In brief

On 6 October 2020 the ECOFIN Council updated the EU list of third country non-cooperative jurisdictions for tax purposes (commonly referred to as the EU 'blacklist') and also updated the EU list of third country cooperative jurisdictions subject to the successful delivery of their commitments (commonly referred to as the EU 'greylist').

The updated EU 'blacklist' and EU 'greylist' are effective as from 7 October 2020, being the date of their publication in the Official Journal of the European Union.

In detail

What are the latest amendments to the EU 'blacklist' and the EU 'greylist'

As a result of the latest update effective as from 7 October 2020:

- Barbados has been added to the EU 'blacklist'

- Anguilla has been moved from the EU 'greylist' to the EU 'blacklist'

- Bosnia Herzegovina, Cayman Islands, Mongolia and Oman are no longer listed due to successful delivery of their commitments.

Background

The ECOFIN Council adopted the initial EU 'blacklist' and EU 'greylist' on 5 December 2017. These have since been updated several times. The EU previously decided that, as from 2020, the lists are updated no more than twice a year. This is the second update taking place in 2020. The next update is expected to be in February 2021.

For more background on the lists and their evolution over time, please refer to our prior Tax Update Newsletters N-17-2017, N-4-2018, N-11-2018, N-19-2018, N-5-2019, N-9-2019, N-11-2019, N-14-2019 and N-2-2020.

Updated EU lists effective as from 7 October 2020

For your ease of reference, the latest updated lists are set out below:

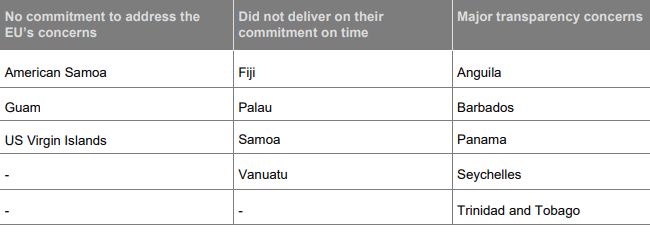

The latest updated EU list of the 12 identified jurisdictions included in the EU common list of non-cooperative jurisdictions for tax purposes (EU 'blacklist'), as adopted and published on 7 October 2020, grouped per reason of listing:

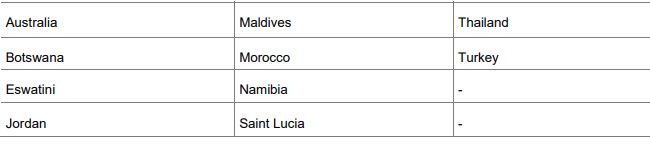

The latest updated EU list of the 10 identified co-operative jurisdictions subject to the successful delivery of their commitments (EU 'greylist'), as adopted and published on 7 October 2020:

The takeaway

Possible impacts on jurisdictions on the EU 'blacklist' include facing increased monitoring and audits, special documentation requirements, increased withholding taxes and other possible defensive tax measures by EU Member States.

In addition, increased DAC6 reporting obligations would apply to certain related party transactions between the EU and the EU 'blacklisted' jurisdictions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.