We would like to update you that the Cyprus Parliament, in response to the ongoing emergency relating to the COVID-19 Virus, has passed the following laws and/or amendments to existing laws, in an effort to provide fiscal assistance to citizens and businesses. The decisions were passed on Friday 27/03/2020 and shall take effect upon publication in the Gazette of the Republic of Cyprus. : the inter-ministerial Committee which met ton the 23/03/2020 under the President, decided to authorize the Minister of Health to publish a Decree with the following measures:

- VAT Law Amendments

VAT Legislation has been amended to provide for a deferral of VAT Payments up to the 10th November 2020. This is applicable for the following businesses and individuals:

- For the majority of entities (legal or physical), with the exception of entities specifically excluded (see below). This is applicable irrespective of turnover amounts, total output or percentage of decrease of turnover.

- The deferral applies to Vat Quarters of December 2019 – February 2020, January 2020 – March 2020 and February 2020 – April 2020.

- It is noted that the VAT Returns should still be filed on time. The deferral is only applicable on the payment obligation, not the filing obligation.

- The deferral also applies to any penalties usually imposed, as well as interest and criminal penalties, as long as the payment obligation is met by 10th November 2020.

The following entities have been specifically excluded:

- Electricity Production and Water Distribution

- Groceries – Food Supermarkets and Kiosks

- Pharmacies

- Retail multi-stores were food, drink, smoking items are not predominant

- Internet and satellite and telecommunication services

- Retail computing, peripheral and software trading

- Retail fuel trading

- VAT Activity Codes: 35111, 36001, 47111, 47112, 47191, 47211, 47221, 47231, 47241, 47242, 47301, 47411, 47611, 47621, 47651, 47731, 61101, 61301, 61901.

- General HealthCare System Law Amendments

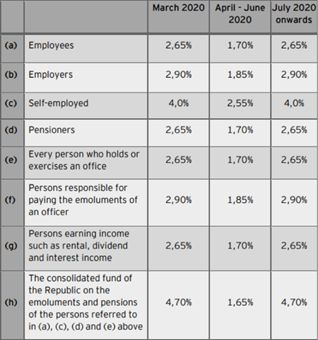

The amending law specifies that the reduced rates which where applicable for Phase A of the GESY will apply for all categories for the months of April, May and June 2020. The increased rates (as originally planned for Phase B) will be applicable for March 2020 and thereafter from July 2020 onwards. The below table summarizes the current position:

- Settlement of Overdue Social Contribution Law Amendments.

Article 7(3) of the Law has been amended to provided that individuals and entities who have regulated the payments of overdue social contributions in installments can defer such agreed payments for the months of March and April 2020, by extending the agreed repayment period by a further two months.

Originally published 29 March 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.