This digest highlights some of the significant legal work carried out by Conyers' lawyers since the start of 2020 for our corporate clients in markets around the globe. The deals include significant restructurings, IPOs, mergers and acquisitions, and finance transactions across a wide range of industry sectors including insurance, banking, investment funds, aviation, shipping, energy, telecoms, property development, healthcare, education and more.

The economic impact of the Covid-19 pandemic has been severe and far-reaching. We are seeing otherwise viable companies forced to restructure liabilities and business structures to try and salvage ongoing trading and keep ahead of the dark cloud of insolvency. It is no surprise that we have seen a rise in corporate restructurings and re-financings.

In Bermuda, the biggest deal of the year was the US$7 billion Digicel restructuring which involved an innovative Bermuda scheme of arrangement. There were also a number of significant financing deals involving the cruise line and aviation sectors, such as Carnival Corporation's US$6 billion private offering and Avolon Holdings' two private offerings totalling US$2.4 billion. M&A activity continued in the insurance sector, and there were two sizeable take-private deals, as well as the locally high-profile acquisition by Algonquin Power Utilities of the Ascendant Group, which owns Bermuda's power plant.

BVI M&A deals included advising AquaVenture Holdings Ltd on its US$1.1 billion acquisition by Culligan, one of the largest takeovers of a publicly-listed BVI company by transaction value. On the finance side, the firm advised Despegar, the leading online travel company in Latin America, on a series of financing transactions raising US$200 million to augment the company's liquidity levels which had been hit by Covid-19, and advised on its acquisition of an 84% equity stake in a Brazilian online payment platform. It was also a busy year for BVI funds with significant work for clients such as Kawa, ACE & Company and Orbimed Partners Ltd.

In the Cayman Islands, Stonegate Pub's US$1.57 billion bond issuance program was the largest in the UK since 2013. LatAm deals remained strong: Brazilian distance learning company, Vitru, had an IPO on Nasdaq and Brazilian facial-recognition company Acesso Digital had a US$107.5 million funding round. On the M&A side, the firm advised Chrysaor the UK's leading independent North Sea oil and gas group, on its proposed merger with Premier Oil plc through a reverse takeover, which will create the largest independent oil and gas company listed on the London Stock Exchange. There have been a number of insurance-related deals, including the establishment of US$1 billion Ivy Co-Investment Vehicle LLC.

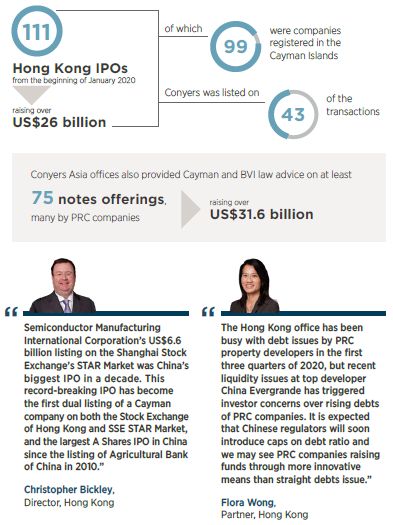

Our offices in Hong Kong and Singapore have continued to see significant deal flow in 2020, particularly with regard to capital markets. IPO activity remained strong and included China's largest IPO in a decade, the US$6.6 billion listing on Shanghai STAR market of Semiconductor Manufacturing International Corporation. Our Asia offices also provided Cayman and BVI law advice on at least 75 notes offerings, many by PRC companies, raising over US$31.6 billion.

We hope this digest will be of interest to our legal colleagues, clients and market followers.

CAPITAL MARKETS, FINANCE & RESTRUCTURING

At the start of 2020, many had predicted a shrinking capital markets landscape fueled by broad over-regulation and the decline of traditionally powerful financial centres such as London and New York. Whilst those underlying themes haven't completely disappeared, the global pandemic caused b y Covid-19 radically changed that outlook (at least in the short-term) and debt and equity capital markets deal-flow has been strong - buoyed by companies in various sectors looking to increase available cash levels to see them through this period of relative uncertainty.

2020 was a busy year for Conyers in respect of capital markets, finance and restructuring transactions, particularly as many businesses looked to address liquidity problems due to the Covid-19 crisis. Deals covered a wide range of sectors including banking, aviation, travel & tourism, food & beverage, and technology. Due to low interest rates and increased market volatility, 2020 has seen an increase in the use of Special Purpose Acquisition Companies (SPACs) for IPOs in the North American and London market. Both Bermuda and the Cayman Islands are ideally placed to provide an offshore domicile for these acquisition vehicles, and we anticipate seeing many more companies going public via SPACs over the next 12 to 18 months.

Deals

Advised Digicel on its US$7 billion debt restructuring

Bermuda: Directors Marcello Ausenda and Christian Luthi, Robert

Alexander, Counsel, and Associates Edward Rance, Rhys Williams,

Andrew Barnes and Jacari Brimmer-Landy

Sector: Technology & Communications

Advised Carnival Corporation on a private offering of US$6

billion in two tranches of notes

Bermuda: Victor Richards, Director, and Alexis Haynes,

Associate

Sector: Travel & Tourism

Advised Avolon Holdings Limited in connection with its two notes

offerings totalling US$2.4 billion

Bermuda: Jason Piney, Director, and Angela Atherden, Counsel

Sector: Aviation

Advised Stonegate Pub Company on its US$1.57 billion senior

secured fixed rate notes due 2025

Cayman: Matthew Stocker, Partner, and Alex Davies, Counsel

Sector: Food & Beverage

Advised Sensata Technologies in connection with its private

offering of US$750 million in senior notes due 2031

Bermuda: Julie McLean, Director, and Andrew Barnes, Associate

Sector: Technology & Communications

Advised Aircastle Limited on its US$650 million offering of

senior notes due 2025

Bermuda: Jason Piney, Director, and Angela Atherden, Counsel

Sector: Aviation

Advised Despegar in connection with their Covid-19 US$100

million debt facility and two preferred share financings totalling

US$200 million, and on their acquisition of an 84% equity stake in

Koin, a Brazilian online payment platform

BVI: Anton Goldstein, Partner, Nicholas Kuria, Counsel, and Rachael

Pape, Associate

Cayman: Nicholas Pattman, Partner, and Rory O'Connor,

Associate

Sector: Travel & Tourism

Provided Cayman law advice to Goldman Sachs & Co. LLC, as

underwriter to Vitru Limited, in connection with Vitru's IPO of

6,000,000 common shares listed on the Nasdaq exchange

Cayman: Cora Miller, Counsel

Sector: Education

Advised Union Asia Enterprise Holdings Limited in connection

with its share capital reorganization, share offer and

creditors' scheme of arrangement

Cayman: Ben Hobden, Partner

Hong Kong: Anna Chong, Partner, and Charissa Ball, Associate

Sector: Consumer Services

Advised J.P. Morgan in connection with the issue of US$500

million senior secured notes due 2025 by Del Monte Foods Inc.

BVI: Anton Goldstein, Partner, and Rachael Pape, Associate

Sector: Food & Beverage

Advised Liberty Latin America Ltd on a US$350 million rights

offering to holders of its common shares

Bermuda: Edward Rance and Karoline Tauschke, Associates

Sector: Telecommunications

Advised Acesso Digital on its US$107.5 million funding

round

Cayman: Nicholas Pattman, Partner, and Ali Low, Associate

Sector: Biometrics & Digital

Advised Citigroup Global Markets Inc. and Itau BBA Securities,

Inc. in connection with the pricing of US$350 million in senior

notes due 2027

Bermuda: Directors Jason Piney and Jennifer Panchaud, and Angela

Atherden, Counsel

Sector: Asset Management/Banks

Advised Global Container International LLC on its issuance of

$US244.5 million fixed rate asset backed bonds

Bermuda: Neil Henderson, Director, Angela Atherden, Counsel and

Amber Wilson, Associate

Sector: Shipping

ASIAN CAPITAL MARKETS & FINANCE

Following amendments to the Listing Rules permitting the listing in Hong Kong of companies with dual classes of shares/weighted voting rights, and non-profitable biotech companies, 2020 has seen a wave of these transactions. Especially popular with US listed Chinese businesses seeking a dual listing nearer to their natural market, 2020 has seen the dual listing of Alibaba, JD.com, NetEase, Huazhu Group and GDS Holdings, each of which has weighted voting rights.

2020 saw the successful first listing of a Cayman incorporated company - China Resources Microelectronics - on the Shanghai STAR market. Conyers also acted on the first dual listing of a Cayman incorporated entity: Semiconductor Manufacturing International Corporation, which was already listed in Hong Kong, also listed in Shanghai. From January to the end of October 2020, 99 Cayman companies launched IPOs on the SEHK with offerings totalling approximately US$15 billion. As usual, Conyers Hong Kong and Singapore offices saw a significant share of the deals, particularly in the real estate and property development sectors.

IPOs:

Cayman law advice for Semiconductor Manufacturing International

Corporation's US$6.6 billion IPO on the Sci-Tech Innovation

Board of the Shanghai Stock Exchange, or SSE STAR Market, and

US$600 million bonds issuance

Hong Kong: Christopher Bickley, Partner, and Rowan Wu, Legal

Manager

Sector: Technology and Communications

BVI and Cayman law advice for China Resources Microelectronics

Limited's US$636 million pioneering red-chip IPO on the

Sci-Tech Innovation Board of the Shanghai Stock Exchange, or SSE

STAR Market

Hong Kong: Partners Lilian Woo and Wynne Lau, Rowan Wu, Legal

Manager, and Beverly Cheung, Associate

Sector: Manufacturing

Cayman Islands and BVI legal advice to Smoore International

Holdings in connection with its US$918 million IPO on the main

board of The Stock Exchange of Hong Kong

Hong Kong: Richard Hall, Partner, Angie Chu, Counsel, and Yvonne

Lee, Legal Manager

BVI and Cayman law advice for Kingsoft Cloud Holdings

Limited's US$510 million IPO on the Nasdaq Global Select

Market

Hong Kong: Paul Lim, Partner, and Hollia Lam, Associate

Sector: Internet Services and Infrastructure

Cayman law advice for Central China New Life Limited's

US$265 million IPO and listing of 300,000,000 shares on the main

board of The Stock Exchange of Hong Kong

Hong Kong: Anna Chong, Partner

Sector: Property Management

BVI and Cayman law advice for Kintor Pharmaceutical

Limited's US$240 million IPO on the main boar d of The Stock

Exchange of Hong Kong

Hong Kong: Richard Hall, Partner, and Angie Chu, Counsel

Sector: Pharmaceuticals

Notes offerings and finance

BVI and Cayman law advice for Sunac China Holdings Limited's

three senior notes offerings totalling US$2.4 billion

Hong Kong: Anna Chong, Partner, and Charissa Ball, Associate

Sector: Real Estate/Property Developer

Bermuda and BVI law advice to CK Infrastructure Holdings Limited

(CKI) in connection with the update of a Euro medium term note

programme, valued at US$2 billion, guaranteed by CKI

Hong Kong: Bernadette Chen, Partner

Sector: Utilities

BVI and Cayman law advice for Central China Real Estate

Limited's four notes offerings totalling US$1.2 billion

Hong Kong: Anna Chong, Partner, and Alexander Doyle,

Associate

Sector: Real Estate/Property Developer

BVI and Cayman law advice for Fantasia Holding Group Co,

Limited's three senior notes offerings totalling US$1.1

billion

Hong Kong: Anna Chong, Partner, and Alexander Doyle,

Associate

Sector: Real Estate

Jiayuan International Group Limited's five senior notes

offerings totalling US$1.1 billion

Hong Kong: Wynne Lau, Partner, and Ryan McConvey, Associate

Sector: Property Developer

BVI and Cayman law advice for Golden Wheel Tiandi Holdings

Company Limited's four senior notes offerings totalling US$1.06

billion

Hong Kong: Richard Hall, Partner, and Ryan McConvey,

Associate

Sector: Asset Management/Banks

Conyers' Singapore office acted as special legal counsel to

Deutsche Bank AG (Sydney Branch, Singapore Branch and London

Branch) in connection with the US$2.1 billion refinancing of

existing debt facilities of the AirTrunk group of companies in

connection with the sale of AirTrunk group of companies to

Macquarie Group

Singapore: Preetha Pillai, Director Hong Kong: Angie Chu,

Counsel

Sector: Asset Management/Banks

Cayman law advice for Sino Biopharmaceutical Limited's

US$882 million convertible bonds issuance

Hong Kong: Anna Chong, Partner

Sector: Pharmaceuticals

New World Development Company Limited's two 5.25% guaranteed

senior perpetual capital securities totalling US$850 million and

NWD (MTN) Limited's US$600 million guaranteed bonds

issuance

Hong Kong: Richard Hall, Partner, and Ryan McConvey,

Associate

Sector: Property Developer

BVI and Cayman law advice for Redco Properties Group

Limited's four senior notes offerings totalling US$808

million

Hong Kong: Flora Wong, Partner, and Ryan McConvey, Associate

Sector: Property Developer

Bermuda and Cayman law advice for PCPD Capital Limited, a

subsidiary of Pacific Century Premium Developments Limited in

connection with a modification to its US$700 million guaranteed

notes programme

Hong Kong: Richard Hall, Partner and Ryan McConvey, Associate

Sector: Property Developer

Advised Agile Group Holdings Limited in connection with a

US$$418 million secured term loan facility and US$500 million in

senior notes due 2025

Hong Kong: Paul Lim, Partner, and Hollia Lam, Associate

Sector: Property Developer

Cayman law advice for Longfor Group Holdings Limited's

US$650 million senior notes offering

Hong Kong: Flora Wong, Partner, and Ryan McConvey, Associate

Sector: Real Estate

BVI and Cayman law advice for Modern Land (China) Co.,

Limited's five senior notes offerings totalling US$650

million

Hong Kong: Lilian Woo, Partner, Associates Ryan McConvey and

Alexander Doyle, and Yvonne Lee, Legal Manager

Sector: Property Developer

BVI and Cayman law advice for China Aoyuan Group Limited's

two senior notes offerings totalling US$648 million

Hong Kong: Paul Lim, Partner, and Hollia Lam, Associate

Sector: Property Developer

BVI and Cayman law advice for Ronshine China Holdings

Limited's three senior notes offerings totalling US$610

million

Hong Kong: Christopher Bickley, Partner, Ryan McConvey, Associate,

and Rowan Wu, Legal Manager

Sector: Property Developer

BVI and Bermuda law advice for Beijing Properties (Holdings)

Limited in connection with BPHL Capital Management Limited's

issue of US$600 million 5.95% guaranteed bonds due 2023

Hong Kong: Bernadette Chen, Partner

Sector: Property Developer

MERGERS & ACQUISITIONS

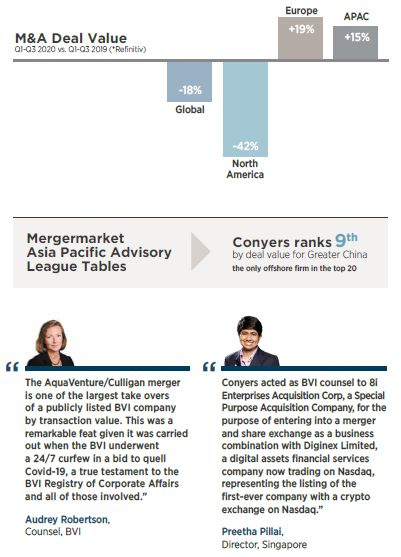

The Covid-19 crisis significantly impacted M&A deal volume globally in the first half of 2020, but the market rebounded in Q3 with a number of major deals. There has been a rise in alternative deal types including acquisition of minority stakes, joint ventures and corporate venture capital investments. The insurance sector has continued to see significant M&A activity (see Insurance, page 11).

The take-private trend that started in 2019 has accelerated. China-based companies listed in the US have been reassessing their strategy and many are opting to go private at this time, when valuations are depressed. Conyers has seen a significant number of take-privates of Bermuda, BVI and Cayman companies in 2020, with a total valuation in excess of US$17.4 billion.

Deals:

58.com Inc.'s US$8.7 billion privatization merger with

Quantum Bloom Company Ltd.

Hong Kong: Anna Chong, Partner, and Charissa Ball, Associate

Sector: Media

Jumei International Holding Ltd's US$2.9 billion

privatization by way of tender offer and short form merger Hong

Kong: David Lamb, Consultant, Angie Chu,

Counsel and Michael Yu, Associate

Sector: Retail

Sogou Inc.'s US$2.1 billion buyout and take private of

Tencent Holdings Ltd. Hong Kong: David Lamb, Consultant,

and Angie Chu, Counsel

Sector: Information Technology

Central European Media Enterprises Ltd.'s US$2.1 billion

take private by way of merger with TV Bermuda Ltd.

Bermuda: Guy Cooper, Director

Sector: Media

AquaVenture Holdings Limited's US$1.1 billion acquisition by

Culligan

BVI: Audrey Robertson, Counsel, and Marcus Hallan, Associate

Sector: Utilities

Li & Fung Limited's US$929 million privatization by way

of scheme of arrangement

Hong Kong: David Lamb, Consultant, and Yvonne Lee, Legal

Manager

Sector: Retail Supply Chain

Associated Partners LP's US$860 million acquisition of AP

WIP Investments Holdings, LP

BVI: Anton Goldstein, Partner, and Rachel Pape, Associate

Sector: Technology & Communications

Springland International Holdings Limited's US$580.6 million

privatization by way of scheme of arrangement by Octopus (China)

Holdings Limited

Hong Kong: Teresa Tsai, Partner, and Hollia Lam, Associate

Cayman: Ben Hobden, Partner

Sector: Commercial Properties

Meten International Education Group's US$535 million merger

transaction involving Special Purpose Acquisition Company EdtechX

Holdings Acquisition Corp.

Hong Kong: Christopher Bickley, Partner, and Ryan McConvey,

Associate

Sector: Technology & Communications

Morgan Stanley Infrastructure Partners' acquisition of Seven

Seas Water

BVI: Audrey Robertson, Counsel, and Marcus Hallan, Associate

Sector: Utilities

Algonquin Power & Utilities Corp.'s US$470 million

acquisition of all of Ascendant Group Limited's issued and

outstanding shares

Bermuda: Directors Marcello Ausenda, Chiara Nannini, Graham Collis,

Ben Adamson, Francesca Fox, and Kent Smith, Counsel, and Associates

Harry Kessaram, Andrew Barnes and Edward Rance

Sector: Utilities

Orthoise Investment Holdings Ltd.'s US$450 million

acquisition and privatization of a Taiwan listed company, On-Bright

Electronics Incorporated, by way of scheme of arrangement

Hong Kong: Flora Wong, Partner, Angie Chu, Counsel, and Michael Yu,

Associate

Sector: Technology & Communications

Hudson Ltd.'s US$311 million take private by way of merger

with Dufry Holdco Ltd. to become a wholly-owned subsidiary of

Dufry

Bermuda: Guy Cooper, Director

Sector: Travel & Tourism

8i Enterprises Acquisition Corp's merger and share exchange

business combination with Diginex Limited

Singapore: Preetha Pillai, Director

Hong Kong: Charissa Ball, Associate

Sector: FinTech

BBI Life Sciences Corporation's US$252.8 million

privatization by way of scheme of arrangement

Hong Kong: Bernadette Chen, Partner

Cayman: Ben Hobden, Partner

Sector: Life Sciences

Chrysaor's proposed merger with Premier Oil plc through a

reverse takeover

Cayman: Partners Craig Fulton and Ben Hobden, Counsels Alex Davies

and Barnabas Finnigan, and Philippa Gilkes, Associate

Sector: Oil & Gas

Changyou.com

Limited's US$580 million group reorganization by way of short

form merger with Changyou Merger Co. Limited

Hong Kong: David Lamb, Consultant, Angie Chu, Counsel, and Michael

Yu, Associate

Sector: Entertainment/Gaming

INSURANCE

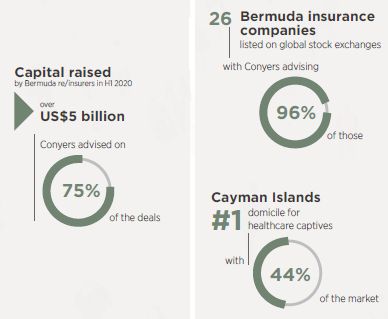

Bermuda re/insurers have raised billions in public offerings in 2020, as the sector faced the claims impact of the pandemic and took advantage of a pricing upswing. RenaissanceRe Holdings Ltd. and Arch Capital Group Ltd. both completed US$1 billion public offerings in June and Athene Holding Limited also raised approximately US$1 billion via two offerings: US$500 million in investment grade notes and US$600 million in a fixed rate preferred stock IPO. Essent Group Ltd. raised US$382 million in an offering of common shares and privately-owned Fidelis Insurance Holdings Limited completed a US$300 million bond offering. Conyers advised on all of these offerings. The firm was also involved in seven M&A deals in the Bermuda market from December 2019 to October 2020.

Conyers advised on the incorporation of the first incorporated segregated accounts company (ISAC) and incorporated segregated account (ISA) under Bermuda's new ISAC legislation, which became operative in January 2020. Both the ISAC and ISA were registered as insurers.

The Cayman captive insurance industry has continued to see growth, especially in complex group captive and sponsored platform structures using Segregated Portfolio Companies (SPCs) and Portfolio Insurance Companies (PICs).

Cayman is the leading jurisdiction for healthcare captives representing almost one-third of all healthcare captives globally. There are 775 licensed insurance entities currently registered in the Cayman Islands and approximately 134 SPCs. The jurisdiction also continues to see momentum on the reinsurance front with two new Class D reinsurance companies, RBC Reinsurance Company (Cayman) Limited and CIBC Cayman Reinsurance Limited, established in 2020.

Bermuda Deals:

Represented Athene Holding Ltd in a transaction with Apollo

Global Management Inc to eliminate the multi-class share structure

into a single class of common shares. As part of the transaction

Apollo also invested an additional US$1.6 billion in Athene.

Directors Charles Collis and Alexandra Macdonald, and Jacqueline

King, Associate

Advising Sirius International Insurance Group on its proposed

US$788 million combination with ThirdPoint Reinsurance Ltd.

Chris Garrod, Director, and Jacqueline King, Associate

Provided Bermuda advice to International General Insurance

Holdings Ltd. on its business combination agreement with special

purpose acquisition company Tiberius Acquisition Corp.

Directors Sophia Greaves and Jennifer Panchaud, and Associate Katie

Martin

Advised GreyCastle Holdings Ltd. and its shareholders on its

US$475 million sale to Monument Re Limited

Chiara Nannini, Director, and Alexis Haynes, Associate

Advised Sagicor Financial Corporation Limited on its acquisition

by Alignvest Acquisition II Corporation

Directors Sophia Greaves, Christian Luthi and Jennifer Panchaud,

and Associates Katie Martin and Rhys Williams

Advised The Carlyle Group on its US$500 million acquisition from

AIG of a 71.5% stake in Fortitude Group Holdings, which holds the

Bermuda registered Class 4 and Class E insurer, Fortitude

Reinsurance Company Ltd.

Charles Collis, Director, and Jacqueline King, Associate

Advised RenaissanceRe Holdings Ltd. on Bermuda law matters

relating to a US$338 million public sec ondary offering of common

shares by Tokio Marine & Nichido Fire Insurance Co., Ltd.

Directors Jennifer Panchaud and Chiara Nannini, and Edward Rance,

Associate

Advised Arch Capital Group Ltd. on its acquisition of Barbican

Group Holdings Limited, including Barbican Managing Agency Limited,

Lloyd's Syndicate 1955, Castel Underwriting Agencies Limited

and other entities

Graham Collis, Director

Advised London Life Insurance Company in connection with its

amalgamation with Great-West Life Assurance Company and Canada Life

Assurance Company

Sophia Greaves, Director, and Jessica Harris, Associate

Advised TigerRisk Partners LLC in connection with its

partnership with private equity firm Flexpoint Ford, LLC.

Chiara Nannini, Director

Advised White Mountains Insurance Group, Ltd. on its acquisition

of Ark Insurance Holdings Ltd.

Chris Garrod, Director, and Associates Jacqueline King and Cathryn

Minors

Acted as special counsel to Bellemeade Re 2019-4 Ltd. in

connection with its US$577.2 million establishment and licensing as

a special purpose insurer

Alexandra Macdonald, Director, and Associates William Cooper, Katie

Martin and Davina Hargun

Cayman Islands Deals:

Acted for Ivy Re Limited in connection with the establishment of

Ivy Co-Investment Vehicle LLC, sponsored by Global Atlantic

Financial Group Limited, designed to co-invest approximately US$1

billion with Global Atlantic and its subsidiaries in qualifying

reinsurance transactions

Derek Stenson, Partner, Jarladth Travers, SVP Conyers Services, and

Associates Philippa Gilkes, Michael O'Connor and Rory

O'Connor

Advised Oxford Risk Management Group on the formation, structure

and related regulation of two complex heterogeneous group captive

portfolio insurance companies

Rob Humphries, Counsel, and Paul Scrivener, Consultant

Advised RBC on the establishment of a new Class D licensed

reinsurer in the Cayman Islands, RBC Insurance Company (Cayman)

Limited

Derek Stenson, Partner, and Philippa Gilkes, Associate

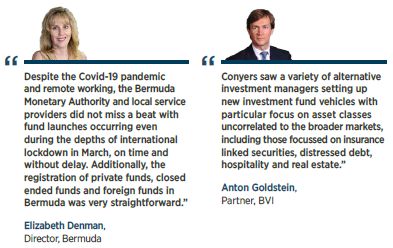

INVESTMENT FUNDS

Despite the Covid-19 pandemic, government mandated lockdowns and the adjustment to remote working, the hedge fund and private equity industry has been active and we have continued to launch international funds, particularly those with opportunistic strategies.

To remain in compliance with international requirements, all three jurisdictions made changes to their various Investment Funds laws this year, introducing new regulatory regimes which brought closed end funds under the scope of regulation in Bermuda, the Cayman Islands and the BVI for the first time.

Deals:

Advised Kawa Group in connection with its BVI domiciled funds,

which have approximately US$1.5 billion under management, in

particular the establishment of two new real estate funds of

US$76.5 million and US$55 million.

BVI: Anton Goldstein, Partner, and Associates Eric Flaye and Isabel

Dwan

Advised ACE & Company in connection with its US$500 million

establishment of private equity vehicles

BVI: Anton Goldstein, Partner

Providing BVI regulatory advice for Orbimed Partners, Ltd, which

has US$14 billion in assets under management

BVI: Audrey Robertson, Counsel

Bermuda: Elizabeth Denman, Director

Advised Adler Real Estate Partners in connection with its

formation and final closing of its US$138 million Fund IV and

ongoing matters

BVI: Anton Goldstein, Partner

Advised Marwyn Investment Management on the launch of three new

vehicles (still fund raising) to take advantage of

pandemic-related, distressed opportunities.

BVI: Anton Goldstein, Partner

Ongoing advice to a global real estate investment manager, and

its group of funds, acting as Cayman Islands legal counsel in

relation to the formation and ongoing operations of a number of

private equity investment fund structures and holding

entities.

Cayman: Matthew Stocker, Partner

MARITIME

Shipping and offshore energy remain important sectors for Conyers' corporate practice. In 2020, with the cruise industry severely impacted by the Covid-19 pandemic, Conyers provided Bermuda law advice in connection with several major deals involving some of the largest cruise companies in the industry. The firm also advised on some significant notes offerings for clients in the oil & gas sector. IPO activity in the shipping and offshore energy sectors was slow in 2020, with the firm involved in just one listing - BW Energy's IPO on the Oslo Börs in February.

Deals:

Advised Carnival Corporation on a private offering of US$6

billion in two tranches of notes

Bermuda: Victor Richards, Director, and Alexis Haynes,

Associate

Sector: Travel & Tourism

Advised Textainer Marine Containers VII Limited on its issuance

of an aggregate of US$1.28 billion of fixed rate asset backed

notes

Bermuda: Sophia Greaves, Director, and Associates Andrew Barnes and

Jacari Brimmer-Landy

Sector: Transportation

Advised CAL Funding IV Limited on its issuance of an aggregate

of US$743 million fixed rate asset backed notes

Bermuda: Sophia Greaves, Director, and Associates Andrew Barnes and

Jacari Brimmer-Landy

Sector: Transportation

Advised Viking Cruises Ltd. in connection with its US$675

million senior notes due 2025

Bermuda: Jason Piney, Director, and Andrew Barnes, Associate

Sector: Travel & Tourism

Advised L Catterton in connection with its US$400 million

investment by way of private placement by Norwegian Cruise Line

Holdings Limited

Bermuda: Directors Neil Henderson and Victor Richards, and Robert

Alexander, Counsel

Sector: Travel & Tourism

Advised Sinopec Group Overseas Development (2018) Limited on its

US$3 billion senior notes offering

Hong Kong: David Lamb, Consultant, and Felicity Lee,

Associate

Sector: Oil & Gas

Advised Tengizchevroil Finance Company International Inc. on its

US$1.25 billion bond issuances

Bermuda: Guy Cooper, Director and Katie Martin, Associate

Sector: Energy

Advised Nabors Industries Ltd. on its US$1 billion notes

issuance

Bermuda: Chiara Nannini, Director

Sector: Oil & Gas

Advised Weatherford International Plc on its US$500 million

asset backed senior secured notes issuance

Bermuda: Edward Rance, Karoline Tauschke, Robert Alexander,

Associates

Sector: Energy

Acted as special legal counsel to BW Energy Limited in

connection with its US$143.8 million initial public offering and

listing on the Oslo Stock Exchange

Bermuda: Directors Sophia Greaves and Jennifer Panchaud, and Katie

Martin, Associate

Sector: Oil & Gas

Corporate Digest: Notable Deals and Transactions – Winter 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.