INTRODUCTION:

The conception of Class Action Suits is one of the many improvement introduced in the Companies Act, 2013 vide Section 245. The concept of Class Action is not new but in Indian context it has found recognition and enforceability now only by means of Companies Act, 2013. The class action suit first time came to the highlight in the context of securities market was when the Satyam scam broke out in year of 2009. Subsequently, the Indian investors in India couldn't take any legal remedy against the company while their counterparts in USA filed class action suit claiming compensations from the company. This mechanism evolved to overcome the well known `Collective Action' problem, where suits by smaller stakeholders are not cost effective, and so may never get filed. As such, this is applicable not just in corporate law, but across the board.

CONCEPTUALIZATION IN INDIAN SCENARIO

It gained its momentum with "India's Enron"- Satyam Fiasco case: where lakhs of shareholders of Satyam Computer Services (now Mahindra Satyam) came together and sued the company. The shareholders claimed damages worth Rs.5000 Crore but India had no law enabling class action lawsuits (where a large group collectively¬ brings a claim to court and/or in which a class of defendants is sued). The shareholders went from the National Consumer Disputes Redressal Commission to the Supreme Court, and had their claims rejected. But the US Investors who owned American Depositary Receipts (ADRs) demand a settlement to the tune of USD 125m (about 700 Crore) by mounting a class action suit. Shareholders of Satyam were able to claim $125 million (about Rs 700 Crore) from the company.

WHO CAN FILE CLASS ACTION SUITS?

As per Section 245(1) r/w Section 245(3), the suit may be filed:-

a) In case of a company having share capital, member or members:

- not less than 100 members of the company or

- not less than 10% of the total number of its members, whichever is less or

- Any member or members singly or jointly holding not less than 10% of the issued share capital of the company. Provided that the applicants have paid all calls and other sums due on their shares.

b) In case of a company not having a share capital, member or members:

- Not less than 1/5th of the total number of its members.

DEPOSITORS

- The number of depositors shall not be less than 100 or

- not less than 10% of the total number of its depositors, whichever is less or

- Any depositor or depositors singly or jointly holding not less than 10% of the total value of outstanding deposits of the company.

WHO MAY BE SUED THROUGH CLASS ACTION SUITS?

A class action suit may be filed against the following Authorities

- A company or its directors for any fraudulent, unlawful or wrongful act or omission;

- An auditor including audit firm of a company for any improper or misleading statement of particulars made in the audit report or for any unlawful or fraudulent conduct.

- An expert or advisor or consultant for an incorrect or misleading statement made to the company.

WHICH RELIEFS MAY BE CLAIMED THROUGH CLASS ACTION SUITS?

Any member or depositor on behalf of such members or depositors may file a class action suit before the National Company Law Tribunal (NCLT) to:

(a) To restrain the company from committing an act which is ultra vires the articles or memorandum of the company;

(b) To restrain the company from committing breach of any provision of the company's memorandum or articles;

(c) To declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by mis-statement to the members or depositors;

(d) To restrain the company and its directors from acting on such resolution;

(e) To restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

(f) To restrain the company from taking action contrary to any resolution passed by the members;

(g) To claim damages or compensation or demand any other suitable action from or

against—

(i) The company or its directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

(ii) The auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

(iii) Any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part;

WHAT ACTION WILL BE TAKEN BY NCLT ON A CLASS ACTION SUIT APPLICATION?

1. On receipt of a class action suit application, the Tribunal will look into the following before admitting it:

- whether the member or depositor is acting in good faith in making the application for seeking an order;

- any evidence before it as to the involvement of any person other than directors or officers of the company on any of the matters on which an order can be passed;

- whether the cause of action is one which the member or depositor could pursue in his own right rather than through an order under this section;

- any evidence before it as to the views of the members or depositors of the company who have no personal interest, direct or indirect, in the matter being proceeded under this section;

- where the cause of action is an act or omission that is yet to occur, whether the act or omission could be, and in the circumstances would likely to be—

-

- authorized by the company before it occurs; or

- ratified by the company after it occurs;

- Where the cause of action is an act or omission that has already occurred, whether the act or omission could be, and in the circumstances would be likely to be, ratified by the company.

2. If an application filed under sub-section (1) is admitted, then the Tribunal shall have regard to the following, namely:—

(a). Issue Public notice shall be served on admission of the application to all the members or depositors of the class in such manner as may be prescribed;

(b) All similar applications prevalent in any jurisdiction should be consolidated into a single application and the class members or depositors should be allowed to choose the lead applicant and in the event the members or depositors of the class are unable to come to a consensus, the Tribunal shall have the power to appoint a lead applicant, who shall be in charge of the proceedings from the applicant's side;

(c) Consolidate all similar applications prevalent in any jurisdiction into a single application and the class members or depositors shall be allowed to choose the lead applicant and in the event the members or depositors of the class are unable to come to a consensus, the Tribunal shall have the power to appoint a lead applicant, who shall be in charge of the proceedings from the applicant's side

- Not allow two class action applications for the same cause of action.

-

1. A copy of every application made under this section shall be served on the Regional Director and Registrar of Companies.

4. The Tribunal shall give notice of every application made to it under this section to the Central Government and shall take into consideration the representations, if any, made to it by that Government before passing a final order under those sections.

1. Where any application filed before the Tribunal is found to be frivolous or vexatious, it shall, for reasons to be recorded in writing, reject the application and make an order that the applicant shall pay to the opposite party such cost, not exceeding Rs. 1 Lakh, as may be specified in the order.

PENALTY FOR NON-COMPLIANCE OF ORDER PASSED BY TRIBUNAL

Any company which fails to comply with an order passed by the Tribunal under Section 245 shall be punishable with fine which shall not be less than Rs. 5 Lakhs but which may extend to Rs. 25 Lakhs and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to 3 years and with fine which shall not be less than Rs. 25,000/- but which may extend to Rs. 1,00,000/-.

Under Section 425 of the Companies Act, 2013 the Tribunal has also been conferred the same jurisdiction, powers and authority in respect of contempt of its orders as conferred on High Court under the Contempt of Courts Act, 1971.

Other points relating to Class Action Suits

The cost or expenses connected with the publication of the public notice shall be borne by the applicant and shall be defrayed by the company or any other person responsible for any oppressive act.

Any order passed by the Tribunal shall be binding on the company and all its members, depositors and auditor including audit firm or expert or consultant or advisor or any other person associated with the company.

Provisions relating to class action suits do not apply to a banking company.

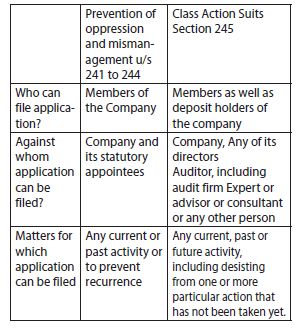

Difference between application for prevention of oppression and mismanagement u/s 241 to 244 and Class Action Suits under Section 245 of Companies Act, 2013.

CONCLUSION

It may be concluded that class action suits will be a beneficial platform for members and depositors to raise their grievances against the management of a company including directors, advisors, consultants, auditors etc for acts or omission that is prejudicial, unlawful or wrongful to the interest of the company. Class action suits may be undertaken as a redressal tool by minority shareholders having common interest for promotion of transparent corporate governance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.