Tax has dominated the news agenda for some time now driven by cash strapped governments need to squeeze every last pound, dollar or euro out of the system. But there is something beyond tax, more important, and fundamental to the freedom and prosperity of nations, and that is trade

Trade creates economic activity between individuals, companies and countries. It creates value as one party manufactures a good or provides a service, that activity in turn generates supporting activity; parts supply, or ancillary services to facilitate the primary, such as transport, shipping, marketing and promotion. Public services are funded out of tax, but tax is funded out of trade and the wealth and employment creation that goes with it. Without business and trade there is no tax.

The remarkable transformation of India, China and Brazil over the last 30 years has proven beyond any doubt that trade not aid brings lasting and sustainable prosperity. It is surprising then that an economic study of Jersey's trade links has never been attempted until the newly released Capital Economics study launched in London last week.

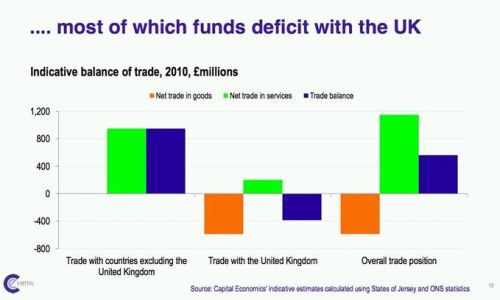

What is also remarkable is how this small economy located in the Channel Islands benefits the United Kingdom to such a significant degree as illustrated by the chart below:-

The chart demonstrates that Jersey generates a significant trade surplus by exporting high-end added value financial services to the tune of a net £0.6bn per annum. It is this trade surplus that supports 12,500 jobs and 50% of Jersey's tax revenues, giving rise to some of the highest quality public services in Western Europe, with still around one third of Island residents on more modest incomes paying no tax at all.

But that is the benefit to Jersey of a trading account in surplus, but what about the UK? An examination of the next slide will surprise many, Jersey is in deficit with the UK on trade, which means the UK benefits from £400m per annum of net trade and 11,000 jobs outside of financial services.

Not only is Jersey an overwhelming benefit to the UK through its placement of international capital but it is a net importer of significant volumes of physical goods from the UK giving rise to a trade surplus in the UK's favour.

Jersey raises revenue from providing services to the mainly non EU world, but most of its spending is benefitting the UK.

Read more from Geoff Cook, CEO of Jersey Finance at CEO blog

Linkedin - www.linkedin.com/company/jersey-finance

Twitter - @jerseyfinance

Youtube - www.youtube.com/jerseyfinance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.