Carey Olsen Partner Christopher Anderson, with the support of the Guernsey Financial Services Commission (GFSC), has created the world's first hybrid vehicle for Insurance Linked Securities (ILS) fund managers.

This briefing looks at the direct implications of this hybrid vehicle for the following areas:

- ILS fund managers

- Investor groups

- Regulation

Get even closer to the risk - Innovation

The Guernsey hybrid is a protected or incorporated cell company which is both a licensed insurance company and a regulated investment fund, bringing a new level of simplicity and efficiency for ILS managers. No other jurisdiction in the world offers such a unique combination.

How it works

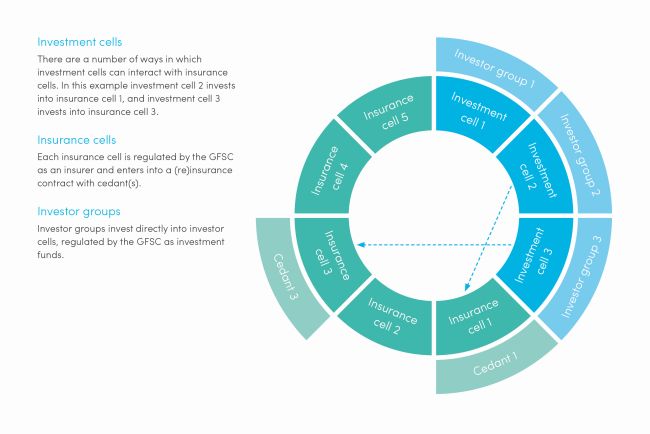

As illustrated below, the Guernsey hybrid comprises:

- investment cells which raise money from third party investors through the offer of shares or other securities. The hybrid can fundraise through any number of investment cells. Each investment cell can issue its own offering document describing its own investment strategy.

- insurance cells which write (re)insurance contracts. The funds raised in the investment cells can be used to collateralise (re)insurance written by the insurance cells through regulation 114A trusts, letters of credit, funds at Lloyds etc. Each investment cell may collateralise any number of insurance transactions or cells; and

- a core which houses the regulatory capital required of a licensed insurer.

The hybrid has a single board of directors with overall responsibility for the operation of the Hybrid. Naturally, the board may appoint an external ILS fund manager or adviser, if desired.

Regulation

As a licensed insurer, the hybrid must maintain minimum share capital - £100,000 for a general, £250,000 for a long-term insurer. This can be achieved through the issue of shares in the core of the company; shares which could be held by the ILS manager itself or by investors.

If fully collateralised, the insurance cells will not be subject to any additional solvency or capital requirements. The hybrid will also be eligible to utilise the Guernsey Special Purpose Insurer (SPI) Rules that enable insurance cells to be licensed instantaneously.

As with all Guernsey regulated funds, the hybrid is expected to appoint a Guernsey licensed fund administrator which will provide administration services to the investment cells. The hybrid is eligible to take advantage of Guernsey's fast-track fund approval regimes meaning it could be regulated as an investment fund in as little as three, or even one, business day.

The Hybrid may also appoint a Guernsey-licensed insurance manager which will provide insurance and administration services to the insurance cells. The hybrid must undergo an annual audit and file a business plan and an annual return with the GFSC. The Board of the hybrid must include one independent director.

Benefits

The idea of fusing two regulated structures into one vehicle provides an opportunity for ILS Fund Managers to realise significant cost savings and other efficiencies.

Prior to the invention of the Guernsey hybrid, ILS fund managers had no choice but to 'rent' cells of protected cell or segregated account companies to act as SPIs. Very often the SPIs would be established in a different jurisdiction from the ILS manager's fund. The SPIs would operate entirely separately from the investment fund. They have a different board of directors, service providers and auditor from the fund and may even be in a different time zone.

For the first time, the Guernsey hybrid provides ILS Managers with the opportunity to operate its investment fund and any number of sub-funds and SPIs in one place, supervised by one regulator, governed by one board of directors with one set of service providers and one auditor.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.