The Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) officially launched the much-anticipated Variable Capital Companies (VCC) framework on 15 January 2020.

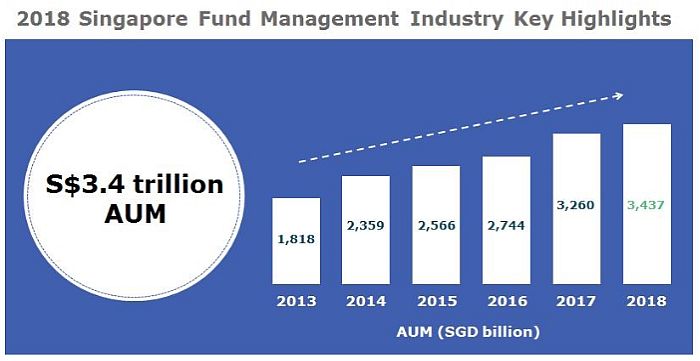

As a leading asset management hub with USD 2.4 trillion AUM, Singapore has long served as the investment gateway to Asia, with 67% of the total AUM invested in Asia Pacific1. In line with the hunt for yields in Asia's emerging countries, more than 30% of this AUM were investments into the Association of Southeast Asian Nations (ASEAN) countries.

SG AUM increased from approximately SGD 1.6 trillion in 20122

Leveraging on its strategic geographical location, stable political climate and an investment friendly regime (neither capital gains nor dividend taxes) the idea of a comprehensive and robust investment funds framework was floated in 20163. Public consultations led by MAS and implementation of the VCC framework were soon underway. The aim is to position Singapore as a leading fund domiciliation hub. It also catches Singapore up with the launch of the Asia Region Funds Passport scheme and the European Union's successful funds passporting scheme, Undertakings for Collective Investments in Transferable Securities (UCITS).

Why do we need the VCC?

Investment funds have long been structured either as a corporate vehicle (Private Limited Company) or a partnership (Limited Partnership) scheme under the Companies Act in Singapore. Though these structures are direct and easy to administer, each type of vehicle poses inflexibilities or constraints to running an asset management business in the long run.

With a typical corporate vehicle, subscription and redemption of shares becomes a cumbersome effort as changes to the capital structure require majority shareholders' approval, being detrimental to the fund taking on larger number of investors.

For a limited partnership, it doesn't have a separate legal entity from the partners and is thus unable to sue or be sued or own property in its own name. In addition, the entity is unable to tap on the 80 tax treaties that Singapore has in place with other countries.

The VCC is launched as a new corporate structure that aims to overcome these constraints, by allowing greater operational flexibility and thereby bring about cost savings to both investors and fund managers.

What's the VCC all about?

Catering to a wide range of investment strategies (traditional and alternative) and structure, the VCC can be used for either open or close-ended funds. It also allows a variable capital shareholding structure.

It can be setup as a standalone investment fund or structured as an umbrella fund with underlying sub-funds, holding segregated portfolios.

Five benefits of the VCC:

- By allowing segmented investment portfolios through the sub-funds, assets and liabilities can be clearly separated and ring-fenced

- Investors have the flexibility to enter and exit the fund as computation of their investment value is straightforward with the capital of the VCC being equal to the net assets

- Cost efficiencies can be achieved by having a single administrator, fund manager, custodian, auditor and compliance officer managing the main and sub funds as opposed to juggling multiple funds

- The ability to tap on Singapore's tax treaties as a legal entity for cross border investments

- Distribution of dividends from the capital to meet dividend obligation as opposed to only being allowed to distribute from the profits for a traditional corporate vehicle

Since the launch of the VCC framework in January, over 20 investment funds have been launched in the form of the VCC Structure. To further encourage the adoption of the VCC Structure, MAS will help defray the cost of setting up the fund through the Variable Capital Companies Grant. Up to 70% of the eligible expenses such as legal and tax advice, incorporation and registration fees, capped at a total of SGD 150,000 will be reimbursed by MAS4.

With over 60 years of experience in the fund administration business, we're a global leader in helping clients operate and invest in an international environment.

In Singapore, we're one of the pioneer fund administrators to provide tech-enabled tailored solutions to tackle the complex world of fund structuring, operational efficiency, governance and global regulation. Our team of specialists can help you with any questions regarding the requirements to set up a VCC structure.

Footnotes

1Singapore Asset Management Survey 2018

2 Singapore Asset Management Survery 2018

4 The grant amount covers a maximum of three VCCs per fund manager in each application.

Originally published by Intertrust, on June 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.