Government actions to alleviate impacts on citizens and the economy.

With the emergency situation generated by the COVID-19 epidemic continuing to affect the economy, as well as our way of life in general, we see governments and businesses focusing on well-being, liquidity and access to finance. In response to the COVID-19 crisis, during March 2020, the Cyprus government published a series of legislative packages of emergency measures and, announced a variety of mitigating steps to be taken in support of the country's citizens and the economy. This document provides an overview of the key points.

1. Tax – Outline of VAT adjustments and amendments to Tax Return submission deadlines.

The government has introduced a variety of tax measures intended to help taxpayers preserve their cash flows and, to ease the administrative burden on them, through this severe public health emergency. A summary of the main features is given below:

a. Deadlines for the payment of indirect taxes have been extended

For VAT periods ended 29 February 2020, 31 March 2020 and 30 April 2020, the taxpayer may defer paying the sum of VAT due until, at the latest, 10 November 2020. It is intended to introduce a phased payment scheme for such arrears terminating on 11 November 2020. No late payment penalty or interest will be applied provided that the VAT return was submitted on the original due date. Eligible businesses for this deferred payment are those with an annual turnover which does not surpass EUR 1 million (based on the total turnover declared in 2019 VAT returns), and those whose turnover has been reduced by more than 25%.

b. Extension of deadlines pertaining to Tax Returns

A two-month extension to the 31 March 2020 deadline for submitting corporate tax returns (TD.4) and self-employed tax returns (TD.1) has been introduced. The new deadline is 31 May 2020.

2. Temporary cessation of divestment scheme – "KEDIPES"

A three-month temporary suspension of the KEDIPES divestment scheme has been agreed. The Cyprus Bank Association has mirrored this by announcing suspension of foreclosure procedures for a similar period. The moves are intended to give generally 'healthy' businesses and individuals some 'breathing space' to deal with the issues arising as a result of the pandemic.

3. Extension of deadlines for information requests – "ESTIA"

A three-month extension period has been granted to allow qualifying applicants to comply with the condition that the requisite supporting documentation is submitted alongside the application for "ESTIA" membership.

4 Public Health Care - Waiver of increased rates

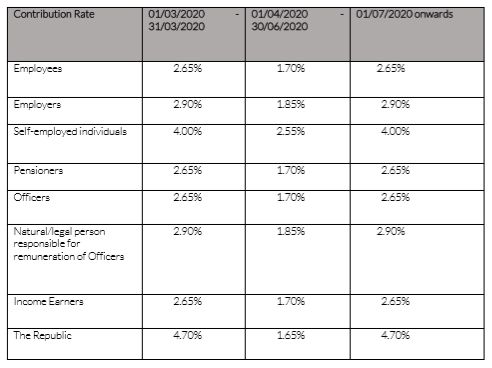

For the period April, May and June 2020, (i.e. from 1 April 2020 to 30 June 2020), the contribution rates for the Generl Healthcare System (GHS), which were applicable from 1 March 2019 to 28 February 2020) will apply. For March 2020 and from 1 July 2020 onwards, the increased contribution rates to the GHS will apply as set out in the table below.

5. Amendment of the Regulation of Overdue Social Contributions Law

For debtors participating in a repayment arrangement for overdue social contributions in instalments, the payment of instalments for the months of March and April 2020 is suspended and the repayment period has been extended by two months.

6. Safeguarding of banks that channel aid to the economy

The European Central Bank (ECB) has already proposed bank lending support initiatives. Under the new measures, Cypriot financial institutions will be able to access liquidity from the Eurosystem on significantly more favourable terms than they previously enjoyed. The measures decided by the ECB include, inter alia, the release of capital stocks which, for the Cyprus systemic banks, are estimated by the Central Bank of Cyprus (CBC) to be in excess of EUR 1.3 billion. Furthermore, the CBC is considering other local measures which will be announced shortly by the Governor of the CBC.

7. Cashflow relief to businesses in a loss-making position and to employees

A Business Suspension Plan Strategy(the "Plan") has been announced: The Plan will be applied for any business that either took the decision to suspend its operations in response to government request, or, continued operating and as a result suffered a turnover drop in excess of 25%. It also includes financial assistance for affected employees. The key points of the Plan are:

- A EUR 10 million Small Business Support Plan for businesses that employ up to 5 people, provided they keep their employees on the job and have had their turnover reduced by more than 25%. The plan provides for a subsidy of 70% of employees' payroll costs.

- A Special Leave Benefit is to be given to working parents with no help at home who have children up to 15 years of age, or, children of any age who have special needs. The benefit is available to those who are not able, due to the nature of their work, to make use of teleworking or, to work flexible hours. The option of the involvement of grandparents is not to be treated as 'support at home'.

- A Special Sickness Benefit is to be given to workers from the private and self-employed sectors that fall into special categories, and who, for healthcare related reasons are unable to carry on working within their workplace.

- A Special Benefit shall be given to self-employed individuals (except for certain professions) who have suspended their operations (on the basis of the Order provided by the Health Ministry and related Council of Ministers decisions) or who have partly suspended their operations, and due to the outbreak of Covid-19, have suffered a decrease in their operations by 25% or more.

- A Special Unemployment Benefit shall be given to workers of affected businesses falling under the Plan including any business which has temporarily suspended its commercial activities (but administrative nature) in compliance with the Order issued by the Ministry of Health and other Council decisions.

- Employees of businesses affected by the Businesses Suspension order should also expect Special Unemployment Benefit. A business may participate in the scheme if its operations have been partially suspended and its turnover has decreased by more than 25%.

- The employer is allowed not to offer a wage to the employees, during the period which Special Leave/Special Sickness/Special Unemployment benefits are payable. If, for any reason, the employer has already paid the salary to the employee, it is permissible that, the part of the salary relating to the period for which the benefit will be payable, can be used as set-off by the employer against future wage payments.

- The self-employed individual is excluded from making social insurance premiums during the period for which Special Benefit for Self-Employed is payable.

The submission of applications can be made online via the Ministry's website www.coronavirus.mlsi.gov.cy and further details about the above plans can be found at The submission of applications can be made online via the Ministry's website www.coronavirus.mlsi.gov.cy and further details about the above plans can be found at https://www.neo.law/covid-19/

8. Preparing to promote the recovery of heavily impacted industries

The government has decided to delegate funds amounting to EUR 11 million in order to support tourism regrowth between June and September 2020. This initiative will be taken in cooperation with Airlines and Travel Agents. Other actions will also be undertaken to enhance the attractiveness of Cyprus to tourists during the period October 2020 to March 2021.

9. Law for postponement of evictions due to non-payment of rents

The Government has enacted the Rent Control Act (temporary provisions) of 2020, whereby any procedures including the performance of eviction decrees which were awarded by the Court due to non-payment of rents in a tenancy, will be postponed up until 31 May 2020. This is as a protection measure for tenants who may be suffering economic hardship as a result of COVID-19 impacts. These temporary provisions will not apply, however, to tenants who have failed to make rental payments which were due up to, and including, 29 February 2020.

10. Provision of generous repayment plans and income support

For the duration of the emergency, special arrangements will be made for those who are included in the Schedule of Debts.

11. Proposals for lower electricity charging costs

The Government has submitted a recommendation to CERA that the charging cost for power is reduced by 10% for a period of three months.

In practice, the Cyprus government stands ready to use the full flexibility of the country's aid rules to help Cyprus business, and Cypriot citizens, to overcome the adverse consequences of the pandemic. The measures in connection with the COVID-19 crisis have been enacted at a national level, however, they do not waive the obligation of citizens to be mindful of the new deadlines or, of necessary procedural steps when submitting aid and other applications. Both businesses and individuals are encouraged to take a precautionary approach in order to mitigate risks and comply with applicable statutes of limitations to the extent that this is possible.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.