As Asia Pacific's preferred international business and financial centre, Labuan International Business and Financial Centre (Labuan IBFC) provides businesses and private clients an ideal balance of fiscal neutrality and transparency located in a midshore jurisdiction.

Well-supported by a robust, modern and internationally recognised legal framework, Labuan IBFC provides clear legal provisions and industry guidelines enforced by its regulator, Labuan Financial Services Authority (Labuan FSA).

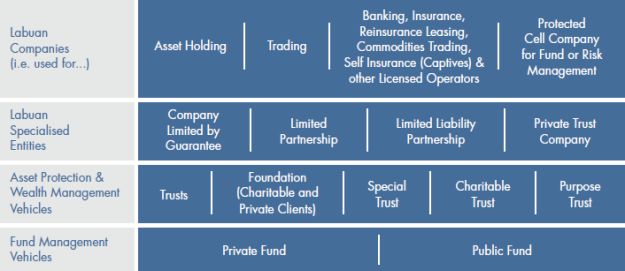

The backbone of Labuan IBFC is its array of business and investment structures for cross-border transactions, business dealings, risk management and wealth management needs.

Anyone looking to benefit or participate in Asia's burgeoning markets would do well to consider Labuan IBFC as their connection to Asia's economies. After all, the jurisdiction has been playing this role for more than 30 years.

STRATEGICALLY LOCATED

Labuan IBFC, located in Malaysia, lies in the heart of the Asia, sharing a common time zone with major Asian cities, while complementing the financial centres of Hong Kong, Singapore and Shanghai.

As such, Labuan IBFC provides an ideal business environment for companies looking to tap into one of the fastest growing regions in the world. It also offers an ideal base for all your wealth management needs.

A ROBUST AND WELL-REGULATED BUSINESS ENVIRONMENT

As one of three Federal Territories in Malaysia, Labuan receives strong administrative, financial and political support from the Federal Government of Malaysia, which appreciates the jurisdiction as an essential part of its financial services industry.

Therefore, Labuan FSA promotes a robust yet pragmatic regulatory regime which adheres to international standards set by global regulatory bodies. It is a member of seven multilateral organisations, all focused on the development and regulation of financial centres globally.

Labuan IBFC was rated as "Not Harmful" and "largely compliant" at the OECD's FHTP and Global Forum on Tax Transparency and Exchange Information.

Being part of Malaysia, Labuan IBFC is committed to reporting requirements under the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standards for Automatic Exchange of Information (CRS-AEOI) and Base Erosion and Profit Sharing (BEPS).

STRIKING A BALANCE

| CONFIDENTIALITY | VS | COMPLIANCE WITH INTERNATIONAL STANDARDS |

|

|

A WIDE ARRAY OF SOLUTIONS AND STRUCTURES

Labuan IBFC's comprehensive legal framework provides for a wide range of legal entities such as companies limited by shares or by guarantee, private and charitable foundations, special purpose trusts, protected cell companies, captives, limited liability partnerships and private trust companies.

As a leading Islamic financial centre, Labuan IBFC provides that each Labuan legal entity boasts a Shariah-compliant version. Provisions for Islamic entities are encapsulated in the Labuan

Islamic Financial Services and Securities Act 2010, the world's first omnibus legislation governing all Shariah-compliant business of an international business and financial centre.

The complete list of statutes governing Labuan IBFC:

- Labuan Companies Act 1990

- Labuan Business Activity Tax Act 1990

- Labuan Financial Services Authority Act 1996

- Labuan Trusts Act 1996

- Labuan Limited Partnerships and Limited Liability Partnerships Act 2010

- Labuan Financial Services and Securities Act 2010

- Labuan Islamic Financial Services and Securities Act 2010

- Labuan Foundations Act 2010

Additionally, all transactions and dealings in Labuan IBFC are subject to Malaysia's

- Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001

- Personal Data Protection Act 2010

LABUAN ENTITIES (Available in conventional, digital and shariah-compliant forms)

AN EFFICIENT AND FLEXIBLE TAX SYSTEM

Labuan IBFC's tax framework provides an ideal ecosystem for global companies to house their international dealings and transactions.

A Labuan business activity is a Labuan trading or Labuan non-trading activity carried out by a Labuan entity in, from or through Labuan, where certain prescribed substance requirements are met.

All non-trading activity undertaken by a Labuan entity does not attract any tax. Labuan non-trading activities mean activities relating to the holding of investments in securities, stocks, shares, loans, deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

Offering an efficient fiscal regime encapsulated in a clear tax framework, Labuan IBFC provides that all Labuan companies or entities that carry out Labuan trading activity are subject to a tax rate of 3% on its audited net profits.

A Labuan entity may select its tax profile, providing unparalleled fiexibility, as it can make an irrevocable election to be taxed under the Malaysian Income Tax Act 1967.

It is worth noting that Labuan companies have access to most of the comprehensive Double Tax Agreements that Malaysia has concluded.

In addition, Labuan entities that undertake a Labuan business activity are also not subject to withholding tax on amounts paid or credited to non-residents and stamp duty.

Further, there is no indirect taxes (including sales and service tax, import duty and excise duties) in Labuan. Labuan (and Malaysia) does not impose a capital gains tax, wealth tax and inheritance tax regime.

There is also a 100% tax exemption for expatriate directors of a Labuan entity on their director's fees earned until the year of assessment 2020.

A SUBSTANCE-ENABLING JURISDICTION

Substance is a common tax concept used in assessing cross-border tax situations, which calls into question the level of operational activity and decision-making process which is conducted in a particular jurisdiction.

In general, a company needs to demonstrate that it has a presence substance via its functional structure such as a physical office, staff administering the day-to-day operations of the company, business spending and the necessary operating tools or equipment, in order to evidence substance in that jurisdiction.

While there are specific requirements towards the establishment of economic substance for companies and entities in Labuan IBFC, curating cost efficient economic substance is possible. It is also worth noting that it is possible to redomicile companies from other jurisdictions to Labuan IBFC.

Why is economic substance important? In light of the worldwide adoption of OECD's BEPS framework, companies will need to demonstrate that they have economic substance wherever the business operate. This is important to prevent tax disputes and to avoid a higher tax burden on the business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.