With 'collateralised re' being an area of high growth in Guernsey's finance industry, research was undertaken to find out why this is the case and what the global prospects are for this source of alternative reinsurance capacity.

Collateralised re is the fastest growing source of alternative capacity and the good news is that it looks like it's here to stay. It is now the dominant source of alternative reinsurance capacity and investors and capacity providers are increasingly seeking out new opportunities.

Unlike the 'promise to pay' traditional reinsurance market, here the risk underwritten is fully collateralised by institutional investors. Sources of collateralised capacity include Insurance Linked Securities (ILS) funds, hedge fund reinsurance companies and reinsurance sidecars.

A number of new vehicles offering fully-collateralised reinsurance and retrocession were set up in 2014, many of them in Bermuda, Cayman and Guernsey.

Collateralised markets use transformer vehicles (e.g. segregated accounts in a protected cell company or incorporated cell company) that are usually not rated by the rating agencies, one reason why collateral is placed in advance.

HERE TO STAY

The attraction of reinsurance as an asset class has transformed the industry over the last five years. In the low interest rate environment, property catastrophe insurance business has offered stable returns that are uncorrelated to the wider financial markets. As a result, a growing number of investors - including pension funds, high net worth individuals and sovereign wealth funds - have begun to allocate small percentages of their substantial assets to insurance risk - mostly catastrophe risk.

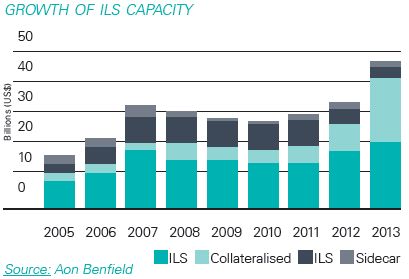

$50bn of ILS was in force at the end of 2013. Aon Benfield predicts a further $150bn of capital will enter the industry by 2020 in the form of catastrophe bonds, sidecars, collateralised reinsurers and hedge fund managed companies. An estimated 15% of total reinsurance capacity is now third-party capital, a figure that is in excess of 20% for the US market.

This so-called 'new money' is here to stay, according to Fitch Ratings, which warns that "the growth of alternative capital represents a structural change to which reinsurers will be forced to adapt". 2013 was the first time collateralised reinsurance overtook catastrophe (cat) bonds as the dominant source of ILS capacity.

Much of the new capital is being deployed into collateralised re. Among its attractions are that it offers investors the ability to diversify their exposures away from the peak US catastrophe zones - Florida wind in particular - that dominate the cat bond market.

"Even where US Hurricane is an exposure contained within a collateralised reinsurance transaction one is often able to improve the geographic diversification by gaining access to companies with exposures outside of Florida, for example," says Dirk Lohmann, managing partner at ILS fund manager Secquaero.

Setting up a transformer vehicle to provide collateralised reinsurance is also quicker and easier. "Collateralised re tends to be conducted by protected cells in a PCC (or the variants of these structures in Bermuda and Cayman) and such mechanisms offer speed of entry and exit along with the necessary cost efficiencies when compared to setting up a stand-alone SPV," says Justin Wallen, Managing Director of Guernsey-based Hexagon PCC Group at Robus Group.

EXPANDING UNIVERSE

While initially only the larger reinsurance buyers dipped their toes in the alternative market, the accessibility of collateralised re has seen this universe of buyers expand considerably, particularly as prices have come down. In contrast to other forms of ILS, particularly cat bonds, cedants do not need a critical mass to access risk transfer in the form of collateralised reinsurance cover.

From a cedant's perspective there are also no additional cost incurred in accessing collateralised capacity in comparison to traditional reinsurance purchases. The product is essentially the same as traditional reinsurance and from an execution perspective is much easier to conclude than a full blown catastrophe bond.

For many cedants, particularly those with catastrophe exposures, a mix of rated capacity and collateralised capacity is ideal as it offers diversification in claims-paying capacity. Reinsurance programmes therefore incorporate collateralised protection alongside traditional Ultimate Net Loss (UNL) protection.

"Increasingly all cedants are accessing collateralised reinsurance and see the liquidity that it offers post loss as an important benefit," says Darren Bailey, Executive Director of Aon Guernsey. "This very much augments their traditional reinsurance protection buying and as a consequence collateralised and traditional capacity can happily coexist."

In most instances only a single limit of collateralised coverage is purchased without a reinstatement, although reinstatements have been and can be provided. "Collateralised cover can fit alongside traditional capacity in syndicated placements, making it easier to diversify the sources of capacity as opposed to an 'either/ or' trade off when considering a catastrophe bond," says Lohmann.

A growing number of collateralised capacity providers cater to the smaller insurance companies and mutuals that do not typically buy from the big ILS funds and also lack the scale to bring a cat bond to market. Reinsurance brokers are also increasingly offering both forms of cover at renewal dates.

There is also the argument that buying collateralised reinsurance reduces counterparty credit risk. This is a factor that may become more attractive if reinsurer results deteriorate (as rating agencies currently anticipate they will) leading to rating downgrades. Having funding sitting in a trust account can be very heartening and secure for a buyer at a time when a traditional counterparty could lose its 'A' rating.

"We have business relationships with smaller insurers and Lloyd's syndicates who are keen to access alternative capital without having to bear the full cost and complexity of issuing a catastrophe bond," says Lohmann. "At the same time, we also have relationships with cedants who are sponsors of catastrophe bonds, but who are comfortable accessing alternative capacity in a collateralised format to diversify their reinsurance panel on traditional placements."

COMPETITION AND PRICE SOFTENING

The impact of the new money on reinsurance rates on line is inevitably being felt. The influx of third-party capital and growth of alternative capacity - particularly for US catastrophe risk - has exerted downward pressure on pricing. Partly as a result of these dynamics, all four rating agencies have implemented negative outlooks on the reinsurance sector, anticipating a deterioration in the financial results of many companies in 2015, even in the absence of major catastrophe claims.

"In a relative world, reinsurance profits have appeared attractive," notes AM Best in a recent briefing. "In absolute terms, the risk premium has been significantly compressed. Even for the most diversified reinsurance organisations, the US property catastrophe business represents a significant share of overall profit, and the earnings compression within that base will be difficult to replace."

While a challenge for reinsurance companies, softening rates are undeniably good news for cedants. Not only is it a buyer's market, the growth of collateralised reinsurance also means there is more counterparty choice. Willis hypothesises that the broad availability of indemnity-based retrocession cover in the collateralised reinsurance market is one reason for this year's reduction in reinsurer cat bond sponsors.

The availability of lower cost capital has also allowed many traditional reinsurers to drive down their own risk transfer costs, notes Aon Benfield in a report. While alternative capacity presents competitive pressures for reinsurers, the good news is that net catastrophe exposures are reducing as reinsurers "lay-off increasing amounts of risk to the capital markets via sidecars, ILS and more cost-effective retrocession cover".

And for investors, while the margins on insurance investments have reduced, insurance risk continues to offer an all-important diversifier. In spite of the softening prices for collateralised re and reducing spreads for cat bonds, as an alternative investment strategy insurance risk remains attractive for now.

One trend for the collateralised re market is its growth outwards, both by territory and line of business. Rating agency AM Best says the market is at an 'inflection point' and that it "sees company names appearing on reinsurance programs for the first time in atypical geographies".

While investors are less comfortable with un-modelled perils, their appetite for catastrophe risk in other geographies is growing. There is also a trend for traditional players to partner with or set up their own collateralised writers. This enables traditional reinsurers to offer new sources of funding and thus maintain their share of property catastrophe business, while allowing the collateralised writers access to their underwriting expertise.

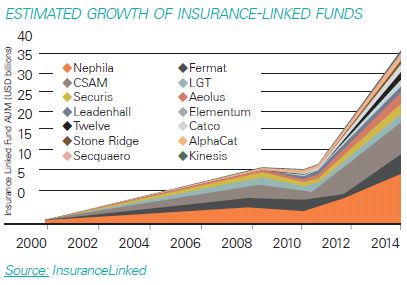

Investors need to weigh up the pros and cons of independent funds (such as Nephila, CatCo and Fermat) versus funds associated with a reinsurer (such as Leadenhall, Kinesis and Blue Capital), thinks Lohmann. While those that can tap into the track record and expertise of a traditional reinsurance company benefit from its proprietary cat models and access to market, others argue there is an inherent conflict of interest.

"The question that arises is how does such an entity decide whether to write the business for its own account or on behalf of third party capital?" he asks. "Are the standards the same? Is there any bias in selection based upon the relative attractiveness of the business? How are conflicts managed? An independent collateralised market is not faced with these potential conflicts."

LEADING COLLATERALISED DOMICILES

It is perhaps unsurprising that collateralised re has found a natural home in Bermuda, Cayman and Guernsey, domiciles which have well-established insurance markets. The existence of re/insurance expertise, investment funds, fund managers, brokers, captive managers and service providers has seen the alternative risk transfer market flourish in these centres.

Having a regulator that understands the industry and can offer pragmatic oversight and speedy approvals is one reason they have gained the 'lion's share' of the collateralised re space, thinks Wallen.

"There is no doubt that having a team of individuals who have successfully conducted many similar transactions previously is an attraction," he says. "You know you will be in safe hands rather than a training exercise for a new domicile promoting ILS without any practical experience of doing so."

While Bermuda and Cayman are ideally placed for capacity focused on US catastrophe perils, Guernsey is fast becoming a hub for collateralised re business in Europe with its proximity to London and Zurich. This is reflected in the latest insurance registration figures which show that 85 new international insurers were registered in Guernsey in the year to the end of December 2014.

Protected and incorporated cell companies are leading the charge, many of them utilised by ILS specialists or reinsurers looking to transact reinsurance contracts on a fully-collateralised basis. Lloyd's re/insurer Barbican is one example. In September 2013 it launched a specialty reinsurer on the Island to focus on business that could not be underwritten in the Lloyd's market.

It is worth noting that in Guernsey, collateralised re activities have not been restricted to property catastrophe risk. At present there are approximately 100 protected cells across four different PCC platforms writing fully collateralised reinsurance business to indemnify marine, crop, life and property catastrophe risks.

"Protected cells have been used since I first started writing collateralised re nearly ten years ago, and are still the vehicle of choice," says Wallen. "That's testament to the robustness and efficiency of these structures. In Guernsey we have also seen ICCs being set up to conclude collateralised re... but that tends to be dedicated platforms set up by a particular ILS fund rather than an open market move towards incorporated cells as the structure of choice."

A recent regulatory development - the pre-authorisation of protected cells conducting collateralised business - has also improved timescales for investors looking to deploy capacity. It means that business concluded by a licensed PCC within strict parameters (e.g. a cell conducting fully collateralised reinsurance for an ILS fund already known to the Guernsey regulator) is able to be concluded without the need to wait for individual regulatory consent.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.