Introduction

The political scene in Malaysia has taken a very dynamic turn and it serves as a timely call for all international and local companies operating in the country to wake up and review their operations there.

The winning of the general elections in May by the new Alliance of Hope (Pakatan Harapan) coalition government saw the dramatic return to power of now Prime Minister Dr. Mahathir. One of their key promises was to abolish the Goods and Services Tax (GST) and reintroduce updated Sales and Services Taxes (SST) within his first one hundred days in office. Malaysia had the the SST for 40 years before it was replaced by the GST in 2015.

On 1 June 2018 the new Prime Minister issued an Order that lowered the GST rate to zero; this does not cover supplies that are already exempted. All GST registrants will continue to be subject to all other GST requirements, including the filing of GST returns, bad debt adjustments, claiming of input tax credits where applicable and issuance of tax invoices.

The Order effectively removes GST in Malaysia, but abolishing it would require Parliament's approval. The Bill for the Goods and Services (Repeal) Act 2018 is expected to be passed within the next few days.

Following the abolition of the GST, all records as required to be retained under the GST Act, should continue to be maintained. Customs will continue to undertake GST audits upon deregistration. These can take place up to seven years from the time of supply.

The transition from GST to SST, within a relatively short time frame, will require careful management. Companies will need focus and resources to ensure a smooth transition.

Companies will need to understand and address the following issues:

- service contracts;

- delays in receiving suppliers tax invoices;

- any deferred income and/or prepaid expenses;

- existing inventories;

- understanding what specific goods and services will be subject to SST; and

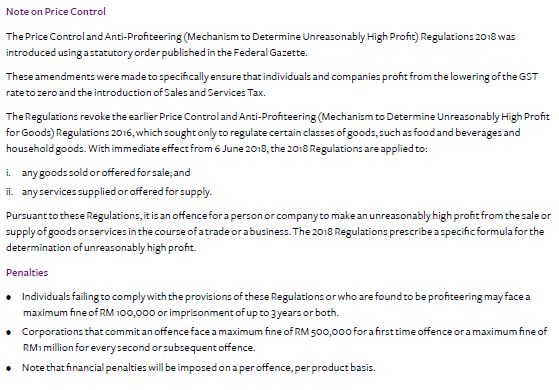

- how goods and services should be priced given the 5 June 2018 changes to the Price Control and Anti-Profiteering (Mechanism to Determine Unreasonably High Profit) Regulations 2018.

SST Bill and Legislation

The bill enacting the SST and its associated legislation is expected to pass through Parliament on or about 7 August 2018.

For the Sales Tax, the following legislations are expected to be promulgated:

- Sales Tax Act 2018

- Sales Tax Regulations 2018

- Sales Tax (Customs Ruling) Regulations 2018

- Sales Tax (Rules of Valuation) Regulations 2018

- Sales Tax (Compounding of Offences) Regulations 2018.

There will also be a series of Orders covering important elements, such as sales value, rates of tax, exempt goods and exempt persons, etc. For the Services Tax, the following legislations are expected to be enacted:

- Service Tax Act 2018

- Service Tax Regulations 2018

- Service Tax (Customs Ruling) Regulations 2018

- Service Tax (Compounding of Offences) Regulations 2018

As with the Sales Tax, a series of Orders is expected to be implemented as well.

SST Registration

Registration for SST is required to be completed by 1 September 2018.

- Manufacturers and service providers, who are currently GST registered and who have been identified and fulfilled the required criteria, will be automatically registered under the Sales Tax Act and/or Service Tax Act.

- Mandatory registration applies to Taxable Goods Manufacturers whose sales value of taxable goods exceeds RM 500,000 for a 12-month period.

- Mandatory registration also applies to manufacturers who carry out sub-contract work on taxable goods where the value of work performed exceeds RM 500,000 for a 12-month period.

Designated Areas (DA) and Special Areas (SA) for SST

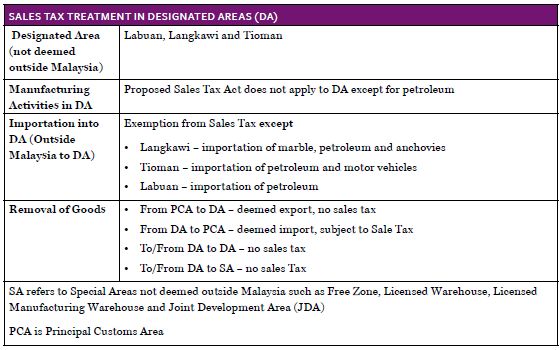

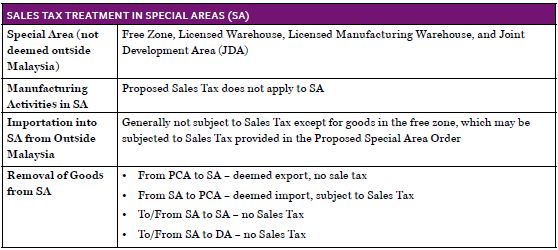

Labuan, Langkawi and Tioman will be designated as Designated Areas (DA) for SST purposes. Free Zones (FZ), Licensed Warehouses (LW), Licensed Manufacturing Warehouses (LMW) and Joint Development Areas (JDA) are designated Special Areas (SA). [See Tables on pages 4 - 5.]

Administration and Enforcement

The Royal Malaysian Customs will be the administration and enforcement authority for the SST.

Sales Tax

The Sales Tax will be charged and levied on:

- Taxable goods manufactured in Malaysia by a taxable person and sold, used or disposed of by that person; and

- Taxable goods imported into Malaysia.

The proposed ad-valorem rates for the Sales Tax are 5% and 10%. The Sales Tax for petroleum will be charged on a yet-to-be-confirmed specific rate.

EXEMPTIONS AND CLASSIFICATION OF GOODS

The reintroduction of Sales Tax also sees the reintroduction of exemptions of certain goods and people from the indirect tax. The 292-page long list of "Proposed Goods Exempted from Sales Tax" currently under consideration by the government is similar to the pre-2015 SST list. Now, as then, the list of goods are based on the Harmonized Systems Tariff Classification (HS); this means that manufacturers and importers must ensure that their goods are correctly classified in order to determine if their goods are SST exempt.

VALUATION FOR SALES TAX

The value upon which the Sales Tax is to be levied for imports will be:

- CIF customs value

- plus any import duty payable

- plus any excise duty payable.

For locally manufactured goods, the sales value will be the transaction value, i.e., the price at which the manufacturer actually sells the goods. We also understand that, similar to the previous SST regime, the SST valuation rules for locally manufactured goods will use the WTO Customs Valuation methodologies to arrive at a value should a transaction value not be available, as follows:

- transaction value of identical goods;

- transaction value of similar goods;

- the computed value of the manufactured goods;

- the deductive value of the manufactured goods; or

- a flexible value (usually based on applying flexibility to one of the previous methods of value.)

Now, with the SST being levied at the level of manufacturing, it raises questions on what the ex-factory price should be, and what costs should be included in the transaction price?

Service Tax

The Service Tax will be charged on any provision of taxable services made in the course of furtherance of any business in Malaysia, by a taxable person in Malaysia.

The Service Tax will not be applicable to imported services or exported services. There is quite a long list of services that will be taxable, including, but not limited to:

- Hotel services

- Food and beverage services

- Clubs and gaming

- Management services

- Telecommunications

- Forwarding agents

- Legal accounting

- Insurance and takaful

- Employment agency

The Service Tax rate will be 6%. In addition, a specific rate of RM 25 will be imposed on the issuance of principal or supplementary credit or charge cards and will apply every subsequent year or part thereof.

Designated Areas and Special Areas (SA) for SST

Labuan, Langkawi and Tioman are being designated as Designated Areas (DA) for SST. Free Zones (FZ), Licensed Warehouses (LW), Licensed Manufacturing Warehouses (LMW) and Joint Development Areas (JDA) are designated Special Areas (SA). [See Tables on pages 4 - 5.]

Considerations for Businesses

The haste to change to the SST will leave businesses in Malaysia with less than one month to determine if their goods or services are subject to the SST, the need to register, and to make the necessary changes to their business and operations.

Businesses will also need to determine the changes needed to their IT platforms because the SST is a single stage tax levied at the manufacturer, importer or consumer level, while GST was levied at all transactional stages.

We suggest that businesses:

- Undertake a careful review of systems, processes and procedures, and ensure compliance;

- Review goods classifications to determine whether they are exempt or taxable;

- Review all long-term service contracts;

- Check the pricing of goods during the transition period;

- Check the exemptions list to determine whether their goods are taxable or not; and

- Review the structure of their manufacturing operations and its associated costs.

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2018. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.