Introduction

Letter of Credit ('LC') is a very common document used in international trade. It is a letter issued by the buyer's bank, guaranteeing payment to the seller upon fulfilment of conditions mentioned therein. Generally, these conditions are with respect to presentation of certain documents evidencing transportation/ shipping of goods.

In recent times, due to Covid-19 situation, many parties have invoked Force Majeure clause in their contract/ agreement. There were cases, wherein the seller had transported the goods up to the landing ports, but the buyer could not take delivery due to lockdown and invoked Force Majeure clause. In such cases, the buyers have approached court to restrain banks from honouring LC. We will analyse the concept of LC and its governing laws in order to understand that, whether the Buyer can restrain banks from honouring the LC.

Structure of LC Transaction

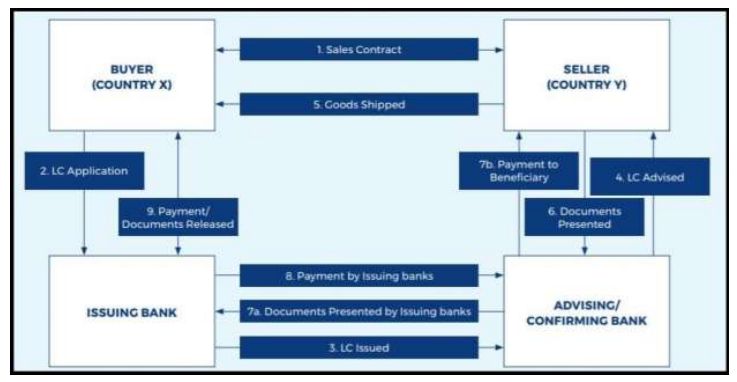

The structure of a typical documentary LC transaction can be best understood as under:

- The Seller and the Buyer enter into an agreement to buy and sell goods with the condition that payment will be made through LC;

- The Buyer thereafter files an application with his bank ("Issuing Bank") to issue LC against pledge over document related to the transaction for which LC is to be issued;

- The Issuing Bank issues LC and sends it to the Seller's Bank ("Advising Bank");

- The Advising Bank subsequently examines the LC and informs the Seller;

- The Seller thereafter dispatches the goods to Buyer;

- The Seller presents documents under LC to the Advising Bank;

- (a) The documents are checked, and forwarded to the Issuing Bank

(b) If the documents are in place, payment is processed by the Advising Bank;

- The documents are then verified by the Issuing Bank and accordingly reimbursement is made to the Advising Bank;

- The Buyer then makes payment to the Issuing Bank and documents related to transaction are released.

Laws Governing LCs

The LCs are governed by Uniform Customs & Practice for Documentary Credits ("UCP 600"). UCP 600 is a set of rules agreed by the International Chamber of Commerce and is applicable to all financial institutions in the world issuing LC. The relevant articles of the UCP 600 are as under:

- Article 4: Credit vs. Contract

In terms of Article 4, a credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to is included in the credit.

- Article 5: Documents vs. Goods or Services

In terms of Article 5, Banks deal with documents (example – B/L, Pre-shipment and post-shipment documents etc.) and not with goods or services to which the documents may relate to.

- Article 15: Complying Presentation

In terms of Article 15, if the documents presented are in compliance with the terms of credit, the Issuing Bank is bound to honour the credit.

Force Majeure and Honouring LC

Recently, in the case of Standard Retail Pvt. Ltd. & Ors. Vs. M/s G.S. Global Corps & Ors., a group of importers approached the Hon'ble High Court of Bombay to seek stay on honourof LC on the ground that the lockdown has rendered the performance of contract impossible. The Hon'ble High Court rejected their plea with one of the reasons being that the LCs are an independent transaction with the Bank and the Bank is not concerned with the underlying disputes between the buyers and sellers.

Conclusion

Before approaching the Court to seek stay on the honour of LC, the Buyer must keep in mind Article 15 of the UCP 600. If the Seller has complied with the conditions of the LC, the Banks are bound to honour the LC and the Buyer cannot take legal assistance to stop theBank from honouring the payment against LC. The Banks are not concerned with the main contract between the parties, the only thing with which the Issuing Bank is concerned are the conditions of the LC.

The Hon'ble High Court of Bombay in the case of Standard Retails (supra) rightly observed that the Banks are not concerned with the underlying dispute between the parties before honouring the LC

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

This content is purely an academic analysis under "Legal intelligence series".

© Copyright AMLEGALS.

Disclaimer: The information contained in this document is intended for informational purposes only and does not constitute legal opinion, advice or any advertisement. This document is not intended to address the circumstances of any particular individual or corporate body. Readers should not act on the information provided herein without appropriate professional advice after a thorough examination of the facts and circumstances of a particular situation. There can be no assurance that the judicial/quasi-judicial authorities may not take a position contrary to the views mentioned herein.