On 19th March 2019, the 34th meeting of the GST Council recommended numerous rate-cuts for the real estate sector in a bid to ease the tax/compliance burden on all the concerned stakeholders. These changes were notified by way of multiple notifications dated 29th March 2019. This article aims to analyze in detail, the important changes brought about by the said notifications, which have come into effect from 1st April, 2019, vis-à-vis the position previously in effect.

A. Previous Position (until 31st March, 2019)

The tax rates prevailing until 31st March, 2019 allowed for complete utilization of the eligible Input Tax Credit, and the rates in force under Notification No. 11/2017-C.T.(Rate) were as under:

| Sr. No. | Construction Service | Rate | Effective Rate (excluding valuation of land at 1/3 rd of consideration) |

| 1. | Commercial apartments (shops, offices, godowns, etc.) | 18% | 12% |

| 2. | Residential apartments other than those at Sr. No. 3 | 18% | 12% |

| 3. | Certain residential apartments under notified schemes such as Rajiv Awaas Yojana, Pradhan Mantri Awas Yojana, etc.1 ("Notified Schemes") | 12% | 8% |

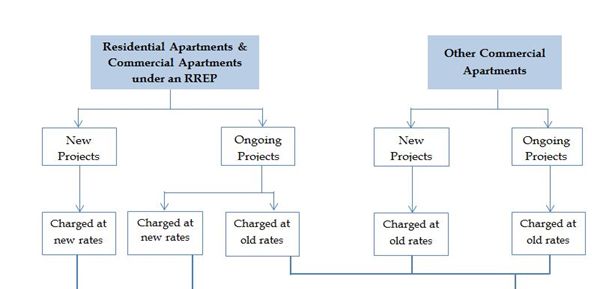

For ongoing projects, developers may exercise the one-time option to pay GST at the old rates or alternatively, opt to transition to the new rates, wherever applicable, as under. The option to pay GST at the old rates is to be exercised by 10th May, 2019, failing which, the option to pay GST at the new rates shall be deemed to have been exercised.

B. New Position (from 1st April, 2019)

Notification No. 3/2019-C.T.(Rate) provides for new rates for construction services in respect of certain specific units. These rates mandatorily apply to projects commencing on or after 1st April, 2019 and optionally to ongoing projects, in case the developer does not opt to pay tax at old rates, in which case the new rates would apply on the installments payable by the customer on or after 1st April, 2019 .

| Sr. No. | Construction Service | New Rate | Effective Rate (excluding valuation of land at 1/3 rd of consideration) |

| Units in a Residential Real Estate Project (RREP)2 | |||

| 1. | Affordable residential apartments 3 | 1.5% | 1% |

| 2. | Residential apartments other than affordable residential apartments | 7.5% | 5% |

| 3. | Commercial apartments | 7.5% | 5% |

| Units in a Real Estate Project other than an RREP | |||

| 4. | Affordable residential apartments | 1.5% | 1% |

| 5. | Residential apartments other than affordable residential apartments | 7.5% | 5% |

Since no new rate has been provided for commercial apartments in a Real Estate Project other than an RREP, such construction services would continue to attract GST at the previous rate of 18% (effective rate being 12%) with full availability of ITC.

It is interesting to note that residential apartments under notified schemes such as Rajiv Awaas Yojana, Pradhan Mantri Awas Yojana, etc. within ongoing projects are selectively included in the definition of "affordable residential apartments" and thus, leviable to the concessional rate of GST at 1%. It, therefore, has to be inferred that the very same residential apartments constructed under projects commencing on or after 1st April, 2019 would not fall under the banner of "affordable residential apartments" and therefore would attract GST at the rate of 5%. This understanding, although leading to a peculiar conclusion, is within the strict letter of the notifications and whether such treatment is intentional or on account of an omission in the framing of the notification remains to be seen.

The following corresponding conditions are to be fulfilled by the developer, to the extent the new rates are applicable to the projects undertaken by it :

- The developer shall not avail ITC of goods and services used in providing such construction services, and the GST thereon will have to be mandatorily paid in cash. (For ongoing projects where the developer has opted to pay tax at new rates, ITC would be allowed on a proportionate basis for payment of GST on installments received on or before 31st March, 2019, and the balance ITC would be required to be reversed by the due date of the return for September, 2019);

- 80% of the value of inputs and input services, (excluding services of grant of development rights, long term lease of land against upfront payment or FSI, electricity, high speed diesel, motor spirit, natural gas but including supplies on which tax is paid under RCM), shall be procured from GST-registered suppliers;

- In case the prescribed threshold of 80% is not maintained for any financial year, the developer shall be liable to pay GST at a flat rate of 18% on the value of shortfall 4, under the reverse charge mechanism (RCM).

- The developer would be additionally

liable to pay GST under RCM on the following purchases:

- At the rate of 28% on every inward supply of cement from unregistered suppliers 5; and

- At the individual applicable rates, on every inward supply of capital goods6.

- An exception has been carved out for the landowner, by virtue of which the landowner is eligible to avail ITC of the GST charged by the developer on construction services provided to the landowner, to offset the GST payable by the landowner on further sale of such constructed units before issuance of completion certificate/first occupation. This is subject to the condition that the GST paid by the landowner on further sale is not less than the GST paid by the developer on construction services.

C. Other Composite Supplies of Works Contract:

A reduced rate of 12% is provided for works contract services applicable for sub-contractors in respect of residential apartments in a project with carpet area of up to 60 sq. m. in metropolitan cities or 90 sq. m. otherwise, and for which the gross amount charged is not more than Rs. 45 lakhs.

The reduced rate is applicable where -

- such residential apartments constitute at least 50% of the total carpet area of all the apartments in the project; and

- in respect of ongoing projects, the developer has not opted to pay GST at the old rates on such construction services.

In case it turns out that the aforesaid criterion of 50% is not achieved at the end of the project, the shortfall in GST i.e. 6% is payable by the developer under RCM.

The residual GST rate for works contract services in respect of certain works under Notified Schemes remains 12%, and in all other cases remains 18%.

D. Liability of Developer in respect of transfer of development rights/FSI or grant of long term lease of 30 years or more (on or after 1st April, 2019)

GST on construction services provided to the landowner, against supply of development rights/FSI, remains payable by the developer in the usual course. However, where the supply of development rights/FSI occurs on or after 1st April, 2019, the liability to pay tax is deferred to the time of issuance of completion certificate/first occupation7. Further, GST on transfer of development rights/FSI or grant of long term lease of 30 years or more in all cases is payable by the developer under RCM 8.

The quantum and instance of liability in respect of supply of transfer of development rights/FSI is illustrated below:

| Sr. No | Consideration payable by the developer9 | Allocation of consideration | Transfer of Development Rights/FSI | ||

| Applicable Rate | Date on which liability to pay GST arises | ||||

| 1. | Consideration in the form of construction service of commercial or residential apartments | RESIDENTIAL | Apartments booked prior to issuance of completion certificate/first occupation | Nil 10 | N. A. |

| Apartments booked after issuance of completion certificate/first occupation | Lower

of the following11 – (i) 18% of the value of development rights (basis value of similar apartments booked nearest to the date of transfer of development rights) proportionately attributable to the residential apartments remaining unbooked as on the date of issuance of completion certificate/first occupation; or ii) 1% of the value of affordable residential apartments and 5% of that of residential apartments other than affordable residential apartments (basis value of similar apartments booked nearest to the date of issuance of completion certificate) remaining unbooked as on the date of issuance of completion certificate/first occupation. |

Date of issuance of completion certificate/ first occupation12 | |||

| COMMERCIAL | Apartments booked prior to or after issuance of completion certificate/first occupation13 | 18% | Date of issuance of completion certificate/first occupation 14 | ||

| 2. | Monetary Consideration | RESIDENTIAL | Apartments booked prior to issuance of completion certificate/first occupation | Nil15 | Nil |

| Apartments booked after issuance of completion certificate/first occupation | Lower

of the following16 (i) 18% of the value of development rights proportionately attributable to the residential apartments remaining unbooked as on the date of issuance of completion certificate/first occupation; or (ii) 1% of the value of affordable residential apartments and 5% of that of residential apartments other than affordable residential apartments (basis value of similar apartments booked nearest to the date of completion) remaining un-booked as on the date of issuance of completion certificate/first occupation. |

Date of issuance of completion certificate/first occupation 17 | |||

| COMMERCIAL | Apartments booked prior to or after issuance of completion certificate/first occupation | 18% 18 | Date of transfer of development rights/FSI19 | ||

The quantum and instance of liability in respect of grant of long term lease of 30 years or more is illustrated below:

|

Sr. No. |

Consideration payable by the developer20 | Allocation of consideration | Long Term Lease | ||

| Applicable Rate | Date on which liability to pay GST arises | ||||

| 1. | Consideration in the form of upfront amount (premium, salami, cost, price, development charges or bearing any other name) | RESIDENTIAL | Apartments booked prior to issuance of completion certificate/first occupation | Nil21 | N. A. |

| Apartments booked after issuance of completion certificate/first occupation | Lower

of the following22 – (i) 18% of the upfront amount payable proportionately attributable to the residential apartments remaining unbooked as on the date of issuance of completion certificate/first occupation; or (ii) 1% of the value of affordable residential apartments and 5% of that of residential apartments other than affordable residential apartments (basis value of similar apartments booked nearest to the date of issuance of completion certificate) remaining un-booked as on the date of issuance of completion certificate/first occupation. |

Date of issuance of completion certificate/first occupation23 | |||

| COMMERCIAL | Apartments booked prior to or after issuance of completion certificate/first occupation | 18%24 | Date of invoice in respect of such upfront amount25 | ||

| 2. | Consideration in the form of periodic rent | RESIDENTIAL | Apartments booked prior to or after issuance of completion certificate/first occupation | 18% 26 | Date of invoice in respect of such periodic rent 27 |

| COMMERCIAL | Apartments booked prior to or after issuance of completion certificate/first occupation | 18%28 | Date of invoice in respect of such periodic rent 29 | ||

Yet another difficulty arises in the joint reading of the new rates of construction services and the taxability of supplies of development rights/FSI or grant of long term lease. While the former relies on the concepts of RREP and projects other than an RREP, the latter only creates a plain distinction between services of construction of residential apartments and of commercial apartments. Consequently, for the specific service of construction of a commercial apartment within an RREP, the effective output rate is 5% without availability of ITC. However, no corresponding exemption (prior to issuance of completion certificate/first occupation) or concession (after issuance of completion certificate/first occupation) is made available in respect of inward supplies of development rights/FSI or long term lease. Thus, developers will be compelled to discharge GST at 18% on such inward supplies to the extent attributable to commercial apartments in an RREP, which would be consequently uncreditable due to the conditions of new rates prescribed from 1st April, 2019.

E. Apportionment of Common ITC

Apportionment of common ITC in respect of units sold prior to and after issuance of completion certificate/first occupation (i.e. between taxable and non-taxable supplies) is to be undertaken separately for each project and is to be finally calculated by the due date of the return for September following the end of the financial year in which the completion certificate is issued/first occupation takes place. This is a significant departure from the previous provision requiring apportionment of common ITC at the end of every financial year. In this regard, the formula for allocation of common ITC has been prescribed in the notifications.

Apportionment of ITC would also be required to be carried out by developers as a condition of transitioning to the new rates for ongoing projects. A simplified snapshot of ITC apportionment provisions is provided below:

| Apportionment of ITC is not required since the new rates come with a condition stipulating that ITC shall not be allowed30. | ITC to be

apportioned by September, 2019. Since ITC is partly available, apportionment is required in respect of construction services provided prior to and on/after 1st April, 2019, respectively in the prescribed formula 31. No apportionment is required in respect of construction services provided prior to and after issuance of completion certificate/ first occupatio32 |

ITC to be

apportioned by September following the FY in which the completion

certification is issued/first occupation takes

place. ITC is to be apportioned in respect of units sold prior to and after issuance of completion certificate/first occupation, respectively. ITC will be allowed only to the extent that it relates to construction services provided prior to issuance of completion certificate/first occupation 33. |

Conclusion

The above notifications, although seeking to alleviate the concerns of the real estate sector, have resulted in a very contrived solution to an already complicated issue. The mandatory denial of ITC on account of a concessional rate defies the original objective of bringing the entire supply chain of the sector fully within the scope of GST. Further, since the notifications, exhaustive as they are, were issued on 29th March, 2019 and became applicable from 1st April, 2019, the stakeholders were faced with a severe time crunch primarily for analysis of the new tax framework and consequently, for its implementation. Whereas for ongoing projects, the developers are required to exercise the option to charge GST at the old rates or move to the revised rates without ITC, the commercial viability of such a move will have be necessarily examined by 10th May, 2019 with little leeway. The discrepancies in notifying the framework have only inflamed the situation further. Further clarifications in this regard are awaited by the industry.

(The views expressed are strictly personal.)

Footnotes

1. See NN 11/2017-CT(R) as amended, Sl. No. 3: clauses (b), (c), (d), (da), (db) of Entry (iv); clauses (b), (c), (d), (da) of Entry (v) and clause (c) of Entry (vi)

2. "Residential Real Estate Project (RREP)" means a real estate project in which the carpet area of the commercial apartments is not more than 15% of the total carpet area of all the apartments in the real estate project

3. See para (v), clause (xvi) of NN 3/2019-CT(R) for complete definition; "affordable residential apartment" means,

i) a residential apartment in a project which commences on or after 1st April, 2019, or in an ongoing project wherein the promoter has exercised the option to pay GST at the new rates, having carpet area not exceeding 60 sq. m. in metropolitan cities or 90 sq. m. otherwise and for which the gross amount charged is not more than Rs. 45 lakhs; and

(ii) a residential apartment in an ongoing project under the Notified S chemes

4. (NN 3/2019-CT(R) and NN 7/2019-CT(R) r/w NN 08/2019-CT(R)

5. NN 3/2019-CT(R) and NN 7/2019-CT(R) r/w NN 1/2017-CT(R) as amended

6. NN 7/2019-CT(R) r/w NN 1/2017-CT(R) as amended

7. Clause (i) r/w clause (d) of NN 6/2019-CT(R)

8. NN 5/2019-CT(R)

9. NN 5/2019-CT(R) prescribes GST payable under RCM for supply of development rights/FSI regardless of nature of consideration i.e. construction services or monetary compensation received against it

10. Entry 41A inserted by NN 4/2019-CT(R)

11. Condition prescribed against Entry 41A inserted by NN 4/2019-CT(R) r/w Explanation 1A and 1B thereto

12. Clause (i) r/w clause (a) of NN 6/2019-CT(R) prescribes deferred liability against outward supply of residential as well as commercial construction services

13. This would be governed by the sundry rate under NN 11/2017-CT(R) as prevailing prior 1st April, 2019

14. Clause (i) r/w clause (a) of NN 6/2019-CT(R) prescribes deferred liability against outward supply of residential as well as commercial construction services

15. Entry 41A inserted by NN 4/2019-CT(R)

16. Condition prescribed against Entry 41A inserted by NN 4/2019-CT(R) r/w Explanation 1B thereto

17. Clause (i) r/w clause (b) of NN 6/2019-CT(R)

18. Since Entry 41A inserted by NN 3/2019-CT(R) only applies to the extent of residential construction services, this would be governed by the sundry rate under NN 11/2017-CT(R) as prevailing prior 1st April, 2019

19. Clause (i) r/w clause (b) of NN 6/2019-CT(R) only prescribes deferred liability against outward supply of residential construction services and thus, liability in respect of commercial construction arises at the time of supply of development rights/FSI

20. NN 5/2019-CT(R) prescribes GST payable under RCM for grant of long term regardless of nature of consideration i.e. upfront or periodic payment received against it

21. Entry 41B inserted by NN 4/2019-CT(R)

22. Condition prescribed against Entry 41B inserted by NN 4/2019-CT(R) read with Explanation 1B thereto

23. Clause (ii) r/w clause (c) of NN 6/2019-CT(R)

24. Since Entry 41B inserted by NN 3/2019-CT(R) only applies to the extent of residential construction services, this would be governed by the sundry rate under NN 11/2017-CT(R) as prevailing prior 1st April, 2019

25. Clause (ii) r/w clause (c) of NN 6/2019-CT(R) only prescribes deferred liability against outward supply of residential construction services and thus, liability in respect of commercial construction arises on the date of invoice in respect of such upfront amount

26. Since Entry 41B inserted by NN 3/2019-CT(R) only applies to the extent of consideration received in the form of upfront payment, this would be governed by the sundry rate under NN 11/2017-CT(R) as prevailing prior 1st April, 2019

27. Clause (ii) r/w clause (c) of NN 6/2019-CT(R) only prescribes deferred liability where consideration is in the form of upfront amount and thus, liability against payment of periodic rent arises on the date of invoice in respect thereof

28. Since Entry 41B inserted by NN 3/2019-CT(R) only applies to the extent of consideration received in the form of upfront payment, this would be governed by the sundry rate under NN 11/2017-CT(R) as prevailing prior 1st April, 2019

29. Clause (ii) r/w clause (c) of NN 6/2019-CT(R) only prescribes deferred liability where consideration is in the form of upfront amount and thus, liability against payment of periodic rent arises on the date of invoice in respect thereof

30. Rule 42(3), CGST Rules, 2017 as inserted by NN 16/2019-CT

31. Annexures I & II to NN 3/2019-CT(R)

32. Rule 42(5), CGST Rules, 2017 as inserted by NN 16/2019-CT

33. Rule 42(3), CGST Rules, 2017 as inserted by NN 16/2019-CT

Originally published by Tax India Online.

© 2018, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.