Abstract

Pursuing its Digital Finance Strategy, on September 24, 2020 the European Commission has adopted a new Digital Finance Package, including legislative proposals for a Regulation on Markets in crypto-assets ("MiCa") as well as a Regulation for a Pilot-Regime for DLT based Market Infrastructures.

It's time to analyse this draft and compare it to the Liechtenstein Tokens and TT Service Providers Law (aka Liechtenstein Blockchain Act) to identify some major challenges and opportunities for Service Providers operating out of Liechtenstein.

1. Making Europe fit for the digital age

During an event at the University of Liechtenstein the Principal Economist of the European Commission, Joachim Schwerin, recently remarked that

"the European Commission has set the traffic lights to green for the token economy".

Pursuing its Digital Finance Strategy, on September 24, 2020 the European Commission has adopted a new Digital Finance Package, including legislative proposals for a Regulation on Markets in crypto-assets ("MiCa") as well as a Regulation for a Pilot-Regime for DLT based Market Infrastructures.

In my Thesis Secondary Market for Security Tokens - The need for a new regulatory approach at the European Union level I came to the conclusion that a technology appears to make the otherwise necessary trust in intermediaries obsolete and is therefore much more efficient, more transparent and thus more secure. It appears that the European Commission has come to similar conclusions regarding the opportunities and challenges when it comes to the secondary markets for security tokens. This might be one of the reasons why the European Commission issued a draft for a Regulation on Markets in crypto-assets ("MiCa").

Establishing a liberal, sustainable crypto asset ecosystem throughout the EU the Digital Finance Package aims to boost Europe's competitiveness and innovation in the financial sector while mitigating any potential risks related to investor protection, money laundering and cyber-crime. It aims to provide more opportunities in financial services, while ensuring financial stability and legal certainty within the entire EU/EEA.

Involved in a regular exchange of experiences in the area of token economics with Liechtenstein, the Principal Economist of the Commission, Joachim Schwerin, recently confirmed Liechtenstein's pioneering role in the field of cryptocurrencies and blockchain.

"Like smartphones have become standard in the meantime, tokens will become standard in the future,"

he remarked at an event at the University.

Reducing the fragmentation by developing a uniform European infrastructure, the long-term vision of the EU is to achieve comprehensive digitalization of industrial production by paving the way for the tokenization of rights and digital money for all economic sectors including agriculture.

The Regulations are proposals of the EU Commission, which are being discussed in the European Parliament and Council. They are expected to come into force by 2024 at the latest. The intention is for the new regime to be directly applicable in all EU member states, replacing existing national frameworks applicable to crypto-assets such as the TVTG.

2. MiCa - What is being proposed

The Mica Regulation establishes minimum disclosure requirements for the issuance and admission to trading of crypto-assets which are currently unregulated in the form of white papers. Furthermore, it regulates certain requirements for crypto asset service providers (trading platform operators, custodians, exchange service providers) such as governance arrangements, prudential requirements, rules regarding the safekeeping of client`s funds and complaint handling procedures.

Crypto-asset services Art. 3 No 9 MiCa

There will also be consumer protection rules for the issuance, trading, exchange and custody of crypto-assets including measures to prevent market abuse. The supervision of the issuers and crypto asset service providers shall be carried out by the competent national supervisory authorities or the EBA.

According to Art.53 of the MiCa proposal the new rules will allow operators authorised in one Member State to provide their services throughout the EU ("passporting").

The draft regulation defines the term "crypto-asset" broadly (and similar to the Liechtenstein TVTG) as "a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology". However, it is important to note that the current crypto-assets that qualify as financial instruments or electronic money (except e-money tokens) still fall under the requirements of their respective directives (MiFID II, Electronic Payment directive, Prospectus and Transparency Directives, CSDR, etc.) and within the context and legal framework that is currently in force.

2.1 Crypto-asset issuances: These are the 3 new crypto value categories

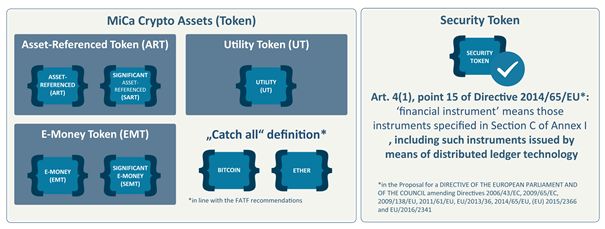

According to a risk-based approach MiCa newly establishes separate frameworks in respect of three distinct categories of crypto-assets: utility tokens, asset-referenced tokens and e-money tokens.

- Utility tokens are defined as crypto-assets which are intended to provide digital access to an application, service or resources available on a distributed ledger and are accepted only by the issuer of that token to grant access to such application, services or resources available.

- Asset-referenced tokens (e.g.DAI) refers to such crypto-assets whose main purpose is to be used as a means of exchange and that purports to maintain a stable value by referring to the value of several fiat currencies, one or several commodities, or one or several crypto-assets, or a combination of such assets.

- E-money tokens (e.g. USDC) means a type of crypto-asset whose main purpose is to be used as a means of exchange and that purports to maintain a stable value by being denominated in (units of) a fiat currency. The issuance of e-money tokens is only permitted for EU credit institutions and for electronic money institutions (authorised under the electronic money directive).

Token classification based on MiCa and the proposed amendmend of MiFID II.

Asset-referenced tokens and e-money tokens can each further be classified as significant asset-referenced tokens (such as Libra Coin) or significant e-money tokens (such as Tether, Libra tokenized EUR) under the draft Regulation. In this case, issuers are subject to more stringent requirements. The "significance" of any tokens is to be assessed by the European Banking Authority (EBA), considering a number of factors such as the size and customer base of the tokens, the number or value of transactions carried out and the interconnectedness with the financial system.

Other crypto assets: The MiCa regime is intended to be a catch-all covering all crypto-asset issuances (e.g. Bitcoin, Ether, Litecoin) that are not covered by other regimes.

The European Commission is also proposing a clarification of the existing definition of 'financial instruments' - which defines the scope of the Markets in Financial Instruments Directive (MiFID II) - to include financial instruments based on DLT (aka "Security Token").

2.2 Crypto-asset service providers

MiCa requires any legal person seeking to provide crypto-asset services in the EU (for example, in relation to custody, trading, exchange, brokerage, promotion or advice) an authorisation in an EU/EEA member state (e.g. Liechtenstein but not Switzerland). For this purpose, a registered office in that state is required.

Authorised service providers must comply with a list of general requirements as well as the additional specific requirements applicable to the particular services they provide. The regulatory requirements concern, among other things, the

- initial capital,

- the IT infrastructure,

- the corporate structure

- and the suitability of the management.

2.3 Transitional measures

Under Article 123 of the MiCa a number of transitional measures will be introduced such as a transitional period of 18 months for service providers which have already provided their services in accordance with applicable laws. EU/EEA Member States such as Liechtenstein may apply a simplified procedure for applications for an authorisation by entities that, at the time of entry into force of MiCa, were authorised under national law to provide crypto-asset services such as registered TT service providers.

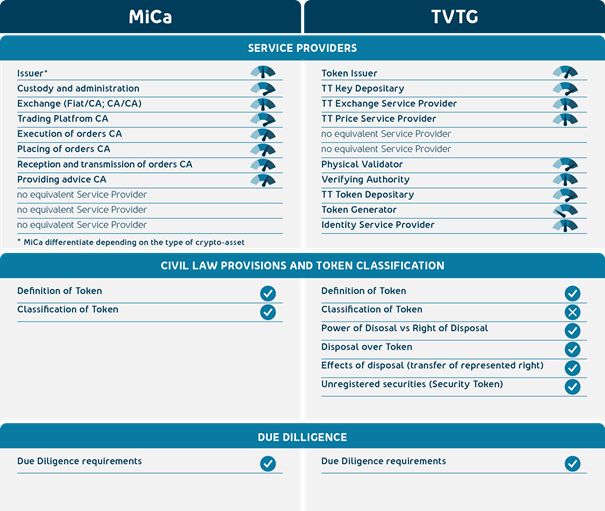

2.4 MiCa and TVTG - These are the Common features

MiCa and the TVTG are based on the same underlying principles, for example a role based regulation, the support of Start-ups by different thresholds, the support of innovation and customer protection, the prevention of market abuse and AML/TF requirements. Like the TVTG, the MiCa proposal reflects on the token container model, indicating that not the act of tokenization but the content of the token is relevant. Furthermore, the requirements for the service providers, such as the requirements for the management (professional qualification, reliability) and shareholders as well as the organisational requirements (regulation on conflicts of interest, information duties, provisions on outsourcing) are similar to those of the TVTG.

2.5 MiCa and TVTG - These are the differences

Differences between Mica and TVTG can be found for example in the catalogue of regulated service providers: While both regulatory approaches include regulations regarding issuers, custody and exchange, the MiCa draft does not include a regulation regarding physical validators, verifying authorities, price service providers or identity service providers while providing new roles such as trading platforms, the execution, placing, reception and transmission of orders as well as providing advice. MiCa stipulates that the issuer and service provider must be a legal entity with registered office in a member state. Therefore, in contrast to the TVTG, these services may not be provided by natural persons.

Comparison of MiCa and the TVTG

For all crypto-assets, the issuer must prepare and publish a whitepaper and notify the competent authority (in Liechtenstein the Financial Market Authority FMA). The whitepaper must describe, among other things, the main features of the crypto asset and the risks associated with them. For «other crypto assets» a content-wise examination by the competent authority does not take place. Regarding asset-referenced tokens the issuer must have an authorisation by the competent authority, the whitepaper needs to be approved and a minimum capital of EUR 350 000 is required.

3. Pilot-Regime for DLT - What is being proposed

With regard to the development of a secondary market and to promote the uptake of DLT in the trading and post-trading area the EU Commission has also proposed a pilot regime to enable regulated institutions to develop DLT-based infrastructure for the trading, custody and settlement of securities. In contrast to centrally organised markets, where securities law ensures the requisite trust in intermediaries, with decentralised exchanges the selection of the technological basis plays an important role in guaranteeing the desired functionality:

Types of Secondary Markets for Security Token

The pilot regime represents a so-called "sandbox" approach - or controlled environment - providing a level playing field across the EU which allows temporary exemptions from certain regulatory requirements that have previously been identified as obstacles to such development (for more info, see Secondary Market for Security Tokens).

The idea of this proposal is also to help regulators to gain experience on the use of distributed ledger technology in market infrastructures, while ensuring that they can deal with risks to investor protection, market integrity and financial stability, as well as to identify all relevant regulatory obstacles and inform more permanent amendments or guidance.

Over a period of up to 6 years, the pilot regime will provide a legal framework for supervised experimentation (sandbox). Based on the experience gained through this process, legislators will decide which permanent changes to the EU regulatory framework are necessary to allow for technological innovation while fostering investor protection.

3.1 Scope of Application

Applicants can request exemptions from specific requirements embedded in the EU legislation (MiFID II, CSDR). The exemptions are limited and contingent. Applications are to be made to the relevant national authority for the applicant. The national authority is required to consult with the European Securities and Markets Authority (ESMA) as part of the decision-making process. Permission granted by that authority would allow the DLT market infrastructure to provide their services across the EU. The Proposal includes two types of DLT market infrastructures:

3.1.1 Authorised investment firms and market operators

Authorised investment firms and market operators (as defined under MiFID II) would be able to admit to trading DLT transferable securities that are not recorded in a CSD (stating an exemption of Art. 3 of the Central Securities Depositories Regulation) but instead recorded on the DLT MTF's distributed ledger meeting certain conditions and relating to factors such as record-keeping, custody arrangements and settlement mechanics (including settlement finality). This is an explicit exemption from the book-entry requirement and the recording with a CSD set by CSDR. Securities trading on DLT MTFs will for now be limited to:

- Shares with a market capitalisation < EUR 200 million or

- Bonds with an issuance size < EUR 500 million. Sovereign bonds will not be admitted.

The market value of securities traded and recorded with one operator is limited to EUR 2.5 billion. According to the proposed pilot-regime, a DLT MTF should be allowed to ensure:

- The initial recording of DLT transferable securities,

- The settlement of transactions in DLT transferable securities, and

- The safe-keeping of DLT transferable securities.

The pilot Regime allows a DLT MTF to perform some activities normally performed by a CSD

Exemptions can be granted if the operator proposes sufficient compensatory measures to meet the objectives pursued by the provisions from which an exemption is requested. As part of their business continuity planning, operators need to establish a strategy in case the DLT infrastructure they are using is disrupted or discontinued.

3.1.2 Authorised Central Securities Depositories "CSDs"

Authorised Central Securities Depositories "CSDs" (as defined under CSDR) would be eligible to apply for permission to operate DLT securities settlement system (DLT SSS) as a temporary derogation from CSDR obligations to hold securities on an intermediated basis.

This would admit investors to DLT market infrastructures without an intermediary.

This is subject to conditions in relation to factors such as investor protection and AML/CTF safeguards.

The license to operate a DLT MTF or DLT securities settlement system can be granted for up to 6 years. Every 6 months, operators have to provide ESMA with reports on trading volumes, key performance data and experienced difficulties.

4. Open questions

Of course, the success of the MiCa proposal depends on many open questions. From the TVTG perspective it remains unclear what applies to those types of services or service providers successfully registered under the TVTG, but whose services are not covered by MiCa, such as price service providers.

Furthermore, it appears that it is not intended to establish civil law rules for crypto-assets, in particular their transfer as is provided for in the TVTG. Since the basic civil law treatment of crypto-assets is subject to great legal uncertainty, creating a harmonised civil law on the treatment of crypto-assets may significantly contribute to fostering Blockchain/DLT technologies.

It is also unclear what impact MiCa will have on completely decentralized crypto projects such as decentralized financial services ( "DeFi").

5. Regulatory Outlook

The proposal is radical and proactive in its scope and clearly shows that the EU wants to tackle the fundamental regulatory obstacles posed by the decentralised nature of the networks by integrating distributed ledger technologies (DLT) into the existing EU legal framework. It is therefore very welcome that the debate on cryptos has now moved from its niche to the highest political level within the European Union. It is to be expected that institutional investors and partners will also increasingly open up to the crypto sector.

One of the difficulties at present is that existing financial services regulation was not designed with DLT in mind.

At present, the obligation to book securities in a book-entry account is probably the greatest challenge on the secondary market for security tokens. Furthermore, in contrast to the traditional world, the booking obligation does not result in an improvement in efficiency and might, in fact, even destroy the potential increase in efficiency. Consequently, the Pilot Regime will make the book-entry redundant. This is hugely innovative and exactly the right step in order to allow a secondary market to flourish.

Several regulatory approaches of the TVTG are also included in the MiCa draft. Therefore, the TVTG can be seen as a valuable template. Nevertheless, MiCa will affect the TVTG directly and the TVTG needs to be amended. However, for countries such as Liechtenstein, where regulations already exist for certain crypto-services, there will be "simplified authorisation procedures".

This could develop into a competitive advantage for a crypto pioneer nation such as Liechtenstein.

However, in order to prove and maintain its pioneering role in the future, Liechtenstein should use the experience gained with the TVTG and already go one step further now - and establish a secondary market in Liechtenstein as another step towards achieving and concretising the vision of the Token Economy.

6. The opportunity for Crypto Exchanges to extend their services to Security Token

For a long time it was unclear in which direction the regulation of crypto-assets and security token at the European level would develop. With MiCa and the pilot regime we have now a pretty clear picture of whats coming.

Crypto Exchanges chose Liechtenstein as their location in Europe because Liechtenstein has shown willingness and enthusiasm for the crypto sector by enacting the TVTG.

In fact, both the government and the supervisory authorities want the business models of crypto companies in Liechtenstein to flourish. A big advantage is that the supervisory authority (FMA) has already gained experience with the registration of crypto companies. Even in the initial phase, it has turned out that the primary market for security tokens in Liechtenstein already works well. It is a more than interesting perspective that thanks to MiCa blockchain related service providers from Liechtenstein might be able to offer their services via passporting in the entire European market in some years. This gives them planning security.

Liechtenstein offers overall very good conditions: In addition to an innovation-friendly climate, Liechtenstein has a relatively large number of consultants, banks, law firms, auditors, tax advisors and compliance specialists who are well versed in crypto and blockchain models and are committed to smooth business operations. One can now start with one's own business model directly in the heart of Europe, Liechtenstein?-?and with regard to MiCa, prepare in time for the pan-European market.

Thanks to my co-authors:

- Tom Albright, CEO Bittrex Global GmbH, Liechtenstein

- Ursula Wegstein, Rechtsanwältin (Deutschland) NÄGELE Attorneys at Law LLC, Vaduz, Liechtenstein

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.