INVESTMENT AND DEAL

ACTIVITY ANALYSIS

HIGHLIGHTS FROM Q3 OF FY 2020-21

Private equity investments and exits

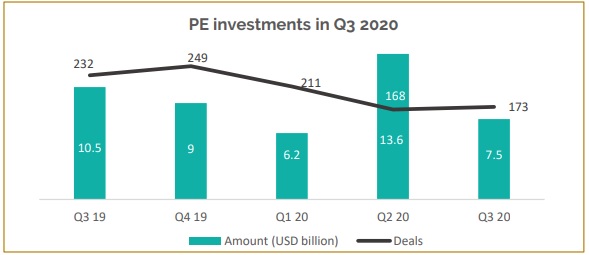

- Q3 2020 witnessed 173 Private equity (PE)

investments worth USD 7.5 billion

- The largest PE investment was announced by Silver Lake, KKR and General Atlantic's USD 2536 million investment in Reliance Retail Ventures

- The second largest investment was the USD 414 million acquisition of publicly-listed pharmaceuticals company JB Chemicals & Pharmaceuticals Ltd by global PE investor KKR

- The third largest investment was the purchase of ECL Finance's sticky corporate loans worth USD 401 million by US-based Farallon Capital and Singapore-based SSG Capital

- Funds with AIF vehicles participated in 75 investments representing 43% of overall investment worth USD 4.6 billion.

- 86 DPIIT registered start-ups raised PE funding worth USD 719 million.

- Q3 2020 saw 38 PE exits that harvested USD 1.6 billion. The largest exit was the USD 253 million part-exit by Blackstone from publicly-listed Essel Propack Ltd.

- India focused funds raised around USD 3.2 billion across 15 funds, an 85% increase (by value) compared to Q3 2019.

Source: IVCA Private Equity & Venture Capital Report, Jul-Sep 2020

Venture capital investments and exits

- Q3 2020 witnessed 113 VC investments worth USD 375 million.

- The largest VC investment during the period was the USD 20 million investment in fintech startup UniOrbit Technologies by Accel India and Lightspeed Ventures

- The second largest investment was the USD 16 million investments in online gaming platform WinZO led by Makers Fund, Courtside Ventures, Kalaari Capital and Bellerive Capital.

- Funds with AIF vehicles participated in 50 investments.

- 75 DPIIT registered startups raised VC funding worth USD 195 million.

- Q3 2020 saw 16 VC exits that harvested USD 358 million.

Source: IVCA Private Equity & Venture Capital Report, Jul-Sep 2020

10 TAKEAWAYS FROM

COMPANIES (AMENDMENT) ACT, 2020

Continuing with Government of India's recent spate of reforms meant to bolster economic activity and investment in the country, the Companies Amendment Bill, 2020 was introduced to amend the Companies Act, 2013 (Act) with the intent of improving the ease of doing business in India, decriminalizing various minor offences and regulating producer companies, amongst other aspects. This Bill received the President's assent and was notified in the official gazette as the Companies (Amendment) Act, 2020 (Amendment) on September 28, 2020, and will come into effect on such date(s) as may be notified by the Central Government.

Key changes in this Amendment are enumerated here below:

- De-criminalization of minor offences: By way of the Amendment, imprisonment as a consequence of contravention of certain provisions of the Act has been done away with for over 46 offences under the Act, in addition to reducing, modifying and omitting the fines/penalties for these offences. By way of example, imprisonment has been removed as a punishment for contravention of provisions in relation to buyback of securities, disclosure of interest by directors, financial statements and Boards' report, formation of companies with charitable objects, disqualification of directors and constitution of audit, stakeholder relationship and nomination and remuneration committee. Similarly, penalties and fines have been omitted/modified/reduced for contravention of provisions in relation to filing of annual return with Registrar, variation of shareholder rights, transfer of securities, alteration of share capital and reduction of share capital, among others.

- Definition of listed companies: Prior to the Amendment, a company with 'any of its securities listed on a recognised stock exchange' was qualified as a listed company and resulted in such companies having to comply with the Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR) in addition to compliances under the Act. The Amendment, however, empowers the Central Government to exempt certain class of companies and securities (which are yet to be prescribed) from being considered as a listed company, in consultation with the Securities Exchange Board of India (SEBI). This exclusion of certain class of securities will ease the burden on companies from rigorous compliance and procedural requirements under the LODR and the Act.

- Foreign listing: Pursuant to the addition of a new sub-section to Section 23 of the Act, certain classes of public companies incorporated in India, as may be prescribed by the Central Government, are permitted to issue securities for listing on stock exchanges in permissible foreign jurisdiction, without requiring compulsory listing in India. The Central Government is also empowered to exempt such class pf public companies from complying with certain provisions of the Act, namely, provisions relating to private placement and public offer of securities, beneficial ownership, share capital and debentures or punishment for failure to distribute dividend, by way of issuing a notification, which has to be placed before both Houses of Parliament.

- Periodic financial results: Section 129A of the Amendment empowers the Central Government to require a certain class of unlisted public companies (which is yet to be prescribed) to prepare periodic financial results. Such periodic financial results are in addition to preparation of annual financial results prescribed under the Act and would need to be approved by the Board of Directors and audited (or subjected to a limited review) by the statutory auditors, in addition to filing periodic financial results with the Registrar. This requirement appears to have been introduced in alignment with similar provisions prescribed for listed companies under the LODR. Given that certain class of public companies will be permitted to list their securities in foreign jurisdictions, without listing on Indian stock exchanges, it is no surprise that the Amendment imposes an additional requirement on unlisted public companies to prepare periodic financial results thereby allowing the Central Government or the Ministry of Corporate Affairs (MCA) to keep a close watch on the functioning of such companies on a periodic basis and not just on an annual basis as per existing provisions of the Act.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.