INTRODUCTION

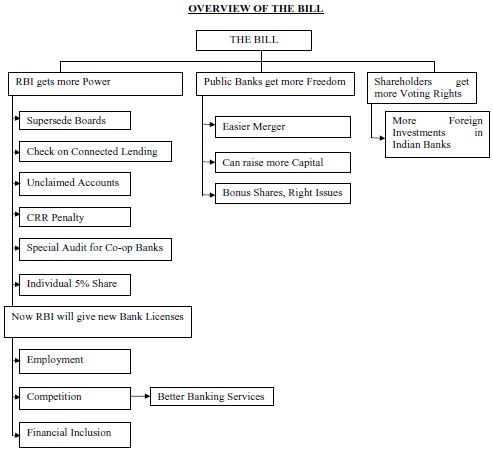

After much delay and deliberation the Banking Laws (Amendment) Bill, 2012) ["Bill"] which seeks to amend the Banking Regulation Act, 1949 and the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980 has been passed in the winter session of parliament of India by both the houses. The Lok Sabha which is the lower house of the Indian parliament passed the bill on 18th Dec'12 & the Rajya Sabha which is the upper house of the Indian parliament passed the bill on 20th Dec'12. The bill will be notified as a statute once it receives the assent of the President of India. The bill seeks to strengthen the regulatory powers of the Reserve Bank of India and to further develop the banking sector in India. This bill aims to address the issue of capital raising capacity of banks in India by enabling nationalized banks to raise capital by issue of preference shares or rights issue or issue of bonus shares. It would also enable them to increase or decrease the authorized capital with approval from the Government and RBI without being limited by the ceiling of a maximum of Rs. 3000 crore. The Bill would also pave the way for new bank licenses by RBI resulting in opening of new banks and branches.

COVERAGE OF THIS INSIGHT

This insight broadly highlights the key amendment brought in under the Bill and its effect on the Indian banking sector as a whole.

OVERVIEW OF THE BILL THROUGH FLOWCHART REPRESENTATION

AMENDMENTS

Powers Granted to RBI Under The Bill

- New Bank Licenses and Greater Regulatory

Oversight.

The Bill enables the Reserve Bank of India (RBI) to issue new bank licenses to corporate houses which will give the RBI greater regulatory oversight over local banks & the ability to overrule board of directors of a banking company for not more than 12 months and appoint an administrator for managing the company during that period.

The Bill also seeks to increase the rates of existing monetary penalties that RBI can impose on a bank if it disobeys RBI rules, directives or gives false information. These amendments shall be conducive to the changing banking scenario because with the issue of new banking licenses the need shall arise for greater regulatory control. - Power to Inspect

The Bill shall give the powers to check the records inspect books of conglomerates, and account-books of mutual funds, insurance and other companies associated/connected with a bank. This is done to prevent and keep a check on connected lending practices. - Unclaimed Bank Accounts

The Bill gives power to RBI to transfer the money lying in the bank account which is not operated by the account holder for more than 10 years, to the "Depositor Education and Awareness Fund". The RBI shall appoint a committee to use money from this fund to create awareness among the customers. But in a case where the account holder returns then, the account holder can claim this money and that bank shall be bound to pay him interest as well. - Acquisition of Shares and Voting Rights

Prior approval of RBI shall be needed for acquisition of 5% or more of shares or voting rights in a banking company by any person. The RBI shall be empowered to impose such conditions as it deems fit in this regard.

For example: If any person wants to buy more than 5% shares of any bank, he'll have to take permission from RBI and before giving him approval, RBI can put conditions on him. For example ask for a deposit worth Rs.X, so that if any mischief, fraud etc is committed by the person then RBI shall take away the deposited amount. - Regulating Cooperative Societies

A license from the RBI is to be taken by primary cooperative societies to carry on the business of banking. RBI shall have powers to conduct special audits of the cooperative banks by extending applicability of Section 30 Banking Regulation Act, 1949 to them. The reason for special audits of these cooperative society is that because they're more liable to collapse and frauds. - Cash Reserve Ratio (CRR)

RBI is empowered by this Bill to demand penalty interest from the bank if the bank fails to maintain the prescribed minimum amount of Cash Reserve Ratio (CRR) on any day.

Amendment Related To Public/Private Sector Banks

- Revised Voting right

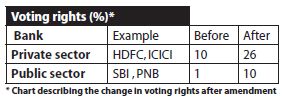

Private Sector Banks: The Bill increases shareholders' voting rights from 10 per cent to 26 per cent in private sector banks, making investment attractive for foreign players.

Public Sector Banks: This Bill also enables the government to raise voting rights in state banks such as the State Bank of India to 10 (ten) per cent from the current 1 (one) per cent, acceding partially to foreign investors' demands to have more say in Indian banking.

In the shareholders meeting voting is done on many issues (for example election of Board of Directors, Changing name of the Company etc.) but in case of public banks the shareholders have only 1% voting right irrespective of number of shares held so they cannot heavily influence any decision. So this amendment will make the voting rights proportional to the number of shares held by shareholders and will attract foreign investors to invest in Indian banks. - Banking Merger

The Competition Commission of India will approve M&A (Mergers and Acquisitions) in banks except in the case of banks that are under trouble. In such cases, the RBI will have the final authority, - Raising Investments

The Bill enables the nationalized banks to raise capital through "bonus" and "rights" issue and also enable public sector banks to increase or decrease the authorized capital with approval from the Government and RBI without being limited by the ceiling of a maximum of Rs. 3000 crore under the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980.

Amendment Related to Foreign Banks

- Stamp Duty

The Bill will allow foreign banks to convert their Indian operations into local subsidiaries or transfer shareholding to a holding company of the bank without paying stamp duty. This move will be helpful for the foreign banks to expand their business operations into India. - Commodity Trading

The Government has dropped the controversial clause in the Bill that would have allowed banks to trade in the commodity futures market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.