1.0 INVESTMENT CLIMATE

1.1 BUSINESS ENVIRONMENT

Malta is a fully independent republic with a parliamentary democracy and an elected president as the head of state. The president is elected every five years by the House of Representatives, which consists of 65 members of parliament. The role of the president as head of state is largely ceremonial. Executive power rests with the prime minister and his cabinet. Malta has two main political parties, the Nationalist Party and the Labor Party.

Malta's economy is dominated by the manufacturing, financial services, tourism and ICT (information and communication technologies) sectors.

Malta relies on foreign trade, as it produces only about 20% of its food needs, has limited freshwater supplies and no domestic energy source. France and Italy are the leading sources of imports. Malta's main exports are machinery and transport equipment. Trade is oriented toward the EU, Asia and the U.S. In principle, Malta has no restrictions on trade with any country, except for countries with regard to which UN restrictions are imposed.

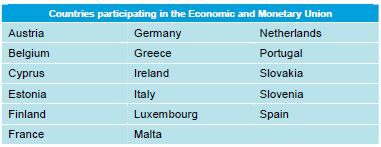

Malta joined the EU in 2004. As an EU member state, Malta is required to comply with all EU directives and regulations and it follows EU regulations on trade treaties, import regulations, customs duties, agricultural agreements, import quotas, rules of origin and other trade regulations. The EU has a single external tariff and a single market within its external borders. Restrictions on imports and exports apply in areas such as dual-use technology, protected species and some sensitive products from emerging economies. Trade also is governed by the rules of the World Trade Organization.

Price controls

Malta has a free market economy in which the principle of market forces is applied to price formation. Direct or indirect fixed purchase and selling prices are prohibited.

Intellectual property

According to the Enforcement of Intellectual Property Rights (Regulation) Act, intellectual property rights are rights accorded under the Copyright Act, the Trademarks Act and the Patents and Designs Act. Malta is a member of the World Intellectual Property Organization (WIPO), the Paris Convention for the Protection of Industrial Property, the Berne Convention for the Protection of Literary and Artistic Works, the Universal Copyright Convention (UCC), the WIPO Copyright Treaty, WIPO Performances and Phonograms Treaty and the World Trade Organization (WTO) Agreement. The necessary action is being taken to secure Malta's accession to the Protocol to the Madrid Agreement on the International Registration of Marks and the Hague Agreement on the International Registration of Designs.

Patents

The Patents and Designs Act provides that, under certain conditions, inventions that are new, involve an inventive step and are susceptible to industrial applications are patentable. An application for a patent must be made to the Office of the Comptroller of Industrial Property, which maintains a register of patents. The term of a patent is 20 years from the filing date of the application. Malta is a signatory to the European Patent Convention (EPC) and the Patent Co- operation Treaty (PCT), which simplifies the filing of patent applications and conducting innovation searches in participating states. Applications for patents under these agreements also may be filed at the Malta Office of the Comptroller of Industrial Property and the countries for which the patent is sought must be designated in the application. The Comptroller publishes a notification in the government gazette or other official publication that the Comptroller may prescribe as soon as possible after the decision is made to grant a patent. Infringement proceedings must be brought before the Civil Court, First Hall, within five years from the date the injured party obtains knowledge of an infringement and the identity of the alleged infringer.

Copyrights

The Copyright Act protects artistic works, audiovisual works, databases, literary works and musical works. Malta has transposed the Berne Convention (Paris Act) into Maltese law and implemented the pertinent provisions of the WTO Trade-Related Aspects of Intellectual Property Rights (TRIPs agreement). A person that infringes a copyright may be subject to damages and/or a fine. A copyright expires 70 years after the death of the author or 70 years from the year in which the copyright was made or from the year in which it was lawfully made available to the public. There is no requirement to register a copyright, but a Copyright Board exists to protect the interests of copyright holders in the different fields.

Trademarks

A registered trademark is a property right obtained by registration under the Trademarks Act; the proprietor of a registered trademark has the rights and remedies provided by the Act. A trademark means any sign capable of being represented graphically that is capable of distinguishing goods or services. An application for registration of a trademark must be made to the Comptroller of Industrial Property, who maintains a register of trademarks. The Act sets out several grounds for refusal of registration. Once an application has been accepted for registration, the certificate of registration must be issued and registration published in the official gazette or other official publication prescribed by the Comptroller. European trademark and design registration may be obtained from the EU's Office for Harmonization in the Internal Market (OHIM). Applications are made to the Malta Comptroller of Industrial Property and a selection can be made for any or all EU member states. Infringement of a registered trademark is actionable by the proprietor of the trademark by sworn application filed in the First Hall of the Civil Court.

1.2 CURRENCY

The currency in Malta is the Euro.

1.3 BANKING AND FINANCING

Banking and finance regulation is based on EU rules, in particular, the directives on banking, insurance and capital adequacy. The Banking Act regulates credit institutions and electronic money institutions. The Financial Institutions Act regulates institutions that do not take deposits or other repayable funds from the public.

All banking and financing services are available on the same terms to Malta-owned and foreign- owned companies. Malta is a growing financial center particularly for funds, securitization and (captive) insurance and re-insurance.

1.4 FOREIGN INVESTMENT

Malta welcomes foreign direct investment. Malta Enterprise is the agency responsible for the promotion of foreign investment and industrial development and for granting tax and nontax incentives to enterprises that carry out specific activities in Malta. There are no requirements for state or public participation in businesses established by foreigners (save for very few industries).

1.5 TAX INCENTIVES

Incentives fall under the following headings: Investment Aid, R&D and Innovation, Access to Finance, SME Development, Employment and Training, and Enterprise Support.

Investment Aid and R&D and Innovation incentives are effected through investment tax credits. The tax credit depends on the size of the enterprise and is offset against the company's tax liability for the relevant year of assessment, with any unabsorbed credits carried forward.

The incentives generally are targeted at enterprises that have a high value-added or high employment potential. Enterprises engaged in ICT development activities, manufacturing, audio visual and filming, healthcare, free port activities, eco-innovation and waste treatment, among others, may benefit from the incentives.

Other incentives are available to persons operating in the shipping industry. Income derived from the operation of qualifying vessels registered under the Maltese flag is exempt from income tax in Malta. The ship owner of a qualifying Malta-flagged vessel instead pays a pre-established annual "tonnage tax" computed on the basis of criteria such as the tonnage of the vessel.

Furthermore, the profits of a nonresident ship owner are exempt from tax in Malta, provided the country in which the nonresident ship owner is resident would extend a similar exemption to Malta resident ship owners.

The Freeport is a custom-free port located in the southeastern part of Malta, as is the third largest transshipment and logistics center in the Mediterranean region.

1.6 EXCHANGE CONTROLS

Malta abolished all exchange controls when it joined the EU, although it negotiated to retain certain restrictions concerning the acquisition by nonresidents of 25% or more of the shares in a Maltese company that owns directly or indirectly (or wishes to acquire) immovable property situated in Malta. In such cases, authorization must be requested from the local authorities.

2.0 SETTING UP A BUSINESS

2.1 PRINCIPAL FORMS OF BUSINESS ENTITY

The principal forms of business entity in Malta are the following:

- Limited liability company (public or private);

- General partnership;

- Limited partnership;

- Sole proprietorship; and

- Branch of a foreign company.

The Societas Europaea or SE company form also is available. The SE is designed to enable companies to operate across the EU with a single legal structure, to facilitate mergers and create flexibility for companies wanting to move their head office from one EU state to another. Companies from two or more EU member states are permitted to merge to form an SE or create an SE holding company or branch. A company may convert an existing firm to SE status without liquidating. One advantage of an SE is that it is possible to move headquarters to another EU member state with minimal formalities.

Businesses also can establish as a European Economic Interest Grouping (EEIG). Companies (even non-EU companies if the vehicle is a subsidiary in an EU country) that want to start working with a Maltese company, but do not want to commit to a formal joint venture may set up an EEIG. The grouping functions much like a partnership in that the income is taxed in the hands of the member companies. At least two of the companies involved must be from different EU member states.

Other company forms

Other forms of company that may be of interest to investors are the Investment Company with Fixed Share Capital (INVCO) and the Investment Company with Variable Share Capital (SICAV). The INVCO may take the form of a public company whose business typically consists of investing in funds (mainly securities with the aim of spreading investment risk and giving members of the company the benefit of the results of the management of its funds). The SICAV can be a public or private company whose memorandum limits the object of the company typically to the collective investment of its funds in securities and in other movable and/or immovable property with the aim of spreading investment risk and giving members of the company the benefit of the results of the management of its funds.

Associations en participation and cooperative societies, although not strictly companies, also may be formed under Maltese law. An association en participation is formed by means of an instrument in writing (a contract), whereby a person ("associate") assigns to another person ("associating party"), for valuable consideration contributed by the latter, a portion of the profits and losses of a business or of one or more commercial transactions. Such an association does not have legal personality distinct from that of its members. A cooperative society is defined in the Cooperative Societies Act (CSA) as an autonomous society of persons united voluntarily to meet their economic, social and cultural needs and aspirations, including employment, through a jointly owned and democratically controlled enterprise, in accordance with cooperative principles. The members of a cooperative society enjoy limited liability with regard to the obligations of the cooperative society.

A securitization vehicle may be set up under various forms.

Formalities for setting up a company

Every company and partnership must be registered with the Malta Registrar of Companies. A company or partnership will be validly constituted when a memorandum of association or a deed of partnership is entered into, and a certificate of registration is issued by the Registrar. This certificate sets out the date of registration, which is the date the company or partnership comes into existence and is authorized to commence business. The Companies Act sets out the specifics that need to be included in the memorandum of association and the deed of partnership.

The Continuation of Companies Regulations allow a body corporate, similar in nature to a Maltese limited liability company, which is formed and incorporated or registered under the laws of an approved country or jurisdiction, to request the Registrar of Companies in Malta to be registered as being continued or re-domiciled in Malta under the Companies Act if it is authorized to do so by its constitutive documents and if the laws of its place of registration sanction such a continuation. Limited liability companies registered and incorporated in Malta also may continue in, or re-domicile to, an approved jurisdiction outside Malta if the necessary authorization is obtained from the Malta Registrar of Companies. No tax implications arise in Malta upon corporate migration.

All businesses must register with the Inland Revenue Department and, if applicable, with the VAT authorities. A business with employees also must register with the social security authorities and the Employment Training Corporation (ETC). Commercial partnerships, including limited liability companies and branches of foreign companies, must register with the Registrar of Companies.

Forms of entity

Requirements for public/private limited liability company

Capital. Public: The issued share capital may not be less than the authorized minimum, currently EUR 46,587.47, and not less than 25% of the nominal value of each share taken up must be fully paid up at the time of incorporation. Also by allotment, shares must be paid up to at least 25% of their nominal value. Private: The issued share capital may not be less than the authorized minimum, currently EUR 1,164.69, and not less than 20% of the nominal value of each share taken up must be fully paid up at the time of incorporation. Also by allotment, shares must be paid up to at least 20% of their nominal value.

Founders, shareholders. Public and private: To constitute a company, a memorandum of association and voluntary articles of association must be subscribed by at least two persons and a certificate of registration must be issued by the Registrar of Companies. At least two shareholders are required and a private company must limit the number of its shareholders to 50. Nominee shareholders are permitted, in principle. There are no requirements on nationality or residence. A private company also may be set up as an exempt private company, provided the memorandum or articles of association restrict the number of persons holding debentures of the company to 50, prohibit any body corporate from holding shares (unless the body corporate is itself an exempt private limited liability company) or debentures of the company, prohibit bodies corporate from acting as directors of the company and prohibit any of the directors from being a party to an arrangement whereby the policy of the company can be determined by persons other than the directors, members or debenture holders of the company. An exempt private company may, in turn, be set up as a single member company.

Management. Public and private: The management of the company's business is entrusted to the board of directors, although if authorized by the articles of association, the board may delegate certain aspects of its functions and responsibilities to a person(s) appointed as agent(s) or attorney(s) of the company. A public company must have at least two directors and a company secretary; a private company must have at least one director and a company secretary. Corporate entities are permitted as directors for public companies and nonexempt private companies. The board of directors has full authority to manage the company's business and exercise powers as specified in the memorandum of association. Directors are liable for proper execution of the duties to the company and for compliance with all legal obligations imposed on them. There are no requirements on nationality or residence.

Disclosure. Public and private: Upon incorporation, a company must submit its memorandum and articles of association, if any, with the Registrar of Companies. The memorandum must include whether the company is public or private, the name and residence of each of the subscribers, the name and purpose(s) of the company, the address of the registered office in Malta, the name and residence of the first directors and company secretary, the manner in which the representation of the company is to be exercised and the name of the first person(s) vested with such representation, and the amount of share capital, including further information on the shares.

Taxes and fees. Public and private: The fee for registration depends on the amount of authorized share capital, with the minimum being EUR 210 and the maximum EUR 2,250. The fee for the registration of an annual return also depends on the amount of the authorized share capital and ranges from EUR 85 up to EUR 1,400.

There are no taxes chargeable upon the incorporation of a company, the initial contribution of capital (unless the contribution consists of a chargeable capital asset under the Income Tax Act) or on an increase in the share capital.

Stamp duty is chargeable at a rate of 5% or 2% on the amount of consideration, or the real value (whichever is the higher), received pursuant to a transfer of marketable securities.

Types of shares. Public and private: Different share classes may be issued with preferred, deferred or other special rights or restrictions, whether in regard to dividend, voting, return of capital, etc. The ordinary shares of a company may not be redeemable, and every company must have ordinary shares at all times. Only preference shares that are to be redeemed or are liable to be redeemed by the terms of their issue will be redeemable, and other shares in a company may not be converted into redeemable shares. The company can reduce or increase its issued share capital and is required to keep a register of its shareholders. A company is not entitled to acquire its own shares, unless specific requirements or circumstances set out in the Companies Act are met.

The share capital of a company may be denominated in any currency that is a convertible currency within the meaning assigned to it by the Central Bank of Malta Act. A public company may, with respect to fully paid-up shares and if authorized by its memorandum or articles of association, issue warrants entitling the bearer to the shares specified in the warrant, but cannot issue bearer shares as such. Public companies may not restrict the free transferability and may invite the public to subscribe for its shares to obtain a listing on the stock exchange. Private companies must restrict the right to transfer its shares and prohibit any invitation to the public to subscribe for any shares or debentures of the company.

Meetings and votes. Public and private: A general meeting takes decisions by passing resolutions either an ordinary resolution or an extraordinary resolution. A majority (more than 50%) is required for an ordinary resolution, unless the memorandum and articles prescribe otherwise. In the case of public companies, extraordinary resolutions must be passed by a member or members having the right to attend and vote at the meeting who hold in the aggregate not less than 75% in nominal value of the shares represented and entitled to vote at the meeting of the company and at least 51% in nominal value of all the shares entitled to vote at the meeting. For private companies, extraordinary resolutions must be passed by a member or members having the right to attend and vote at the meeting holding in the aggregate not less than 51% in nominal value of the shares represented and entitled to vote at the meeting of the company.

Branch of a foreign corporation

A foreign company may set up a branch or place of business within Malta in the same manner as a company incorporated in Malta. Except for some restrictions regarding ownership of immovable property in Malta, there are no restrictions on a company formed outside Malta from carrying on business through a branch established and situated in Malta.

Within one month of establishing a branch, the foreign company must deliver various documents to the Registrar of Companies, such as an authentic copy of the statutes of the foreign company, a list of the directors and company secretary of the head office and the name, legal form, address, activities and names and addresses of one or more representatives resident in Malta of the branch in Malta.

Once registered as an overseas company, the overseas company must, within 42 days from the end of the accounting period, file copies of its balance sheet, a profit and loss account and the notes to the accounts.

A branch of a foreign company is subject to tax in Malta on Malta-source income and capital gains, which are computed on the same basis as applies for Maltese resident companies. A branch, therefore, is entitled to claim all deductions provided to resident companies and generally enjoy the same rights. The income of a branch is taxed at the same rate as that of a Maltese company. There is no branch tax.

2.2 REGULATION OF BUSINESS

Mergers and acquisitions

A merger of two or more companies may be effected by a merger by acquisition or by a merger by formation of a new company. A merger by acquisition occurs when the acquiring company acquires all the assets and liabilities of the acquired company (or companies), with the acquired company's shareholders receiving in exchange shares in the acquiring company and a cash payment, if any, not exceeding 10% of the nominal value of the shares so issued. A merger by the formation of a new company takes place when merging companies contribute all of their assets and liabilities to a new company (Newco) that they establish, with shareholders of the merging companies receiving in exchange Newco shares and a cash payment, if any, not exceeding 10% of the nominal value of the shares so issued.

The Malta Companies Act governs mergers and includes simplified rules for mergers between a parent company and a wholly owned subsidiary and, to a lesser extent, mergers between a parent company and a subsidiary in which the parent company holds at least 90%, but less than 100%, of the issued shares of the subsidiary.

Merger activity in Malta also is regulated by the Office for Fair Competition in terms of the Control of Concentrations Regulations, under which (unless otherwise provided in the regulations), an acquisition of two or more undertakings must be notified to the Director of the Office for Fair Competition for approval before being implemented if there is a change of control on a lasting basis and: (a) two or more previously independent undertakings merge; or (b) one or more undertakings acquire, whether by purchase of securities or assets, by contract or by any other means, control of one or more undertakings; and (i) the combined aggregate turnover in Malta of the preceding financial year of the undertakings concerned exceeds EUR 2,329,373.40; and (ii) each of the undertakings concerned has a turnover in Malta equivalent to at least 10% of the combined aggregate turnover of the undertakings concerned.

Merger activity in Malta also is subject to the provisions of Council Regulation 139/2004/EC on the control of concentrations between undertakings and to the provisions of Directive 2005/56/EC on cross-border mergers of limited liability companies. A concentration (inter alia, a merger) has an EU (Community) dimension:

- Where the combined aggregate worldwide turnover of all of the undertakings concerned is more than EUR 5 billion and the aggregate EU-wide turnover of each of at least two of the undertakings is more than EUR 250 million, unless each of the undertakings concerned achieves more than two-thirds of its aggregate EU-wide turnover in a single member state; and

- Where the combined aggregate global turnover of the undertakings concerned exceeds EUR 2.5 billion, aggregate global turnover in each of at least three member states is more than EUR 100 million, aggregate turnover in each of these three member states of at least two undertakings is more than EUR 25 million and aggregate EU-wide turnover of each of at least two of the undertakings is more than EUR 100 million, unless each achieves more than two-thirds of its aggregate EU-wide turnover within one and the same state.

A concentration that has a Community dimension must be notifiied to the Commission. In the case of a merger or acquisition, the notification is to be completed jointly by the parties involved.

If a concentration does not have a Community dimension, the affected companies may inform the Commission as to whether such a concentration is capable of being reviewed under the national competition laws of at least three member states. If none of the member states concerned objects to the review by the Commission, a concentration will be deemed to have a Community dimension.

Monopolies and restraint of trade

The Office for Fair Competition regulates monopolies and restraints of trade in Malta. The Competition Act deals with monopolies and market dominance by prohibiting abuse or extension of a dominant position by one or more undertakings within Malta or any part of Malta. In the absence of evidence to the contrary, an undertaking, which alone or in conjunction with others, has a share of at least 40% of the relevant market will be deemed to be in a dominant position. The Act also prohibits fixed purchase or selling prices or other trading conditions, limits or controls on production, markets, technical development and investment, sharing markets or sources of supply and dissimilar conditions to equivalent transactions thereby placing one at a competitive disadvantage.

The Treaty on the Functioning of the European Union (TFEU) also applies where any abuse by an undertaking may affect trade between Malta and one or more EU member states and where any agreement between (associations of) undertakings or any concerted practice may appreciably affect trade between Malta and any one or more member states.

2.3 ACCOUNTING, FILING AND AUDITING FILING REQUIREMENTS

The financial statements must comply with the requirements of the Companies Act and the International Accounting Standards (IAS).

The directors of every company are required to prepare for each accounting period a directors' report and annual accounts comprising the balance sheet as at the last day of the accounting period, the profit and loss account, the notes to the accounts and any other financial statements that may be required by generally accepted accounting principles and practice. The annual accounts must give a true and fair view of the company's assets, liabilities, financial position and profit or loss.

An auditor must be appointed at the annual general meeting and must make a report on all annual accounts of the company. The report is prepared in accordance with IAS and must state whether a true and fair view is given of the state of affairs and the profit and loss statements. A copy of the annual accounts, together with a copy of the auditors' report and the directors' report, must be submitted to the Registrar.

Small companies are permitted to draw up abridged balance sheets and abridged layouts of profit and loss accounts and abridged notes to the accounts. Small companies are those not exceeding two of the three following criteria: (1) balance sheet total of EUR 2,562,310.74; (2) turnover of EUR 5,124,621.48; and (3) an average number of 50 employees during the accounting period. A parent company may not be treated as a small company unless the group qualifies as a small group, i.e. a group not exceeding two of the three following criteria: (1) aggregate balance sheet total of EUR 2,562,310.74 net or EUR 3,074,772.89 gross; (2) aggregate turnover of EUR 5,124,621.48 net or EUR 6,149,545.77 gross; and (3) 50 employees in the aggregate.

Private companies not exceeding two of the three following criteria: (1) balance sheet total of EUR 46,587.47; (2) turnover of EUR 93,174.94; and (3) an average number of two employees during the accounting period need not be audited (however, audited accounts still have to be drawn up for ongoing local tax reporting and compliance purposes) and may draw up abridged balance sheets and abridged layouts of profit and loss accounts and abridged notes to the accounts.

Banks and financial institutions must comply with the directives issued by the relevant competent authority under the Banking Act and the Financial Institutions Act, and insurance companies must comply with regulations made under the Insurance Business Act.

Malta has adopted International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS), as well as General Accounting Principles for Smaller Entities (GAPSE).

To read this Guide in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.