The trade of dual-use (civil and military) goods, services and technologies (SCOMET items) are closely scrutinized to ensure that they do not fall into the wrong hands. As a consequence of this, businesses who legitimately deal with such items are also required to pass this scrutiny. We provide an overview of the regulations governing the SCOMET items and highlight the key aspects that businesses involved in the trade of SCOMET items should know.

Four Multilateral Export Control Regimes ("MECRs") 1 came into force in the wake of India's nuclear tests in 1974 and Iraq's use of chemical weapons during the Iran-Iraq war in 1980-1988. MECRs sought to control the trade of dual-use (both civilian and military) goods, services and technology (collectively referred to as "items"). India is a member of three MECRs and maintains a list of items controlled for export: the Special Chemicals, Organism, Material, Equipment and Technologies ("SCOMET") list. This article sumarrises the trade regulations that govern SCOMET items and what businesses who deal with these items should know.

The Foreign Trade (Development and Regulation) Act, 1992 ("FTDR Act") and the Foreign Trade Policy of India ("FTP") 2govern the Indian trade regime. The FTP contains a Handbook of Procedures ("HBP") 3 and a specific item wise policy for classification called the Indian Trade Classification [Harmonized System] ("ITC(HS)") Classification of Export and Import Items. Appendix 3 of Schedule 2 of the ITC(HS) contains the SCOMET list.

India has aligned itself with the MECRs and ensures that it closely scrutinizes trade of SCOMET items to prevent them from falling into the wrong hands and being utilised for illegitimate purposes. However, this also affects entities who trade SCOMET items for legitimate business purposes.

What is included in the SCOMET List?

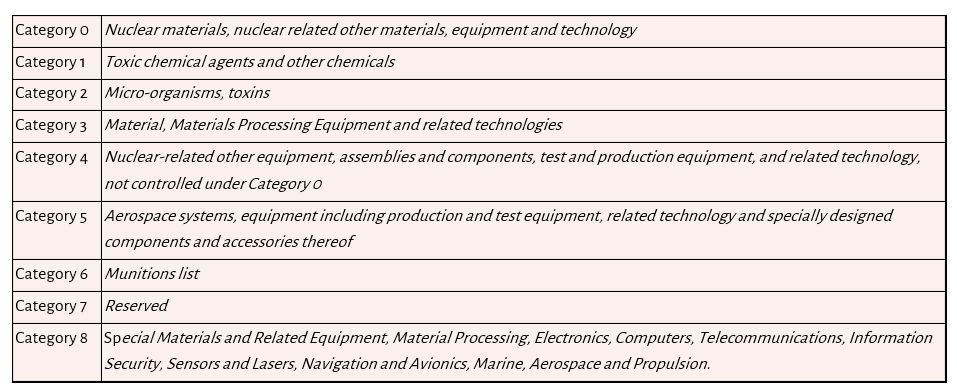

The SCOMET list covers items which have dual-uses. Export of SCOMET items should be against an export authorization unless it is prohibited. 4 Notified in 1992, the SCOMET list has been amended multiple times to align it with the global practices. The SCOMET list classifies items into 9 distinct categories.

Export Authorization

Application for Export Authorization

The entity that seeks to trade SCOMET items must create an online profile and obtain a unique Importer-Exporter Code ("IEC"). Application for grant of export authorisation has to be made online to the Director-General of Foreign Trade ("DGFT") as prescribed in HBP. 5 Certain documents have to be uploaded along with the application such as a purchase order from the foreign buyer, an end-user certificate(s), technical specifications of the items being exported and bills of entry for items exported during the last year. 6

Examination of Application

An Inter-Ministerial Working Group in the DGFT scrutinizes applications to ensure that all required conditions are being fulfilled, including:

- credentials of the end-user and declarations related to the end-use of the items;

- assessed risk of the exported goods falling into the hands of terrorists, terrorist groups, and non-state actors;

- export control mechanism instated by the recipient state which is receiving the items;

- the defence capabilities and objectives of schemes and programmes related to weapons and delivery in the recipient state; and

- analysis of applicable bilateral or multilateral treaty in which one party is India on a case to case basis. 7

Once the Inter-Ministerial Working Group accepts the request, they issue an export authorization, with or without conditions, to the exporter. Once issued, an export authorization is valid for 24 months from its issue.

Bulk Licensing for re-export

In 2019, the DGFT has introduced an advance bulk license system known as the Global Authorization for Intra-Company Transfers ('GAICT'). 8 This license can be used by an Indian subsidiary to re-export SCOMET items to overseas group companies who have availed a license exception for original export of such items to India. Subject to the specific conditions prescribed by the DGFT, 9 it applies to re-export of all SCOMET items other than those falling under Categories 0 (Nuclear materials), 1C (Toxic chemicals, to the extent re-exports to States not a party to CWC), 3A401 (Prescribed high explosives, etc.), 5 (Aerospace systems, etc.) and 6 (Munitions List).

Export/Supply of SCOMET items to/from Special Economic Zones

Special Economic Zones ("SEZ") are specific regions in a country which are governed by different economic policies than the rest of the regions within the same country. It is deemed to be a foreign territory for trade and levy of customs duties and tariffs. Domestic supply of SCOMET items to an SEZ does not require any export authorization provided it is being reported to the Development Commissioner of the respective SEZ. 10 However, export authorization is required if the SCOMET items are to be exported from an SEZ to another country. 11

Consequences of Exporting SCOMET Items without Authorization

In a case where any of the SCOMET items are exported without the proper authorization, penal provisions under the FTDR Act will be attracted. 12 The penalties include suspension or cancellation of IEC, imprisonment for a term between 6 months and 5 years and/or fine of not less than INR 3 lakhs which may extend up to INR 20 lakhs or five times the value of the items exported.

Implications for Indian businesses

Accurate Classification

It is important that Indian entities who deal in SCOMET items thoroughly peruse through the applicable category(s) to ascertain the precise classification number applicable to their goods, services and technologies. The classification is very granular and a thorough examination is required. For certain items, more than one category may be applicable (for example, aerospace is covered in Category 5 and Category 8). If an item fits under two or more separate classification heads, the most specific classification description based on end-use will apply. Identifying the precise classification is crucial for obtaining export authorizations and an inaccurate classification could lead to a delay in obtaining an export authorization, and consequently business operations will be affected. Therefore, Indian entities should thoroughly examine and ascertain the relevant classification number and the applicable conditions for SCOMET items at the earliest. This will streamline the export authorization process.

Export of technology and services

The export of goods occurs when the goods are taken out of India by land, air or sea. 13 Services and technology will be deemed to be exported even if it is provided to a foreign consumer within the territory of India. 14 Indian entities who supply SCOMET services and technology to foreign consumers must be weary of this and ensure that adequate export authorizations, if required, are obtained prior to supply.

Conclusion

Indian entities who trade in SCOMET items in the regular course of business should examine their goods, services and technologies individually and holistically and ensure that they are matched with the relevant classification number. This exercise will mitigate errors which result in rejection of application for export authorization or exporting SCOMET items without authorization.

Footnotes

1 Australia Group, Missile Technology Control Regime, Nuclear Suppliers Group, and Wassenaar Arrangement.

2 Chapter 1, FTP.

3 Para 1.03 and 1.05, Chapter 1, FTP.

4 Para 1, Page no. 2, Appendix 3, ITC(HS).

5 Para 2.72, Chapter 2, HBP.

6 FAQ 22, Guidelines related to Export Policy, http://dgftcom.nic.in/exim/2000/scomet/2017/guidelines2017.pdf.

7 Para 2.74, Chapter 2, HBP.

8 Vide Public Notice 1 issued on July 24, 2019 (can be accessed at http://dgft.gov.in/sites/default/files/PN%2020%20dated%20%2018.07.2019%20on%20GAICT%20Eng_0.pdf 2).

9 Id.

10 Page 1 of Appendix 3, HBP.

11 Rule 26 of the Special Economic Zones Rules, 2006.

12 Section 14E, FTDR Act.

13 Section 2(e)(I), FTDR Act.

14 Section 2(e)(II)(ii), FTDR Act; Para 9.53, FTP; and Naman Hotels v. Union of India (2015) 326 ELT 513; Vodafone Essar Ltd. v. Union of India (2011) 270 ELT 492.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.