In Q3 2015, we saw continuation of the strong industry trends that the Bermuda insurance market has been driving in recent years. The ILS market remains robust, with US$3.725 billion in new cat bond issuances in the first half of the year alone – a record volume. Notably, along with the "traditional" markets favouring the use of cat bond and other ILS structures for risk transfer, the third quarter saw the issuance of the first Chinese-sponsored cat bond, Panda Re, an indication of the ever-broadening acceptance of these innovative structures – and yet another endorsement of Bermuda as the jurisdiction of choice. Further, this past quarter saw some very significant new commercial Class 4 insurers raising capital and starting to write business, with ABR Re raising US$800 million, and Fidelis Insurance raising a staggering US$1.50 billion – making it the largest new Bermuda start-up in over a decade. It speaks volumes that even in the conservative post-financial crisis environment, these commercial ventures are finding significant investor support – and are choosing Bermuda as the optimum jurisdiction in which to do business. With several other very large commercial ventures in the pipeline, and the ILS market showing no sign of slowing down, we have every expectation of these trends continuing and, going into the final quarter of the year, look forward to maintaining our role as a lead advisor.

This update provides an overview of the Bermuda Insurance sector and features a recap of the latest trends, registrations, news and event highlights.

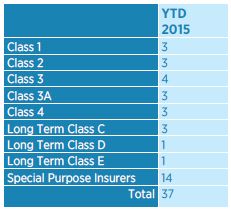

REGISTRATIONS IN BERMUDA

TRANSACTIONAL HIGHLIGHTS

1 Conyers advises Panda Re Ltd. on the issuance of US$50 million Series 2015-1 Class A Principal At-Risk Variable Rate Notes

Conyers advised Chinese state-owned P&C reinsurer China Re on the issuance by Panda Re Ltd. of US$50 million Series 2015-1 Class A Principal At-Risk Variable Rate Notes due July 9, 2018 pursuant to its Note Program. This is deal is significant as it represents the introduction of the first cat bond covering Chinese perils.

Charles Collis and Alexandra Macdonald advised on the matter.

2 Conyers Advises on the formation and licensing of ABR Re

Conyers acted as Bermuda counsel in connection with the formation, licensing and capitalisation (US$800 million) of a new Class 4 multi-line reinsurer, ABR Re. Unlike a typical Class 4 reinsurer, ABR Re was specifically formed to underwrite reinsurance treaties placed by ACE Limited within the traditional reinsurance market, while having its assets invested in an alternative investment portfolio managed solely by BlackRock, Inc., the world's largest investment manager, creating a completely unique Bermuda joint venture.

Charles Collis, Mary Ward and Jacqueline King worked on the matter.

3 Conyers advised on the formation, licensing and capitalisation of Fidelis Insurance Holdings Limited and its wholly-owned subsidiary, Fidelis Insurance Bermuda Limited

Conyers advised on the formation, licensing and capitalisation (US$1.5 billion) of Fidelis Insurance Holdings Limited and its wholly-owned subsidiary, Fidelis Insurance Bermuda Limited. The transaction represents the largest new start-up Bermuda Class 4 commercial reinsurer since 2005, and is the single largest insurance capital raising transaction for 2015.

Michael Frith, Mary Ward and Jacqueline King advised on the matter.

LEGAL UPDATES

Bermuda Monetary Authority Consultation Paper on Funding Agreements

In July 2015, the Bermuda Monetary Authority ("BMA") issued a consultation paper on funding agreements. A funding agreement, or non-life annuity, is defined as an agreement whereby an insurer receives and accumulates money and makes one or more payments on dates and in amounts that are not based on life contingencies. At present, there is some uncertainty as to whether such contracts are long term business, general business or not insurance business at all. Under the proposed amendments, a funding agreement would be considered long-term business under the Insurance Act, 1978 and would be regulated as such.

It is important to note that the proposed definition of a funding agreement includes a requirement that the agreement is, by its terms, expressed to be a funding agreement. This requirement is important because banks and other institutions will still be permitted to offer similar products, without having to be registered as an insurer under the Insurance Act, 1978.

The proposed amendments will bring Insurance Act, 1978 in line with many States in the US, which have amended their legislation over the past several years to allow life insurance companies to issue funding agreements and will clear the way for Bermuda long-term insurers to do the same.

BMA Signs Memorandum of Understanding with the National Association of Insurance Commissioners (the "NAIC")

During the recent NAIC meeting in Chicago, the BMA signed a Memorandum of Understanding ("MoU") with the NAIC.

Under the MoU, the BMA and NAIC agree, among other things, to increase cooperation and to the exchange of non-confidential information.

The MoU follows Bermuda's recognition by the NAIC as a Qualified Jurisdiction under the NAIC's credit for reinsurance model law, enabling Bermuda insurers to be certified for reduced collateral requirements. The signing of the MoU strengthens Bermuda's standing as a Qualified Jurisdiction and the Bermuda insurance market more generally.

NEWS & INSIGHTS

In the Headlines

- Chris Garrod participates in Xuber Roundtable - An Executive View of M&A in Bermuda's Insurance sector

- David Doyle participates in Captive Review's feature on the Bermuda Captive Insurance sector

- Charles Collis participates in Bermuda Finance - ILS Roundtable

- Elizabeth Denman recognised in Bermuda:Re+ILS Influential Women of Bermuda feature

- Charles Collis speaks at Trading Risk Monte Carlo Rendez-Vous | 15 September

Upcoming Events

- Chris Garrod & Dawn Griffiths participate in Trading Risk New York Rendez-Vous | 14 October

- Conyers gold sponsors of ILS Convergence | Charles Collis, Chris Garrod, Dawn Griffiths & Michael Frith to attend | 11-13 November

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.