The current pandemic has made businesses worldwide undergo serious distress. Before preparing financial statements, one needs to reassess fundamental estimates and assumptions, which were otherwise presumed.

As a relief measure, lessors have started providing lease rent concessions in the form of rent reductions, rent deferrals, or even complete rent holidays.

Businesses are still adapting to the new accounting for leases after the introduction of IFRS 16. The new standard has given specific guidelines on the accounting treatment in case of modification in any lease contract. Companies that have received lease concessions due to the pandemic will also be tested under these provisions. However, these modification provisions may prove to be complicated and cause a major impact on the financial statements.

In light of the above, the International Accounting Standards Board (IASB) has amended IFRS 16 and introduced a practical expedient that will allow lessees to bypass the modification provision on account of the current pandemic.

General provisions of lease modification for lessees under IFRS 16

Lease modification is defined as a change in the lease payments and/or scope of the lease, which was not a part of the original contract. Under this, if there is a reduction in the lease rentals without any reduction in the scope of the lease, the lease liability is re-measured considering:

- The revised discount rate prevalent as on the date of modification for the remaining lease term;

- Revised future lease payments finalized as a result of the modification

This reduction in lease liability will be adjusted with the right-ofuse asset as on the date of modification.

Note: Modifications due to changes in the scope of a lease are not covered in this article as the Practical Expedient given by IASB is only applicable in case of modifications to lease rentals with the scope of leases remaining the same

Amendment by IASB in May 2020

The practical expedient issued by the IASB in May 2020 grants an option to the lessee not to apply for the lease modification provisions where lease concessions are a direct result of the COVID-19. Lessees may apply this practical expedient for reporting periods beginning on or after 1 June 2020; however, the application is permitted even for financial statements not authorized as on the date of the amendment.

The standard further requires that the circumstances of changes in the lease arrangement meet the following criteria:

- The changes in lease results are substantially the same, or lower, lease consideration compared to the period preceding this change.

- The reduced lease payments are due for the period on or before 30 June 2021. In case the reduction in lease payments is in the form of deferrals, such deferrals can extend to the period beyond 30 June 2021.

- There is no major change in any other terms of the lease.

Where the changes in the lease are in line with the above criteria, lessees may opt for the practical expedient and charge the difference arising in the lease payments to the statement of profit and loss (in case such changes result in the reduction of overall lease rentals). At the same time, changes in lease payments and/ or the point of payment will have no impact on interest charged on lease liability or valuation and amortization of right-of-use assets.

Example

APL has rented an office space under an agreement that terminates on 31 March 2021.

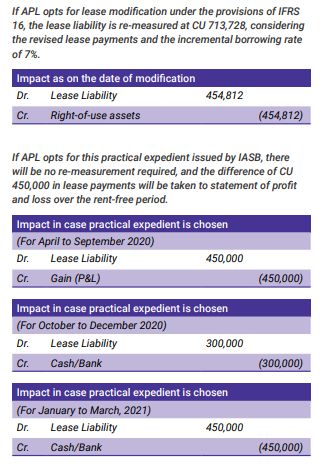

Monthly rent is CU 100,000. The economic circumstances due to the pandemic, the company and landlord come to an understanding whereby the landlord has abated rent for the period of April to September 2020. As compensation, rent for the period of January to March 2021 is increased to CU 150,000.

The total lease rentals payable over the remaining term of the contract was CU 1,200,000. After the renegotiation, the total payable is reduced to CU 750,000.

APL's incremental borrowing rate was 6% at lease inception and is now at 7% because its credit rating has fallen.

The lease liability as on 1 April 2020 is CU 1,168,540, and the right-of-use assets are CU 1,135,470.

Interest expense on lease liability and depreciation of the ROU asset will continue to be charged as they were before the modification was finalized.

With this practical expedient, IASB has tried to exclude the particular changes in lease payments arising as a product of the pandemic from the purview of lease modifications under IFRS 16.

In this case, while preparing the financial statement, one does not has to navigate through IFRS 16's complicated lease modification provisions, recalculate the lease liabilities, and reconsider its initial estimates and assumptions for the lease contracts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.