For a fund manager wishing to establish and manage a hedge fund in Asia, Hong Kong has traditionally been a leading choice. It is the financial centre of the Greater China region. It places hedge fund managers at the heart of the flow of information relating to the Greater China financial markets and offers hedge fund managers a low-tax environment together with a legal and regulatory environment that is well respected by the investor community. With recent regulatory changes in the Cayman Islands and the introduction of Hong Kong tax incentives as well as domestic Hong Kong fund structures, the case for Hong Kong as a hedge fund center has become even stronger. In this article, we review options to structure a hedge fund, SFC licensing requirements and tax burdens for operating a fund manager in Hong Kong and the regulatory environment for raising capital in Hong Kong.

Hong Kong: A Preferred Choice for Hedge Fund Managers

Since the early 2000s, hedge fund managers looking to capitalize on the opportunities available in the Greater China region have looked to set-up in Hong Kong. The reasons are easy to understand:

- Hong Kong is the leading financial market for the Greater China Region. It has an open, developed and sophisticated foreign exchange, banking and securities infrastructure and serves as the Asian hub for many of the world's leading prime brokers, custodians and administrators.

- Hong Kong offers a favourable low-tax environment which can accommodate tax efficient structures for hedge funds and hedge fund managers.

- Hong Kong has a rigorous regulatory environment which offers, for those who comply with its standards, international credibility. At the same time, Hong Kong provides flexibility for hedge fund managers and, except to protect market integrity, hedge fund managers are not restricted in the strategies they deploy in the management of hedge funds of non-retail money.

- Hong Kong has an established legal system with a business oriented government and a well-respected and independent judiciary.

Hong Kong Hedge Fund Vehicles

Despite Hong Kong's dominant position as a place for hedge fund managers to establish an operational base, until recently, it was common for hedge fund managers based in Hong Kong to select Cayman companies limited by shares or Cayman segregated portfolio companies ("SPCs") as the vehicle for their funds. In part, this was because until 2018, Hong Kong could only offer traditional private companies limited by shares or unit trust structures.

The former were unsuitable for use as open ended hedge fund vehicles due to capital maintenance requirements. The latter were regarded as unsuitable for hedge funds whose strategies (e.g. shorting for investment purposes) might result in unlimited liability as trustees would generally not be prepared to accept such a role.

Open-Ended Fund Company

To address this deficit in domestic Hong Kong structural options for an open-ended hedge fund vehicle, in 2018, the Hong Kong government enacted legislation to introduce open-ended fund companies ("OFCs"). OFCs are vehicles similar to Cayman SPCs. They offer:

- Limited Liability - Shareholders are not liable for the debts of an OFC beyond the amount of capital which they have agreed to subscribe.

- Variable Capital - Shares of an OFC may be redeemed out of capital, meaning that, unless otherwise prescribed by the open-ended fund company's terms, an investor can redeem his holdings in the open-ended fund company at any time and receive the net asset value of his holding at the time of redemption.

- Segregation of Portfolio Liability - An OFC can have multiple portfolios each attributable to a separate sub-fund and the liabilities of each portfolio are segregated from each other under Hong Kong law. This means that if one portfolio suffers a loss which exceeds the net asset value of that portfolio, creditors of that portfolio cannot look to the assets of a different portfolio to satisfy that shortfall.

OFCs hold significant promise for Hong Kong hedge funds because they are domestic Hong Kong vehicles, meaning that they enable hedge fund managers to operate under a single legal regime. There is no need for Cayman money laundering control officers or otherwise to comply with Cayman anti-money laundering regulations and there is no concern whether the segregation of liability offered under Cayman law for Cayman SPCs would be effective against Hong Kong creditors, such as prime brokers and other trading counterparties.

At the same time, as OFCs are domiciled in Hong Kong, establishing Hong Kong tax residency is simple and allows the fund to take advantage of double taxation agreements in place with Hong Kong, including the double taxation agreement in place with the People's Republic of China ("PRC").

Tax Exemptions for Hong Kong Based Hedge Funds

Curiously, for many years, the Hong Kong government actively encouraged hedge fund managers to locate control of their funds outside of Hong Kong by exempting hedge funds managed from Hong Kong from Hong Kong profits tax where the central management and control of those funds was outside Hong Kong. No such tax exemption was available to hedge funds where central management and control resided in Hong Kong.

However, the enactment of the Inland Revenue (Profits Tax Exemption for Funds) (Amendment) Ordinance 2019 created a new tax exemption ("Unified Funds Exemption") under the Inland Revenue Ordinance ("IRO"), pursuant to which it is no longer necessary to situate central management and control of a hedge fund outside of Hong Kong for it to qualify for relief from Hong Kong profits tax.

Hedge Fund Structure

The target investor base often determines the basic structure of a hedge fund, regardless of the location of the fund manager. Typical structures include standalone funds, master-feeder funds, and parallel funds.

Each jurisdiction has its own securities, tax and other regulatory requirements. As a result, subject to costs, it is generally preferable at the outset to seek advice from lawyers in each jurisdiction where the fund manager expects to raise significant capital to minimize the risk that the fund manager will be unable to market the hedge fund successfully or at all in those jurisdictions as a result of legal, regulatory or tax prohibitions or concerns.

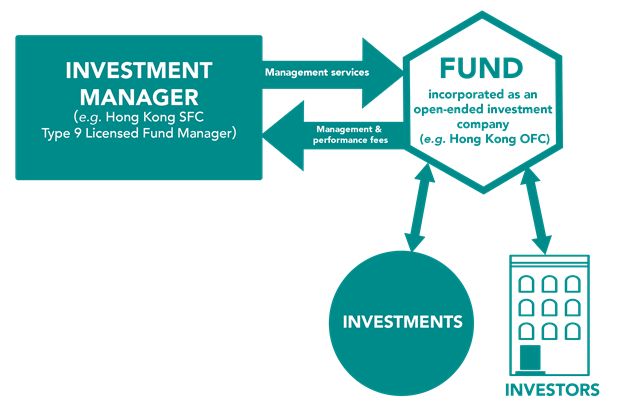

Standalone Fund

In a standalone fund, there is a single fund vehicle which accepts investments from investors around the world. As noted above, traditionally, the fund vehicle has been formed in an offshore tax neutral jurisdiction, such as the Cayman Islands, but since the introduction of the OFC regime in Hong Kong , for a standalone fund, incorporating the fund vehicle in Hong Kong as an OFC is now a genuine alternative.

As there is only one fund vehicle, a standalone fund generally has less flexibility to cater to the different requirements of different investors.

For example, if the fund manager intends to target U.S. investors, a standalone fund cannot cater simultaneously to their different needs. In this regard, U.S. taxable investors, such as high net worth individuals based in the U.S., investing in a hedge fund may be subject to onerous tax rules applicable to investments in a passive foreign investment company ("PFIC"). These rules penalize the sheltering of passive investment income in a PFIC to defer tax. To avoid these rules, U.S. taxable investors tend to prefer to invest in flow-through entities such as partnerships or corporations that make an election to be treated as a partnership for U.S. tax purposes.

Conversely, U.S. tax exempt investors, such as pension funds, investing in flow-through vehicles may be subject to tax on unrelated business taxable income ("UBTI"). UBTI may arise where a hedge fund earns income using leverage. As a result, U.S. tax exempt investors tend to prefer to avoid flow-through entities. Obviously, a standalone fund cannot at the same time be a flow-through vehicle for U.S. taxable investors and a non-flow through vehicle for U.S. tax exempt investors.

Master-Feeder Fund

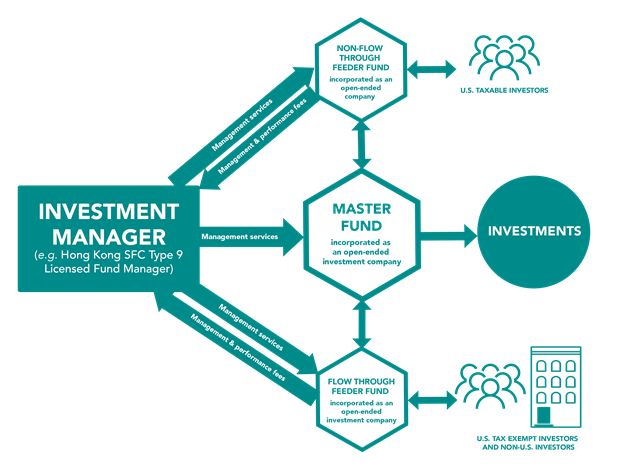

A master-feeder fund is often the structure of choice for a hedge fund where the fund manager expects to raise significant amounts of capital from the U.S. or multiple jurisdictions, each with different and potentially contradictory requirements. A master-feeder therefore tends to be a structure adopted for larger scale institutional launches.

As the name suggests, a master-feeder fund structure is one where the assets of multiple feeder funds, each catering to a different type of investor, are invested into one central master fund. Whilst the trading and investment of the hedge fund occurs at the master fund level, investors invest and pay management and performance fees at the respective feeder fund. Each feeder fund can have different fees, subscription terms, investment strategies, or otherwise.

While the precise structure of each master-feeder fund may vary, in a prototypical master-feeder fund catering to U.S. investors, there are 3 separate fund vehicles which make-up the hedge fund structure:

- A U.S. feeder fund established as an open-ended investment company or limited partnership. This feeder fund caters to U.S. taxable investors.

- A non-U.S. feeder fund established as an open-ended investment company. This feeder fund caters to U.S. tax exempt investors as well as investors outside the U.S.

- A master fund established as a limited partnership or an open ended investment company which elects to be treated as a partnership (i.e. a flow-through vehicle) for U.S. tax purposes. The assets from the feeder funds are pooled into the master fund. This pooling results in greater economies of scale than would otherwise be possible and enables the fund manager to achieve a higher assets under management ("AUM") figure, essential when seeking investments from institutional investors.

In recent years, Hong Kong hedge fund managers have tended to prefer an open-ended investment company as the vehicle for both the U.S. feeder fund and the non-U.S. feeder fund as this results in the documents for the U.S. feeder and non-U.S. feeder being fundamentally the same with changes necessary only for securities law disclosure, U.S. tax, and the provisions of the Employee Retirement Income Security Act ("ERISA").

Parallel Fund

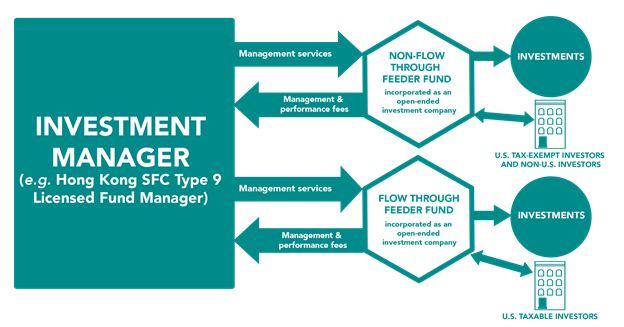

A parallel fund, also known as a side-by-side fund, comprises at least 2 fund vehicles. Like a master-feeder fund, a parallel fund enables a fund manager to cater to the different requirements of different investors by offering a different fund vehicle for each type of investor.

In a parallel fund, each fund vehicle has its own portfolio but the hedge fund generally shares similar investment strategies across these vehicles. A parallel fund may be advantageous where it is not possible to pool different types of investors together in a master-feeder structure. This may, for example, occur where a hedge fund adopts slightly different strategies for different types of investors.

The disadvantage of a parallel fund is that the assets under management are split amongst different portfolios, necessitating separate accounts for each fund with each service provider (e.g. each fund would need to appoint a prime broker and an administrator) and splitting of deal tickets between those accounts.

Umbrella Funds: Multi-Portfolio Option

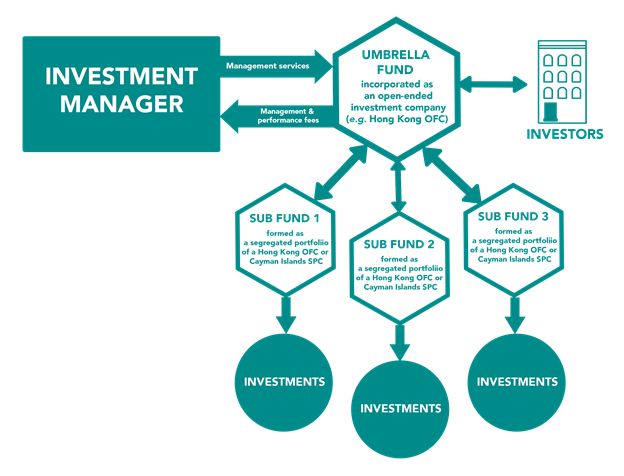

Whereas the hedge fund structural options above go to how to pool investors together to invest into a single portfolio, another structural consideration is how many portfolios a single hedge fund will have. A hedge fund may be structured as a single fund, meaning a fund with a single investment portfolio, or an umbrella fund, meaning a fund with multiple portfolios, each portfolio belonging to a separate sub-fund. Each sub-fund can have its own fund manager and pursue its own investment strategy.

Standalone funds, master-feeder funds and parallel funds can be single funds or umbrella funds. For example, a hedge fund may offer 2 different strategies, one focused on special situations and one focused on long-short. Such a hedge fund may be structured as an umbrella fund, with one sub-fund for the special situations portfolio and another sub-fund for the long-short portfolio. This hedge fund could then be structured as a master-feeder fund, with feeder funds and the master fund each having a sub-fund for the special situations portfolio and a sub-fund for the long-short portfolio. An investor in the special situations portfolio of a feeder would see his funds pooled into the special situations portfolio at the master fund level.

As noted above, historically, fund managers in Hong Kong have opted for Cayman SPCs. However, Hong Kong OFCs offer a compelling alternative because they too allow for the creation of multiple sub-funds but this time, with the entire hedge fund structure under Hong Kong law and no risk that the segregation of the liabilities between the different portfolios will fail to be recognized by the Hong Kong courts.

Taxation of Hedge Fund Manager

In a typical structure, the hedge fund manager is a legal vehicle separate from the hedge fund vehicle. So, for example, if the hedge fund is setup as a Hong Kong OFC, the hedge fund manager will normally be setup as a separate Hong Kong company. Amongst other things, the separation gives the fund manager greater flexibility to manage client funds. The hedge fund manager can manage segregated accounts for multiple clients as well as multiple hedge funds using a single license granted by the Securities and Futures Commission ("SFC") under the Securities and Futures Ordinance ("SFO") and a single set of operational resources.

The separation of the fund manager from the hedge fund vehicle means that the fund manager is taxed separately from the hedge fund.

Historical Fund Manager Structure

Historically, to minimize tax on the fund manager, Hong Kong managed hedge funds employed a two-tiered fund manager structure, establishing 2 separate fund manager vehicles, one based in an offshore jurisdiction such as the Cayman Islands and one based in Hong Kong. The hedge fund would delegate investment discretion to the offshore fund manager and pay management fees and performance fees to the offshore fund manager. In turn, the offshore fund manager would delegate investment discretion to the Hong Kong fund manager but would only pay the Hong Kong fund manager its costs plus a mark-up (the so-called cost-plus basis). The fund manager would thus seek to shelter a good portion of its management fees and performance fees in the offshore jurisdiction to minimize Hong Kong profits tax even though the Hong Kong fund manager carried out key profit generating activities of the hedge fund in Hong Kong.

Effect of Offshore BEPS Legislation on Fund Manager Structures

The introduction globally of legislation to combat base erosion and profit shifting ("BEPS") has dramatically reduced the use of the two-tiered fund manager structure. BEPS legislation seeks to allocate tax liability according to the place where economic activities take place.

In offshore jurisdictions, BEPS legislation requires that there be sufficient economic substance in those jurisdictions. Thus, for example, in 2019, the Cayman Islands introduced The International Tax Co-operation (Economic Substance) Law ("ESL"). As a result of the ESL, it is no longer possible to establish in the Cayman Islands a fund manager of a hedge fund to collect management and performance fees from a hedge fund unless the fund manager carries out genuine profit generating activities in the Cayman Islands, a task that is likely to be impractical and uneconomical for the vast majority of Hong Kong based fund manager groups.

Hong Kong IRD Anti-Avoidance Attacks on Fund Manager Structures

At the same time, Hong Kong has stepped up efforts to tax economic activities taking place in Hong Kong. In its Departmental Interpretation and Practice Note No. 46 ("DIPN 46") issued in 2009, the Inland Revenue Department ("IRD"), the tax authority in Hong Kong, announced a more aggressive approach to using anti-avoidance provisions of the Inland Revenue Ordinance ("IRO") to scrutinize transfer pricing arrangements, taking particular aim at the two tiered fund manager structures used by hedge funds allocating the lion's share of economic returns to the offshore fund manager vehicle.

Effect of Hong Kong BEPS Legislation on Fund Manager Structures

The introduction in 2018 of BEPS legislation in Hong Kong then established new tools, consistent with BEPS legislation globally, allowing the IRD to impute upon the Hong Kong fund manager economic returns commensurate with its activities and role within the hedge fund structure. As a result, it has become more challenging to shelter management fees and performance fees in an offshore fund manager vehicle in circumstances where the day-to-day fund management activities take place in Hong Kong through the Hong Kong fund manager.

Current Hong Kong Tax Position of the Fund Manager

In light of the above, it has become far more common for fund managers whose real operations are based in Hong Kong to opt for a single fund manager vehicle. The hedge fund will pay management and performance fees directly to this fund manager vehicle, subjecting those fees to Hong Kong profits tax at a tax rate of 8.25% on the first HK$2 million and at a tax rate of 16.5% thereafter.

Taxation of the Hedge Fund

Because the hedge fund vehicle is separate from the fund manager of the hedge fund, the hedge fund's tax position is distinct and separate from the fund manager's tax position. In broad terms, the Hong Kong government offers preferential treatment to the hedge fund itself with a view to ensuring that hedge funds managed from Hong Kong are tax neutral. This policy objective is intended to ensure that Hong Kong remains competitive as a hedge fund management centre.

Liability of Hedge Fund for Hong Kong Profits Tax

Under the IRO, a person who carries on a business in Hong Kong is subject to profits tax on the assessable profits of that business which arise in or derive from Hong Kong.

Under Hong Kong BEPS legislation, a hedge fund may be regarded as having a permanent establishment in Hong Kong and hence, may be regarded as carrying on a business in Hong Kong, on the basis that the fund manager habitually concludes contracts on behalf of and in the name of the hedge fund in Hong Kong.

At the same time, where a hedge fund trades securities traded in Hong Kong, any profits from such trading will likely be regarded as arising in Hong Kong.

Unified Funds Exemption

Given concerns as to whether the presence of a fund manager in Hong Kong would result in a hedge fund being subject to Hong Kong profits tax, the hedge fund industry sought bright line exemption from the Hong Kong government. Initially, the Hong Kong government exempted hedge funds from Hong Kong profits tax under an exemption ("Offshore Funds Exemption") which required the central management and control of the hedge fund to be located outside of Hong Kong. However, with the introduction of BEPS initiatives globally, the Hong Kong government brought into force a new exemption ("Unified Funds Exemption") which no longer conditions exemptive relief on whether the hedge fund is controlled onshore in Hong Kong or offshore outside of Hong Kong.

Under the Unified Funds Exemption, all funds, including hedge funds, regardless of their structure, central management and control location, size or the purpose that they serve, may be eligible for exemption from profits tax subject to certain conditions. While there were concerns that certain hedge funds might fall outside the scope of the Unified Funds Exemption, DIPN 61 issued by the IRD has largely clarified the position and it appears an inclusive approach will be taken.

Conditions for Exemption from Hong Kong Profits Tax

Under the Unified Funds Exemption, a hedge fund may be exempt from Hong Kong profits tax on profits derived from "qualifying transactions" and "incidental transactions". For a hedge fund, transactions in exchange traded shares, options, futures contracts and commodities contracts as well as over-the-counter foreign exchange contracts and derivative contracts will generally be "qualifying transactions" on the basis that the fund manager making the investment decisions and executing the orders holds an SFC Type 9 license. Hong Kong OFCs can trade a wider range of investments and still qualify for exemption.

Transactions of a hedge fund which do not qualify as "qualifying transactions" may nevertheless be exempt from Hong Kong profits tax if they are incidental to qualifying transactions and the profits of the hedge fund from such incidental transactions do not exceed 5% of the hedge fund's total trading profits from both qualifying and incidental transactions.

SFC Licensing of Hedge Fund Managers

Invariably, fund managers who choose to operate in Hong Kong will need to address the requirement under the SFO to be licensed by the SFC. On the basis that the fund manager exercises investment discretion over the hedge fund, the fund manager will typically need to apply for an SFC Type 9 (asset management) license.

Whilst not yet in force, the Securities and Futures (Amendment) Ordinance will introduce a new regulated activity relevant to hedge fund managers whose hedge funds are active in over the counter ("OTC") derivative contracts. In particular, a hedge fund manager that deals or advises in relation to OTC derivative contracts or whose hedge fund enters into an OTC derivatives transaction other than as a price taker may be subject to SFC licensing for Type 11 (dealing or advising in OTC derivative products).

Overview of SFC Licensing

The process of applying for an SFC Type 9 license involves completing prescribed forms and questionnaires for the fund manager and prescribed forms for its individual representatives. This is because under the SFO, SFC licensing requirements extend to both the firm and its individual representatives.

Fund Manager: Application for SFC License

Generally, for the fund manager's application, the SFC forms and questionnaires are supplemented with a business plan and compliance manual. These supplements set out the nature and scope of the business, operational work flow, organization structure and internal controls. For an SFC Type 9 license, they are intended to explain the types of assets the fund manager will manage, the investment strategies the fund manager will use and how the fund manager will raise capital and to demonstrate to the SFC that the fund manager understands the risks of its business, has the experience and systems to manage these risks, and will be able to comply with regulatory requirements applicable to its business.

SFC Licensing: Internal Controls for Fund Managers

Whilst the SFC may streamline applications from certain fund manager applicants (i) who are, or whose parents are, licensed or registered by the U.S. Securities and Exchange Commission or the U.K. Financial Services Authority, or (ii) who have, or whose parents have, proven track records, in general the SFC will scrutinize each fund manager applicant's risk management, compliance, valuation and conflict of interest policies and procedures with some vigour. Since the introduction of Questionnaire A and Questionnaire B in 2019, the SFC requires a much greater level of detail upfront regarding the internal controls and procedures of a fund manager applicant and the applicant is required to confirm that it has such controls and procedures in place.

SFC Licensing: Capital Requirements for Fund Managers

A hedge fund manager holding an SFC Type 9 license (asset management) will normally be subject to a licensing condition that it not hold client assets. On this basis, under the SFO, the fund manager will have no minimum paid-up share capital requirement but its liquid capital requirement may be reduced to as low as HK$100,000. In practice, liquid capital requirements will vary according to the business of the fund manager.

Responsible Officers of SFC Licensed Fund Manager

From an SFC licensing perspective, the most important representatives for a fund manager will be its responsible officers. Every fund manager applying to be licensed must have at least 2 individuals who are approved by the SFC as responsible officers, one of whom must be an executive director (i.e. a member of the board of directors of the fund manager who actively participates in, or is responsible for directly supervising, the business of a regulated activity for which the fund manager is licensed). At the same time, any individual who is a member of the board of directors of the fund manager and who actively participates in, or is responsible for directly supervising, the business of a regulated activity of the fund manager, must be approved as a responsible officer of the fund manager in respect of that regulated activity.

At least 1 of these responsible officers must fully satisfy the SFC that he or she has adequate local regulatory knowledge, industry knowledge, relevant experience and management experience and be available at all times to supervise the business of the fund manager. In reality, this means that a fully qualified responsible officer (as opposed to a responsible officer subject to the non-sole condition) must be based in Hong Kong and immediately contactable by the SFC. In the case of an SFC Type 9 license, the portfolio manager himself will normally be one of the responsible officers.

SFC Licensing Exams for Responsible Officers

To satisfy the requirement for local regulatory knowledge, unless otherwise exempted, an individual who is not currently an SFC licensed representative must pass two Hong Kong regulatory examinations, namely LE Papers 1 and 6, to qualify as a responsible officer for an SFC Type 9 license. The relevant Hong Kong regulatory examinations are held regularly and may be taken by way of either a computer or paper based examination.

Relevant Experience for Responsible Officers

To satisfy the requirement for relevant experience, the SFC generally requires a responsible officer candidate for a hedge fund manager to have at least 3 years of experience in the management of public funds (i.e. collective investment schemes sold to the public), proprietary trading, alternative investments (e.g. managing a hedge fund) or investment research.

Managers-in-Charge

In December 2016, the SFC introduced the Manager-in-Charge regime ("MIC Regime"). Under the MIC regime, a fund manager must nominate a member of the management team to be responsible for each of the prescribed core functions. Typically, a responsible officer will serve as an MIC for a line of business (e.g. portfolio management) and as the MIC with overall management responsibility. Other individuals may serve as MICs for other functions, such as compliance, finance and accounting, operational control and review, and information technology.

MICs who fail to meet regulatory standards may be subject to disciplinary action, even if they are not required to have an SFC license in the first place and are thus not licensed by the SFC.

Ongoing Obligations of Fund Manager

A hedge fund manager holding an SFC Type 9 license must remain fit and proper on an ongoing basis. This will normally include complying with all applicable provisions of the SFO, its subsidiary legislation, the Code of Conduct for Persons Licensed by or Registered with the SFC ("Code of Conduct"), and the Fund Manager Code of Conduct ("FMCC").

Reporting for SFC Type 9 Licensed Fund Manager

On the financial reporting side, a hedge fund manager holding an SFC Type 9 license is required to submit its audited accounts to the SFC within four months of the end of each financial year and, assuming that it is subject to a licensing condition that it shall not hold client assets, a financial resources return within three weeks of the end of June and December each year.

On the business and risk management side, a hedge fund manager holding an SFC Type 9 license is required to submit a Business and Risk Management Questionnaire within four months of the each of each financial year and an annual return within one month of the anniversary date of its license, with an annual fee also being payable within the same time frame.

Notification of Events and Changes

A hedge fund manager holding an SFC Type 9 license must notify the SFC of certain events and changes, including changes in address, changes in its shareholders, changes in its business and litigation. Most minor changes must be notified within seven business days; however, some changes require advanced notice to be given, and major changes generally require the prior approval of the SFC.

Raising Capital for a Hedge Fund

In broad terms, securities laws of key capital raising jurisdictions generally restrict offers or invitations to the public to acquire shares or other interests in hedge funds. Fund managers raising capital for hedge funds in specific jurisdictions may face additional hurdles beyond securities law restrictions on investment offers including, in some cases, requirements to be licensed or registered in a jurisdiction and the imposition of fiduciary duties. At the same time, specific requirements of jurisdictions may, as alluded to above, may render certain hedge fund structures more or less attractive to investors in those jurisdictions. As a result, it is preferable for a fund manager intending to raise significant capital for a hedge fund in any jurisdiction to obtain legal advice in relation to the issues which may arise in marketing in that jurisdiction.

Authorization

In Hong Kong, offers and invitations to the public to acquire shares or other interests in hedge funds are subject to regulatory authorization requirements unless exempted. Whilst the SFC does offer a pathway for authorization of a hedge fund, it is uncommon for fund managers to take that pathway given restrictions imposed by the SFC. In other words, fund managers will typically avoid authorization by relying on exemptions. The most commonly used exemptions are set out below. The mere fact that a fund manager holds an SFC Type 9 license does not exempt the hedge fund from authorization requirements.

Professional Investors Exemption

If the hedge fund is marketed only to professional investors as defined in the SFO, the hedge fund may not be required to obtain SFC authorization. SFO professional investors include institutional investors and non-institutional investors. The former include banks, dealers, insurance companies and certain regulated collective investment schemes. The latter include:

- High net worth individuals, meaning individuals with a portfolio of not less than HK$8 million;

- Corporations whose sole business is to hold investments and which are wholly-owned by high net worth individuals (as defined above);

- Corporations or partnerships with a portfolio of not less than HK$8 million or total assets of not less than HK$40 million;

- Trust corporations registered under the Trustee Ordinance or regulated under the laws of a place outside Hong Kong having total assets under trust of not less than HK$40 million.

Minimum Subscription Size for Hedge Fund

If a hedge fund is structured as a company, such as a Hong Kong OFC, an offering of the shares of the hedge fund may be exempt from SFC authorization if the minimum subscription into the hedge fund by any person is not less than HK$500,000.

Hedge Fund Private Placement

Only offers of shares or other interests in a hedge fund to the public are subject to SFC authorization requirements. In the case of a hedge fund structured as a company, it may be possible to be exempt from authorization requirements if the shares of the hedge fund are offered to no more than 50 persons in any 12 month period.

Suitability

A fund manager holding an SFC Type 9 license is subject to suitability requirements in marketing a hedge fund managed by it. As a result of changes to the SFC Code of Conduct introduced in July, 2019, a fund manager must assess whether the hedge fund is a "complex product". If it is, the fund manager must, amongst other things, ensure that any subscription into that hedge fund is suitable for the investor in all the circumstances. This is so even where the fund manager neither solicited nor recommended the transaction (i.e. the investor simply approached the hedge fund manager and enquired about investing into the hedge fund).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.