The Hon'ble President of India promulgated an ordinance being the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021 dated 4 April 2021 (Ordinance) which inter-alia added Part III-A to the Insolvency and Bankruptcy Code, 2016 (IBC), introducing a framework for prepackaged insolvency resolution (Prepack) for corporate debtors qualifying as micro, small and medium enterprises (MSMEs). The Ordinance comes in the backdrop of the Covid-19 pandemic on MSMEs given that the pandemic exposed many of such businesses to severe financial distress. Last year, around the same time, recognizing the need for protecting smaller businesses, the Government of India, by way of a notification dated 24 March 2020, had also raised the minimum threshold for initiating corporate insolvency resolution processes (CIRP) to INR 1 crore (approx. USD 130,000) from earlier INR 1 lakh (approx. USD 1300). This was followed by a 1 (one) year suspension on initiation of any new insolvency proceedings for defaults occurring on or after 25 March 2020, irrespective of the size of default.

While the newly introduced Prepack Framework, is largely in line with the pre-pack framework recommended by the sub-committee of the Insolvency Law Committee (Sub-Committee), in its report to the Ministry of Corporate Affairs, Central Government dated 31 October 2020 (Report), its applicability is limited to MSMEs, as against the suggestion of the Sub-Committee, which had proposed a framework for all corporate debtors and for the resolution of stress in such corporate debtors pre and post default.

The Ordinance has been promulgated with the intent and objective of providing an alternative insolvency resolution process for MSMEs, which will address the specific requirements of such businesses and ensure quicker, cost effective, and value maximizing outcomes for all stakeholders.

Close on the heels of the Ordinance, the Insolvency and Bankruptcy Board of India (IBBI) and the Central Government issued the Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Regulations, 2021 (Prepack Regulations) setting down the manner of conducting various actions required to be contemplated by different stakeholders involved in a Prepack along with the Insolvency and Bankruptcy Board of India (Pre-packaged Insolvency Resolution Process) Rules, 2021 ("Prepack Rules").

In this Ergo, we set out to analyse the salient features of the framework for Prepacks as laid down by the Ordinance and the Prepack Regulations (Prepack Framework), while also highlighting some of its key departures from the Report of the Sub-Committee.

APPLICABILITY OF THE ORDINANCE

The Ordinance stipulates that an application for Prepack can be made under the Prepack Framework only in relation to a corporate debtor which qualifies as a micro, small or medium enterprise under Section 7(1) of the Micro, Small and Medium Enterprises Development Act, 2006.

THRESHOLD OF DEFAULT

The Ordinance adds a second proviso to Section 4 of the IBC (Second Proviso). Pursuant to this proviso, the de minimus threshold for initiating a Prepack against an MSME is a default of INR 1,00,000 (Indian Rupees One Lakh) which could be increased by the Central Government upto INR 1,00,00,000 (Indian Rupees One Crore) (De Minimus Threshold). The Central Government issued the Notification being S.O 1543 (E) dated 9 April 2021 specifying INR 10,00,000 (Indian Ten Lakhs) as the De Minimus Threshold.

INFORMAL STAGE OF THE FRAMEWORK

The Report had recommended that the Indian prepack framework should be one which combines 'best of both worlds', by combining elements such as speed, efficiency and flexibility of an informal process with the binding effects and structure of a formal process. In consonance with this objective, the Prepack Framework envisages the completion of certain actions prior to formally filing an application (Application) for commencement of the pre-packaged insolvency resolution process ("PP-IRP"), thereby keeping most of the time taking actions outside the rigors of a formal process. These actions are set out below:

Actions by the Corporate Debtor

- The members of the corporate debtor are required to pass a special resolution or at least three-fourth of the total number of partners of the corporate debtor, as the case may be, are required to pass a resolution, approving the filing of the Application (Resolution). This deviates from the Report which had recommended the approval of members of the corporate debtor by a simple majority.

- The corporate debtor shall prepare a "base resolution plan" (Base Resolution Plan) for the insolvency resolution of the corporate debtor. The Base Resolution Plan is required to comply with the provisions of Sections 30(1) and 30(2) of the IBC.

- The majority of the directors or partners of the corporate

debtor, as the case may be, should make a declaration

(Declaration), stating, inter alia that:

- the corporate debtor shall file the Application within a period not exceeding 90 days;

- the Prepack is not being initiated to defraud any person;

- the name of the resolution professional proposed and approved to be appointed; and

- the Nomination Process has been completed.

Approvals to be taken by Unrelated Financial Creditors

The Prepack Framework stipulates that the corporate debtor is required to convene a meeting of financial creditors of the corporate debtor who are not related parties of the corporate debtor (Unrelated FCs) by serving a notice of at least 5 (five) days before the date of the meeting, unless a shorter time is agreed to by the Unrelated FCs. In the said meeting, the corporate debtor is required to obtain the following approvals:

- The Unrelated FCs representing not less than 66% in value of the financial debt due to such creditors, should approve the filing of the Application (Approval). Prior to seeking such Approval, the corporate debtor is required to provide the Unrelated FCs inter-alia with: (a) Resolution; (b) Declaration; and (c) Base Resolution Plan;

- The Unrelated FCs, representing not less than 10% of the value of the total financial debt of such creditors, should propose the name of an insolvency professional to be appointed as the resolution professional for conducting the Prepack and the said person should be approved by the Unrelated FCs with a weighted voting share of at least 66% (Nomination Process).

In case the corporate debtor does not have Unrelated FCs or no financial debt, then the corporate debtor is required to convene the meeting of operational creditors, who are not related parties of the corporate debtor and the approvals set out in this section are required to be obtained from operational creditors in the same form and manner as required to be obtained by Unrelated FCs.

PREPARATION OF REPORT BY THE RESOLUTION PROFESSIONAL

Pursuant to the completion of the Nomination Process, the RP who has been approved by the Unrelated FCs is required to prepare a report (Report) confirming whether the Conditions Precedent (defined hereinbelow) are satisfied and that the Base Resolution Plan complies with the provisions of Sections 30(1) and 30(2) of the IBC.

FORMAL STAGE OF THE FRAMEWORK

Application for commencement of Formal Stage of the Framework

Once the informal process, as set out above, is complete, an application for the formal commencement of a Prepack may be made before the relevant Adjudicating Authority in relation to a corporate debtor pursuant to the satisfaction of the following conditions (Conditions Precedent):

- The corporate debtor is an MSME;

- The default meets the De Minimus Threshold;

- All the actions required to be completed during the Informal Phase, as elucidated above, are complied with;

- The corporate debtor has not undergone Prepack or completed CIRP, as the case may be, during the period of 3 (three) years preceding the date of initiation of Prepack (3 Year Period). It is interesting to note that from the text of the Ordinance, it appears that the 3 Year Period is calculated from the notional date on which the Prepack would be initiated if the Application is admitted, as opposed to the date of filing of the Application.

- The corporate debtor is not undergoing CIRP as on the date of filing the Application;

- An order has not been passed by the Adjudicating Authority under Section 33 of the IBC directing the liquidation of the concerned corporate debtor; and

- The corporate debtor is eligible to submit a resolution plan under Section 29A of the IBC.

The Application is required to be accompanied by: (a) Declaration; (b) Resolution; (c) Approval; (c) the name and written consent of the proposed RP; (d) Report; (e) a declaration regarding any avoidance transactions under Chapter III of the IBC or fraudulent or wrongful trading under Chapter VI of the IBC; and (f) information relating to books of account of the corporate debtor; (d) audited financial statements of the corporate debtor for the last 2 (two) financial years; (e) provisional financial statements for the current financial year made up to the date of Declaration; and (f) written consent of the insolvency professional proposed to be appointed as authorised representative of a class of creditors (if applicable). The Central Government has issued the Prepack Rules on 9 April 2021 prescribing the format in which the Application is required to be filed.

The Application is required to be admitted by the Adjudicating Authority within a period of 14 (fourteen) days, if the Application is complete i.e., aforesaid conditions are satisfied, and such date of admission shall be considered as date of commencement of Prepack of the concerned corporate debtor (ICD). However, it is relevant to note that while a similar time period prevails for admission of an application to commence CIRP of a corporate debtor, such timelines have been seldom followed by the Adjudicating Authority. If the Application is not complete, then the Adjudicating Authority is required to give notice to the applicant to rectify the defect in the Application within 7 (seven) days from the date of receipt of such notice from the Adjudicating Authority.

Declaration of moratorium and Appointment of Resolution Professional.

Upon admission of Application, the Adjudicating Authority shall declare a moratorium prohibiting the actions restricted under Section 14(1) and 14(3) of the IBC. It is relevant to note that the Prepack Framework excludes the applicability of Section 14(2) of the IBC which stipulates that even during moratorium, the supply of essential goods or services to the corporate debtor shall not be terminated or suspended or interrupted.

Simultaneously with admission of the Application and declaration of moratorium, the Adjudicating Authority shall, subject to certain conditions, appoint the resolution professional based on the Nomination Process. Additionally, the Adjudicating Authority shall cause a public announcement of the initiation of the Prepack by the resolution professional, within 2 (two) days of his/her appointment (Public Announcement) inter-alia providing the following information: (a) name and basic information about the concerned corporate debtor; (b) the date of commencement of PP-IRP; and (c) name, registration number, address and e-mail address of the resolution professional. The Public Announcement is required to be: (a) sent to every creditor of the corporate debtor; (b) sent to the information utilities; and (c) published on the website, if any, of the corporate debtor and the IBBI.

Constitution of CoC

Contrary to a CIRP, the corporate debtor, in a Prepack, is required to prepare a preliminary list of claims, along with the details of the respective creditors, their security interest and guarantees, if any, and submit it to the RP within a period of 2 (two) days from ICD. Based on the records of the corporate debtor and other relevant material available on record, the RP shall confirm the details received and maintain a list of claims. The RP is also required to inform every creditor regarding its claims, as confirmed by him/her, and seek objections, if any.

Subsequently, within a period of 7 (seven) days of the ICD, the RP is required to constitute the committee of creditors (CoC) basis the list of claims submitted by the corporate debtor.

The composition of the CoC during a Prepack shall be pari materia to its composition during a CIRP in the event the corporate debtor has Unrelated FCs. However:

- where the corporate debtor has only creditors in a class and no other Unrelated FCs, the CoC shall consist of only the authorised representative(s); and

- where the corporate debtor has no financial debt or all financial creditors are related parties, the CoC shall consist of the following unrelated operational creditors: (i) 10 (ten) largest operational creditors by value, and if the number of operational creditors is less than 10 (ten), the CoC shall include all such operational creditors (Largest OCs); (b) 1 (one) representative elected by all workmen other than those workmen included in Largest OCs; and (c) 1 (one) representative elected by all employees other than those employees included in Largest OCs.

Preparation of Information Memorandum

The corporate debtor is required to prepare a preliminary information memorandum containing information relevant for formulating a resolution plan and submit it to the RP within a period of 2 (two) days from ICD. The RP is required to finalise the information memorandum and submit to members of the CoC within 14 (fourteen) days of ICD after receiving an undertaking from the members of the CoC that such member shall maintain confidentiality of the information and shall not use such information to cause an undue gain or undue loss to itself or any other person (as the case may be).

Management of corporate debtor during Prepack

In a significant departure from the CIRP framework and with the intent to avoid disruption in business operations and/ or dent to the business reputation, the Prepack Framework envisages that the management of the affairs of the corporate debtor shall continue with its board of directors or the partners ("Erstwhile Management"), as the case may be, subject to the following conditions:

- The board of directors or the partners, as the case may be, of the corporate debtor shall make every endeavour to protect and preserve the value of the property of the corporate debtor and manage its operation as a going concern;

- The promoters, members, personnel, and partners, as the case may be, of the corporate debtor shall exercise their contractual or statutory rights and obligations in relation to the corporate debtor.

However, while the management of the corporate debtor remains with the Erstwhile Management, the RP is obliged to: (a) monitor the management of corporate debtor by the Erstwhile Management; and (b) inform the CoC in the event the Erstwhile Management breaches any of its obligations under the provisions of the Framework. Therefore, while the Prepack Framework endeavors least business disruption by allowing the existing management to run the business during the process unlike in a CIRP, it is not without checks and balances.

In fact, at any stage of the Prepack, the CoC by vote of minimum 66% can resolve to vest the management of corporate debtor with the RP (Replacement). In this regard, the RP is required to make an application for approving the Replacement to the Adjudicating Authority, which can pass an order granting such relief, if it is satisfied that: (a) the affairs of the corporate debtor have been conducted in a fraudulent manner; or (b) here has been gross mismanagement of the affairs of the corporate debtor (Replacement Event).

It is relevant to note that while the management and affairs of the corporate debtor remains with the Erstwhile Management (unless a Replacement Event occurs), the Ordinance stipulates that the provisions inter-alia of Section 28 of the IBC shall apply mutatis mutandis to a PP-IRP. Accordingly, erstwhile Management is required to take prior consent of CoC while undertaking actions contemplated in Section 28 of the IBC. Additionally, the Prepack Regulations also prescribe that erstwhile Management cannot undertake a transaction above a threshold as decided by the CoC. In other words, the PP-IRP framework sets out a debtor in possession with a creditor in control model of resolution process.

Consideration and approval of Resolution Plan

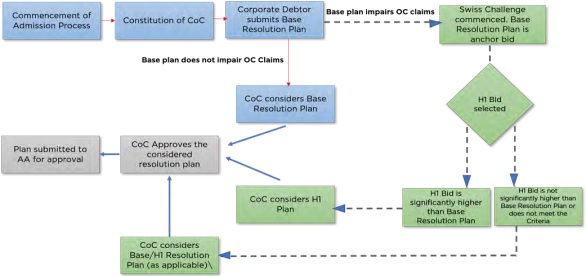

The corporate debtor is required to submit the Base Resolution Plan to the RP within a period of 2 (two) days from ICD. The CoC may consider and approve the Base Resolution Plan if it does not impair the claims owed to the operational creditors i.e., if the Base Resolution Plan discharges the debts owed to operational creditors in full.

However, in the event:

- the CoC is not satisfied with the Base Resolution Plan; or

- the Base Resolution Plan impairs any claims of operational creditors,

then the RP is required to invite prospective resolution applicants ("PRAs") no later than 21 days from the date of ICD to submit a resolution plan for the corporate debtor to compete with the Base Resolution Plan (Swiss Challenge Process). The CoC is authorised to determine: (a) the criteria required to be satisfied by PRAs and/or their resolution plans while submitting the resolution plans having regard to the complexity and scale of operations of the business of the corporate debtor and such other conditions as may be specified by IBBI (Criteria); and (b) the matrix to evaluate the resolution plans submitted by PRAs (Resolution Plans). However, before taking these actions, the CoC may consider providing the corporate debtor an opportunity to revise the Base Resolution Plan.

A Resolution Plan is required to provide (a) an affidavit that the resolution applicant is eligible to submit a resolution plan under IBC; (b) a statement giving details if the resolution applicant or any of its related parties has failed to implement or contribute to the failure of implementation of any resolution plan approved by the Adjudicating Authority at any time in the past; (c) an undertaking that every information and record provided in connection with or in the resolution plan is true and correct and discovery of false information and record at any time will render the resolution applicant ineligible to participate in any resolution process under IBC; (d) the term of the plan and its implementation schedule; (e) the management and control of the business of the corporate debtor during its term; (f) a statement as to how it has dealt with the interests of all stakeholders of the corporate debtor; and (g) adequate means for supervising its implementation.

Additionally, the Resolution Plan is also required to demonstrate that: (a) it addresses the cause of default; (b) it is feasible and viable; (c) it has provisions for its effective implementation; (d) it has provisions for approvals required and the timeline for the same; (e) the resolution applicant has the capability to implement the Resolution Plan; (f) the amount payable under the Resolution Plan to the operational creditors shall be paid in priority over financial creditors; and (g) the amount payable under the Resolution Plan to the financial creditors, who have a right to vote and did not vote in favour of the Successful Plan (defined below), shall be paid in priority over financial creditors who voted in favour of the Successful Plan.

If no Resolution Plans are received which are in accordance with the provisions of the IBC and the Prepack Regulations, the CoC shall consider the Base Resolution Plan for approval ("Compliant Resolution Plans"). However, if the Compliant Resolution Plans are received, then the CoC shall evaluate the Compliant Resolution Plans presented by the RP and select a Resolution Plan from amongst them ("H1 Plan").

If the CoC opines based on the Criteria that the H1 Plan is significantly better than the Base Resolution Plan, then the H1 Plan may be approved by the CoC with a voting share of 66%. The Prepack Regulations define the term "significantly better" in relation to a resolution plan, to mean that the score of the resolution plan is higher than that of another resolution plan by a certain number or percentage, as approved by the CoC, and disclosed in the invitation for resolution plans. However, if the H1 Plan is not selected for approval, then the RP shall disclose the score allotted to the H1 Plan based on the Evaluation Matrix and the Base Resolution Plan to the concerned bidder and the corporate debtor respectively and invite them to improve the H1 Plan and the Base Resolution Plan respectively (together "Plan(s)") within a window of 48 (forty eight) hours (Comparison Event). The Plan having higher score on completion of the Comparison Event shall be considered by the CoC for approval.

While approving a Plan, the CoC is, inter-alia, required to consider the feasibility and viability of the Plans and the manner of distribution proposed, taking into account the order of priority amongst creditors as set out in Section 53(1) of the IBC.

A Plan once approved by the CoC (Successful Plan) shall be submitted to the Adjudicating Authority. The Adjudicating Authority shall approve the Successful Plan if the following conditions are satisfied:

- the Successful Plan satisfies the conditions stipulated under Section 30(2) of the IBC; and

- the Successful Plan has provisions for effective implementation,

TERMINATION OF PREPACK

A Prepack may be terminated upon the occurrence of the following events:

- a Plan is taken up for consideration by the CoC pursuant to the Comparison Event, but is not approved by the CoC;

- the CoC does not approve a Plan before the expiry of 90 (ninety) days from ICD; and

- the CoC decides, by a minimum voting share of 66%, any time between ICD and approval of a Plan, to terminate the Prepack.

Liquidation: It is relevant to note that (i) if the Prepack of a corporate debtor has been terminated on account of the grounds mentioned in (a) or (b) above; and (ii) a Replacement Event has transpired, then the Adjudicating Authority may pass an order not only terminating the Prepack, but also liquidating the said corporate debtor.

and upon such approval the said Plan becomes binding on the corporate debtor and its employees, members, creditors (including statutory creditors) guarantors and other stakeholders involved in the Plan.

For ease of reference, we have set out below, a pictorial representation of Formal Phase of the PP-IRP:

INVOCATION OF THE CIRP

At any time during the Prepack but before the approval of a Plan by the CoC, the CoC by exercise of minimum 66% of the voting rights may resolve to initiate the CIRP against the corporate debtor. In such case, the Adjudicating Authority will pass an order commencing CIRP of the said corporate debtor. The said order shall be deemed to be an order of admission under Section 7 of the IBC.

TIME-LIMIT FOR COMPLETION OF THE PROCESS

The Framework prescribes strict timelines for the completion of the formal stage of the Prepack. The key timelines are as follows:

- a Plan is required to be approved by the CoC within a period of 90 (ninety) days from the ICD, failing which the Prepack may be terminated.

- the entire Prepack process i.e., the formal process post admission of PP-IRP, including obtaining necessary orders from the Adjudicating Authority approving the Successful Plan or terminating the Prepack, is to be completed within a period of 120 (one hundred and twenty) days from ICD.

COMMENTS

The IBC and the Reserve Bank of India's Prudential Framework for Resolution of Stressed Assets dated 7 June 2019 have taken long strides towards putting in place a comprehensive and efficacious mechanism for resolution of stressed assets. However, on account of certain inherent drawbacks, a comprehensive framework for prepackaged insolvency resolution was long overdue in India. In this backdrop and in line with the recommendations of the Sub-Committee in its Report, the Prepack Framework sets out a sui generis process which is a hybrid of formal and informal processes thereby providing flexibility to the corporate debtor and its creditors to amicably arrive at a mechanism for resolution of stress of the corporate debtor and providing it legal sanctity by way of a stamp of approval from a court/tribunal.

The Prepack Framework envisages a debtor in possession and a creditor in control model unlike that of a CIRP. This model safeguards against disruptions in the management of the corporate debtor and resultant deterioration in the value of assets and goodwill of the corporate debtor. However, at the same time, there are provisions that provide for curbs on the powers of the erstwhile Management to manage the affairs of a corporate debtor during PP-IRP.

The Central Government and the IBBI have been very quick footed in coming out with the Prepack Regulations and the Prepack Rules close on the heels of the Ordinance. The framework of PP-IRP of MSMEs would provide an interesting prelude and a reliable testing ground for a framework of PP-IRP of other categories of borrowers, allowing the legislature to suitably put in place a comprehensive framework for all categories of borrowers based on the experiences and lessons learnt from the PP-IRP framework for MSMEs

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com