Since its introduction in 2013, the Safe Harbour Rules have provided a window for taxpayers, wherein the income-tax authorities shall accept the transfer price under eligible circumstances. The previous measures, as updated in 2017, can be viewed here. However, the Safe Harbour Provisions were prescribed1 only till the financial year ending up to March 2019. Most MNCs were eagerly waiting for a clarification in this regard, especially for the FY 2019-20 before they close their financial statements. In this regards, the Central Board of Direct Taxes (CBDT) has issued a notification recently2, the key terms of this notification are:

- Former Safe Harbour Rates will continue to apply for the FY 2019-20

- The application to be made in Form 3CEFA for the FY 2019-20 would be for 1 year only

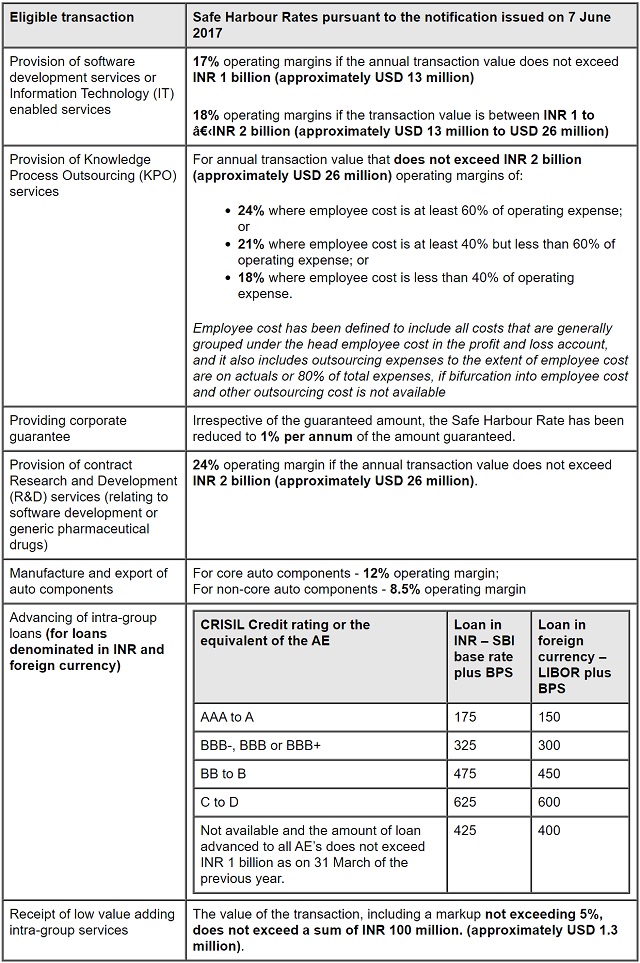

A summary of the former Safe Harbour Rates that would be applicable for the FY 2019-20 are:

Our Comments

Better late than never, this notification is a welcome move for companies to revalidate their existing transfer pricing policies in light of confirmed Safe Harbour Rules for the closure of FY 2019-20 books. In these unprecedented times, Safe Harbour as a means for reducing the transfer pricing disputes, providing administrative simplicity and certainty to the taxpayers is a boon.

Interestingly the Safe Harbour Provisions that were historically applicable for a period of 3-5 years have been notified for a single year only. There is a possibility that we may receive more notifications in this context for the FY 2020-21 due to the background of the unprecedented global pandemic.

Footnotes

1 Pursuant to sub-rule 3A of Rule 10TD of the Income Tax Rules 1962

2 Notification No. 25/2020 for Rule 10TD and 10TE

Originally published 22 May, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.