With the COVID-19 outbreak, countries around the world are facing a tough task of preventing their economies from shrinking. Various countries have announced stimulus packages, and India too has launched 'Aatma Nirbhar' Mission to make itself a 'selfreliant nation.'

Aatma Nirbhar Package

To achieve the objective of a self-reliant nation, the government seems to have focused on Micro, Small and Medium Enterprises (MSME) and have announced a slew of measures keeping them in mind. One such major relief is expansion in the scope/ definition of MSMEs to enable a large number of entities to be covered by MSME benefits. Apart from this, the package seems to ensure liquidity and operational continuity of the MSMEs while simultaneously providing opportunities for the potential growth of their businesses.

Expanded Definition

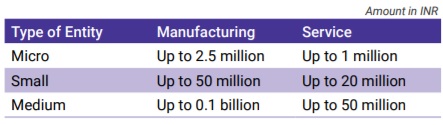

Existing definition under MSME statute provides for the following criteria based on investment in plant and machinery to be qualified as an MSME entity:

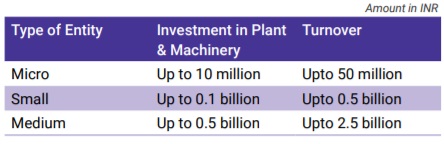

With an expansion in the scope of definition of MSMEs, the distinction between manufacturing and service enterprises has been done away with, and now the entities (both manufacturing as well as service sector) would need to fulfill the following criteria in order to be qualified as an MSME:

As per a recent notification, the above definition is applicable with effect from 1 July 2020. It has also been clarified that 'export turnover' will be excluded for the purposes of arriving at the 'Turnover' threshold.

Benefits

Upon registration, the following benefits may be available to the entities:

- Earlier debtor collection: Under MSME

statute, it is mandatory for every person to make payment to a MSME

within 45 days. Any payment beyond this timeline would attract

compounding interest at thrice the rate notified by RBI. Further,

such interest is not allowable as deduction while filing the tax

return.

Also, dues to MSMEs need to be disclosed in the financial statements of the creditor. An MSME may also approach the relevant authorities on MSME Samadhaan Portal for settlement of its dues;

- Insolvency proceedings: Under AtmaNirbhar Package, it has been proposed to increase the threshold limit for initiation of insolvency proceedings against MSME to INR 10 million. It has also been proposed to provide for a special insolvency resolution framework for MSMEs;

- Collateral free credit facilities: Collateral free working capital loan has been provided to the existing entities having an outstanding loan of up to INR 0.25 billion as on 29 February 2020, and turnover of up to INR 1 billion as on 31 March 2020. Moreover, the dues should not have been outstanding for more than 60 days as of 29 February 2020. Maximum credit for an amount up to 20% of outstanding credit facilities as on 29 February 2020 can be given. The scheme is valid till 31 October 2020. To avail benefit under the scheme an entity need not be registered as an MSME however, all entities need to have GST registration apart from fulfilling the above criteria;

- Provision of subordinate debt to promoters of stressed MSMEs for necessary equity infusion in MSMEs. Considering that the facility is available to the stressed MSMEs, it may also be open to the MSMEs who are already registered and have stressed accounts with financial institutions;

- Support to Venture Capital/Private Equity firms via Fund of Funds to encourage private sector participation in MSMEs and/or listing of MSMEs on stock exchanges. This is to handhold MSMEs, having potential for future growth, in these turbulent times;

- Government Procurement: All tenders valuing up to INR 2 billion by government/government owned enterprises must be floated to domestic players, thereby opening new opportunities for MSMEs. This is apart from the existing mandatory policy for 25% of all procurement by government/ government owned enterprises from MSMEs;

- Priority payment by government: Under the package, provision has also been made for payment of existing MSME dues by government/government owned enterprises within 45 days.

Way Forward

Entities falling within the existing thresholds may get themselves registered at udyogaadhaar.gov.in, to avail the above benefits. However, it is pertinent to note that the entities qualifying for MSME registration under the new thresholds need to wait for the amended forms to be released.

Further, newly set-up entities may get themselves registered both as a start-up as well as a MSME.

While these are welcome steps and should enable MSMEs to sail through in these turbulent waters, clarifications are still required for the following, specifically concerning newly registered MSMEs:

- Whether newly registered MSMEs can pursue collection of receivables due even for the period before their registration;

- Whether newly registered MSMEs can also be entitled to the 'Fund of Funds' Scheme.

Originally published 10 June, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.