climate and what several see as the end to the "commodity super-cycle". Commentators are divided as to the likely duration of these trends, or whether they will be reversed by inflationary policy responses.

The results of the survey are set out on the following pages, together with commentary on the key findings.

Key Findings

Key findings from the survey are:

- On balance, a majority of respondents believe that markets are sophisticated enough and liquid enough to manage the risks they face, and that there is sufficient information on market fundamentals to help price forecasting.

- Market participants' opinion is broadly split over whether markets will be more or less volatile in the coming year than in the current one.

- Nonetheless, 70% of respondents believe that risk and complexity will increase in the coming 12-18 months.

- Counterparty risk, liquidity risk and market risk are the top three risks identified by survey respondents as affecting them currently.

- Four in five respondents expect their risk monitoring to evolve in the coming year, by increasing the frequency of monitoring, the number of risks measured, the level of detail or the degree of centralisation.

- Three quarters of survey respondents expect regulation of their activities to increase over the next 12-18 months.

- Political and country risk remains an issue for some: rising country risk premiums, coupled with falling commodity prices and lower risk appetites, have the potential to reduce the incentive to invest.

- Three in five respondents foresee a worsening in capital available for investment and do not anticipate further investment being made to alleviate problems.

The findings highlight that, as a result of current market conditions, a number of organisations have changed aspects of the way they operate. Many expect to make further changes in the coming period, to respond to decreased availability (or higher-cost) of finance, increased credit risk, heightened regulation or elevated political/country risk. All of these factors are likely to increase the cost of doing business.

Organisations and management will need to ensure their current systems and strategies are sufficiently robust to respond to the current environment and dynamic enough to react to future changes.

Whatever and whenever the resolution of the current market turmoil, the results of the survey illustrate that market participants will need to keep a tight grip on all the tools in their risk management armoury in the period ahead.

MARKET CONDITIONS

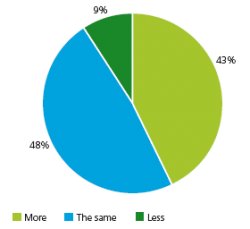

Do you expect that markets will be more or less volatile over the next year than over the previous year?

Whilst opinion was divided, a slightly higher proportion of respondents expected less volatility in the coming year than more. This can be attributed partly to falling prices, but also to wider market conditions, confidence and sentiment. A number of respondents referred to a reduction in volumes as a result of limitations on liquidity or credit, or clear concerns about counterparty risk.

In itself, this reduction in volumes might be expected to reduce volatility; at the time of writing, however, volatility, whilst reduced slightly from the peaks of summer 2008, is still at higher levels than earlier in the year. The absolute change in daily spot prices for Brent crude, for example, continues to show significant variation (see graph overleaf).

|

The Impact On Working Capital Several respondents alluded to the negative effect of recent high prices on working capital and hence volume of activity. Whilst the fall in prices had eased this effect for some, pressures are still felt from the restrictions on financing availability which some are currently experiencing. Others considered the issue to be less severe where they were able to manage working capital on a net basis, seeing liquidity availability as more constraining. The impact on funding cost, both of the working capital position and any guarantee deposits required, was also mentioned by some respondents. In addition to the increased cost of funding, the recent experience of many market participants is that trade finance, such as letters of credit, is harder to come by and/or subject to greater scrutiny than in the past. Those on the other side of such transactions face a choice of either accepting a degraded quality of credit or walking away from the business. Reduced (or non-increased) credit limits are also restricting volumes for some. Other notable responses included: "Working capital is affected through higher tenders for drilling and seismic acquisition. Financing for junior companies has been difficult since a lot of investors tend to be more risk averse." "Prices rose 30% but the banks followed thanks to the abundance of capital. When the prices fell, the capital fell faster." |

"The new market conditions are untested and not all players

are ready to face them."

Survey Participant

MORE RISKS ON THE RADAR...

The Major Risks

What do you consider to be the three greatest risks facing your organisation currently?

Unsurprisingly, in current market conditions, counterparty risk, liquidity risk and market risk are top of mind for respondents. This was also reflected in many of the enhancements which participants expected to make to their risk management or monitoring procedures (discussed below) and is fully consistent with observed behaviour in the wider markets at present.

The majority of respondents are taking steps to enhance aspects of their risk monitoring, with one reply referring to a "reassessment of capabilities from the bottom up". The panel overleaf highlights a selection of the specific measures being taken by respondents.

A key issue with implications for the longer term is human capital: recruitment and retention of talent is not only critical to immediate business needs, but the pipeline of new and experienced talent will need careful nurturing as much of the global economy enters a downturn.

Regulatory risk, as to be expected, was a key concern given the overriding view that regulation is likely to increase (this is discussed further on page 11). Also important (and in some cases closely linked to regulatory risk) is political risk. This comes in three guises: the impact of the economic and political environment in which some respondents (or their counterparties) operate, relationships between producers and host governments and the political/regulatory framework applicable to midstream or downstream users. With the tightening of returns currently being experienced it will become harder for many organisations to carry higher risk projects with elevated country risk. This has the potential to reduce investment flow into, and revenues for, emerging nations.

|

Responses To The Credit Crunch Over half of the survey respondents (53%) reported that they have reviewed their credit methodology in the light of current market conditions. As overall credit becomes scarcer, organisations are seeking to optimise their own credit policies. Some of the ways in which respondents' approaches have changed are:

In addition to these measures, our current experience is that a number of companies (or their lenders) are seeking more credit enhancements from counterparties, such as prepayments, margin deposits and/or greater use of letters of credit. Combined with the greater difficulties in obtaining such enhancements (as noted above), this is a cause of reduced trading volumes for some. |

...WITH NO IMMEDIATE RESPITE AHEAD

Do you see risk and complexity increasing or decreasing over the next 12-18 months?

Risk And Complexity

A large majority of respondents foresaw heightened risk and complexity in their markets in the coming year. This expectation was driven by a variety of factors, including:

- Heightened counterparty risk.

Counterparty risk has increased across the spectrum and, for some, is coupled with reduced liquidity. One consequence of greater counterparty risk is unintended exposure to market risk – failure of a counterparty could leave an organisation with an ostensibly square position exposed. - Expectation by some of greater volatility.

As noted above, almost half of respondents foresee more market volatility in the coming year. - Wider economic concerns.

Respondents were obviously concerned by the impact of recession and risk of further demand-side slowdown in wider markets. Additionally, some highlighted what they perceived as a lack of full transparency of demand conditions in their markets, making forward planning even more difficult. - Impact of emerging markets.

Several respondents considered that the increasing role of emerging markets would lead to heightened risk and volatility, with the potential, in the view of some respondents, to destabilise markets. - Conditions in the wider market.

Participants referred to loss of market confidence, the effect of wider financial crisis on liquidity and prices, current market turmoil and what one respondent described as a lack of capital throughout the entire chain, leading to higher risk of default throughout.

Those who expected similar levels of risk and complexity in the coming year noted high levels of complexity in some aspect of their operations already, with some referring particularly the EU's REACH regulations on importation of chemicals, which will have a significant effect on non-EU traders (see panel), especially for oil products. Others noted that they hoped for a return to pragmatism and that risk and complexity were already at extreme levels: "it can't get worse".

Those who expected a decrease in complexity in the next year attributed this sentiment to cautiousness on the part of market participants.

"I see complexity decreasing as sellers of complex

instruments step back a little and users learn the lessons of

buying structures they don't fully understand."

Survey Participant

|

What Is REACH? REACH (registration, evaluation and authorisation of chemicals) is a European Community Regulation (no. 1907/2006) which came into force on 1 June 2007. Its objective is to provide protection to human health and the environment from the use of chemicals by requiring those who manufacture or import chemicals in the EU to ensure they fully understand and manage the associated risks. The underlying ethos of the REACH regulation is "no data, no market". Failure to register a substance will mean it cannot be manufactured or imported in the EU in quantities over one tonne. It is expected that over 30,000 substances will be regulated by REACH and as such the new regulation will affect not just the chemical industry but a variety of industries which use REACH chemical substances in their supply chains, both upstream and downstream. This includes the petroleum sector, certain metals products and ethanol. |

Developments In Risk Monitoring

Do you expect your risk monitoring to evolve in the coming year?

Over four in five respondents expected their risk monitoring procedures to develop in the coming year. Whilst some considered further review would be necessary before determining the exact changes they would make, common enhancements which survey participants expected to make included:

- The number of variables monitored.

Participants referred to various risks which would receive greater attention in their monitoring procedures in future. These included credit risk, price risk, interest rate risk and currency risk. Others referred to more group-wide integrated risk management. - Greater centralisation of risk reviews.

Various respondents have begun to centralise their organisation-wide risk reviews. Businesses which had previously left the majority of this work to individual offices are now seeking to do this on a global basis. Whether across geographies or business lines, there is focus, in one respondent's words, on "integration of all credit risk silos". - Increased frequency of monitoring.

In particular, answers referred to more frequent and intensive (re-)assessment of counterparty, hedging and market risk. For one respondent, improved internal cash flow forecasting would form part of this.

- More detail.

Respondents commonly referred to greater conservatism, more detailed procedures and heightened analysis. Some respondents opined that an overall improvement in transparency in the financial world was required.

In addition, various respondents made reference to greater use of IT, both in terms of automation of procedures and recognition of the need to invest in systems improvements.

In addition to these measures, it will also prove necessary for some to review existing models, and particularly the assumptions some of those models make about liquidity. Consistent with the priority given to liquidity risk by survey respondents, some organisations will need to (re-) assess their approach to measuring and managing liquidity risk.

|

Organisation-Wide Risk Monitoring In the current market environment, as the responses to the survey confirm, there is a need for organisations to monitor and address liquidity, working capital and cash challenges on a business-wide basis, to avoid foregoing opportunities which might be missed from devolving this to different parts of the business. For some, improving visibility of these issues across the business will be important to understand cash trends and the projected covenant compliance position. |

HEDGING AND RISK MITIGATION

Are today's markets sophisticated enough to assist in managing the risks your organisation faces?

Are today's markets liquid enough to assist in managing the risks your organisation faces?

Whilst a majority of respondents considered that there was sufficient sophistication in the market to support their activities, a number of specific challenges were identified by some participants, including:

- lack of liquidity and transparency in certain markets;

- management of freight exposure and emissions; and

- inconsistent contractual documentation.

Sixty percent of the respondents to the survey believed that there continues to be sufficient liquidity in the markets. The fact that a significant minority believed liquidity to be an issue is consistent with observed market phenomena.

In the weeks leading up to the publication of this report, there has been significant press comment on the move to transfer over-the-counter transactions into clearing houses, or transact more business on-exchange.

Have your hedging strategies or instruments changed over the last year, or do you expect them to do so over the next year?

"Some markets are not liquid enough to manage risks

properly."

Survey Participant

Opinion was evenly divided between those who expected their hedging strategies to change over the coming year and those who did not. The attitude and approach to hedging will clearly depend on where the responding organisation is in the value chain from producer to consumer, as well as its risk appetite.

Changes foreseen by respondents to the survey included greater use of electronic trading and exchange clearing, in line with observed trends in recent months, as well as greater use of natural hedging. Several of the respondents who traded gas and power expected to make greater use of structured products in future. Others were reviewing risks not currently hedged to determine if this decision remained appropriate.

|

Tax Implications Of Hedging Tax implications were systematically considered by 46% of respondents in formulating their hedging strategies. Amongst trading organisations, however, this figure fell to 31%. Our experience in recent years is that the separation of the tax and risk management functions, combined with the execution of certain risk mitigation strategies (e.g. production hedging arrangements), has seen many organisations adversely affected from a tax standpoint. This is particularly the case where the consequences of hedging are analysed on a pre-tax rather than post-tax basis and highlights the need for companies at all stages of the energy and commodity value chain to ensure that the post-tax outcomes associated with any risk mitigation strategy are considered at inception. Similarly, any increased levels of risk monitoring should also take into account the tax consequences of strategies adopted. Such proactive and regular management of tax exposures is also of benefit in terms of management of liquidity and cash flow risks. |

REGULATION

Do you see regulation of your activities increasing or decreasing over the next 12-18 months?

Overall, three quarters of respondents expected further regulation of their activities in the coming year. Amongst the traders who responded, however, this figure was lower, at 63%.

Regulatory risk takes different forms for different market participants, from utilities whose pricing and returns are already regulated, to potential regulation of commodity trading activities which would be a new development for many market participants.

The overall response is consistent with general market expectations that, at some point, governments and regulators will review the underlying framework. For those whose activities are not currently regulated, this may well challenge the continuance of self-regulation.

Within the EU, the Markets in Financial Instruments Directive (MiFID) currently applies only to commodity derivatives when used for investment. It explicitly exempts those whose main business consists of dealing on their own account in commodities and/or commodity derivatives and who are not part of a group whose main business is the provision of other investment services or banking services. It remains to be seen whether, in the current financial climate, this or other regulations will be extended to include commodity producers and traders, and what the effect will be on those with operations established outside the EU.

In addition to regulation of trading, various respondents mentioned the impact of regulation on other aspects of their operations, such as REACH (above), or emissions. In jurisdictions where CO2 emissions are not yet regulated, organisations potentially affected will need to give thought to their strategies to monitor and transact in these markets.

Consequently, a key challenge for market participants will be to understand their ability to address and manage regulatory risk (in the many forms it may take), and to begin to consider the potential impact of regulation on their trading strategies.

INVESTMENT AND INFORMATION

Investment

Do markets give adequate price signals for investment?

Is there sufficient capital available for investment?

Do you see further investment being made to alleviate problems?

Do you see this getting better or worse?

"Banks need to become serious again and there should be

less fanning of the flames by the media."

Survey Participant

Respondents were broadly evenly balanced as to whether sufficient capital was available for investment. Three in five respondents did not see adequate market signals to encourage investment, nor an improvement in this situation. To encourage further investment, respondents considered that the following would be required:

- calm and stability;

- fair, consistent, stable, long-term regulation and clarity as to requirements;

- less speculation;

- greater macro-economic certainty;

- return of market confidence and re-establishment of trust; and

- transparency.

For some emerging markets, various market participants are experiencing rising country risk premiums, as a result of demand uncertainty and general re-rating of borrowing costs. Coupled with falling commodity prices and lower risk appetites, this has the potential to reduce the assessment of project viability at the margin and consequent incentive to invest.

Information

Is there enough information in terms of fundamentals (demand, supply, storage etc) to help price forecasting?

Respondents who considered there was a lack of information highlighted issues in certain crude oil markets (issues mentioned were production capacity and reserves), storage information, and the true physical balance of the market. This was emphasised by the concern of some over the influence of other factors on prices beside the fundamentals. Lack of visibility of demand was also an uncertainty for some, particularly in the current economic climate.

Several participants in the gas and power markets referred to lack of information in certain European markets.

"The influence of non "fundamental" factors is

ever increasing, and largely non-transparent – so it is

difficult, even with a fairly robust model of the

"fundamentals" to forecast prices accurately in the

short/medium term."

Survey Participant

CONCLUSION

The consistent message from survey respondents is one of cautiousness. It is, though, coupled with an overall belief that today's markets are sophisticated enough, and remain liquid enough, to manage the risks they face.

Nevertheless, there remains a widespread expectation that risk and complexity will increase in the short- to medium-term. Consequently, re-evaluation of the risks faced, and how these are monitored, is a priority for many.

Many respondents to the survey expect to make further changes in the coming period to aspects of the way they operate, to respond to decreased availability (or higher-cost) of finance, increased credit risk, heightened regulation or elevated political/country risk. All of these factors are likely to increase the cost of doing business.

In this context, there are a number of key issues which organisations will need to consider now:

- The need to ensure current business strategies and systems are sufficiently robust to respond to continued market turmoil, overall cautiousness in credit assessment and reduced liquidity and dynamic enough to respond to further changes.

- The need to monitor more risks, more frequently across the whole organisation and for existing measures and models of risk to be re-assessed to ensure they remain fit-for-purpose.

- The need to respond and adapt to changing and increasing regulatory requirements.

- The need to ensure tax implications of trading and hedging decisions are systematically taken into account.

- The impact on longer-term business strategies of the current investment climate.

Organisations which can respond positively, or even anticipate, these challenges, are likely to be best placed to retain a competitive advantage in today's markets.

|

Why Deloitte? Our energy, infrastructure and utilities group provides comprehensive, integrated solutions to the sector. These solutions address the range of challenges facing energy and commodity trading organisations as they adapt to changing regulatory environments, to political, economic and market pressure and to technological development. With specialist skills across audit, tax, consulting and corporate finance, we serve a significant proportion of the world's major energy and commodity trading companies. Our goal is to provide the industry with unparalleled service, innovation and critical thinking. |

ABOUT THE SURVEY

The survey took place between 22 September and 24 October 2008. Participants from all stages of the energy and commodity value chain took part and were predominantly, but not exclusively, Swiss-based.

The estimated combined revenues of the responding organisations are over $250 billion. The profile of the respondents is summarised below.

Profile Of Respondents

Revenues Of Respondents In $ Millions (Percentage Of Respondents In Category)

Type Of Organisation

Individuals Responding

Commodities Traded (%)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.