In response to industry representations, the Central Board of Direct Taxes (CBDT) has issued a circular on 7 November 2017 (Circular) granting some relief from the applicability of Indian capital gains tax on indirect transfers of Indian assets (Indirect Transfer Rules) as contained in the Income Tax Act, 1961 (IT Act) to certain offshore holding structures. As per the Circular, Indirect Transfer Rules would not apply to investments made by non-resident (NR) investors in feeder vehicles being set-up to pool capital overseas for investments into India, i.e. multiple tier pooling structures used for investing into India will not be subject to Indirect Transfer Rules in case the feeder vehicles redeem or buy-back shares / other instruments for the purpose of distribution of gains to their investors from sale of Indian investments.

Background

Indirect Transfer Rules, introduced in 2012, provide that transfer of shares or interest in a foreign entity, by a NR, which in turn derives its value substantially from Indian assets, would be subject to capital gains tax in India. These provisions resulted in economic double taxation of proceeds received from sale of Indian assets as follows: Firstly, at the time of sale of the Indian asset by the transferor; and secondly, (or many times over in case of multilayer investment vehicles) at the time of distribution of such sale proceeds to the NR investor either through buy-back or redemption or such other mode which also results in transfer of shares in the offshore entity, thereby triggering Indirect Transfer Rules. The offshore pooling vehicle in most of these cases, being set up for investment in India would continue to derive substantial value from Indian assets till such time that the last of its Indian asset is sold off. Typically, the redemption or buy-back would be made by the offshore pooling vehicle post its exit from only some and not all of its Indian investments.

Pursuant to representations made by the stakeholders, the Government recognised the need to provide relief from such economic double taxation. The Finance Act, 2017 did provide some relief by amending the IT Act whereby investors of Category-I and Category-II Foreign Portfolio Investors (FPI) were exempted from application of the Indirect Transfer Rules. Accordingly, investors of Category-I and Category-II FPIs would not be subject to Indian capital gains tax at the time of their exit from the FPI.

However, the economic double taxation in the case of other multiple tier investment structures (other than FPIs) remained unaddressed. The current Circular is intended to address this issue.

Circular

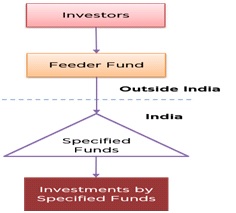

The clarification is explained below with the help of following structure:

The Circular provides relief for investors in pooling vehicle set up outside India, which has in turn invested in certain specified Indian funds, i.e. Investment Funds (registered as Category I or Category II Alternate Investment Funds), VCF, VCC, (together referred to as, Specified Funds). These Specified Funds are not subject to tax in respect of the capital gains from transfer of investments owing to the pass-through status granted to them under the IT Act. Hence, any direct transfer of the investments by the Specified Funds, is taxable only at the level of its investors, as if such investors had directly earned income from transfer of investments. The Circular clarifies that if the capital gains on transfer of shares or securities held by a 'Specified Fund' are chargeable to tax in India in the hands of the NR entity which directly holds the Specified Funds, then income arising to NR investors of such NR entity (as it would be in case of the NR being a feeder fund or pooling vehicle) on account of redemption or buyback of the share or interest in such NR entity would not attract the Indirect Transfer Rules.

Thus, in the above structure, redemption of share or interest held by the Investors in the Feeder Fund or buy back of shares by the Feeder Fund would not attract Indirect Transfer Rules, if the Feeder Fund is chargeable to tax in India on the income from transfer of shares held by the Specified Funds.

The Circular further provides that exemption from the Indirect Transfer Rules would be available only in the cases where the redemption proceeds or the buy-back amount arising to the NR (Investors in the above illustration) does not exceed its pro-rata share in the total consideration realized by the Specified Funds from the transfer of shares or securities in India.

Comment

It is common to have multitier structures set-up overseas for the purpose of pooling capital of offshore investors from various jurisdictions for the purpose of facilitating investments in Specified Funds. These structures, generally referred to as a 'Unified Structure' have found popularity owing to the reduced burden of Indian compliances (such as need to obtain a tax registration number in India and make annual tax filings with Indian authorities) for the investors. Applicable tax, as rightly observed in the Circular is paid at the Feeder Fund level where all the investors are pooled, owing to the pass-through status granted to the Specified Funds under the IT Act.

While the Circular provides much-needed respite to investors using pooling vehicles (which are not FPIs) for making investments into Investment Funds, VCF, VCCs, there are certain gaps and unfortunately it does not achieve the full objective it set out to achieve.

The Circular requires the direct investor (Feeder Fund in the above illustration) to be 'chargeable to tax in India' on the income from transfer of the shares and securities by the Specified Funds. Given that the idea is to avoid double taxation of the same income, once at the level of the Feeder Fund and again in the hands of the NR Investors upon redemption or buy back of shares held in the Feeder Fund, one can infer that the Feeder Fund should have paid tax on the income from transfer of the Indian investments for its investors to be able to claim relief under the Circular. Thus, where the Feeder Fund is not taxed in India owing to relief available under a tax treaty or exemption under the IT Act (eg due to exemption available on on-market sale of long term listed shares), the relief under the Circular would not be available to its investors. For example, in the above illustration where the Feeder Fund is established in a country whose tax treaty with India exempts Indian capital gains tax (eg Mauritius, Singapore, Cyprus, when investment was made before 1 April 2017, and the Netherlands in certain cases), relief under the Circular would not be available to its Investors.

Further, it is vital to note that the Circular requires the redemption amount or buy back amount not to exceed the pro-rata share of the NR in the consideration received on sale of shares / securities by the Specified Funds. Therefore, relief under the Circular may not be available where the redemption or buy back by the Feeder Fund contemplates a differential pricing resulting in disproportionate gains in the hands of the Investors. Given that the industry practice or fund document permits this, one would need to carefully examine distributions (including distributions in the nature of carry), if any, being made at the level of the offshore Feeder Fund.

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com