According to the latest World Bank 2018 annual ratings, Montenegro is ranked 50th among 190 economies in the ease of doing business ratings.

In the long-term, the ease of doing business is projected to trend around 58.00 in 2020, according to the World Bank forecast.

Many have chosen Montenegro as a location for their business for the following reasons: a low corporate tax rate, an easy and efficient company incorporation process, as well as supportive strategies and laws for foreign direct investment and foreign ownership.

It is also considered to be one of the easiest places to start a business globally.

But, before you start doing business in Montenegro, here are some things you need to know:

Tax overview

- Corporate income tax 9%

- Personal income tax 9%

- VAT 21% (standard); reduced rates of 7% and 0%

- Withholding tax 9%

- 40+ double taxation agreements

Tax incentives

As a supportive strategy for its further development, Montenegro has introduced a number of attractive incentives.

Developing areas

In economically underdeveloped municipalities, the Law on Corporate Income Tax provides that a newly established legal entity does not pay corporate income tax for the first eight years of operation. Moreover, the Law on Personal Income Tax stipulates that the tax calculated on the taxpayers' personal income for the first eight years of operation is reduced by 100%.

Some sectors are excluded from these exemptions, including the sector of primary production of agricultural products, transport, fisheries and steel production.

It is also worth noting that the tax relief is applicable only if the total amount of taxes does not exceed the amount of €200,000 for the first eight years of operation.

VAT Incentives

When the output tax for the taxable period is lower than the input VAT, the difference is either recorded as a tax credit for the upcoming period or refunded. The request will be processed within 60 days, starting from the date of submission of the VAT return.

For the taxpayers that are mostly involved in the export business, this overpaid VAT is refunded within 30 days from the date of submission of the VAT return.

An attractive incentive in terms of VAT regulation incentivizes the supply of goods and services for the purposes of construction and equipment of four or five stars hotels by setting the VAT rate at 0% for such activities.

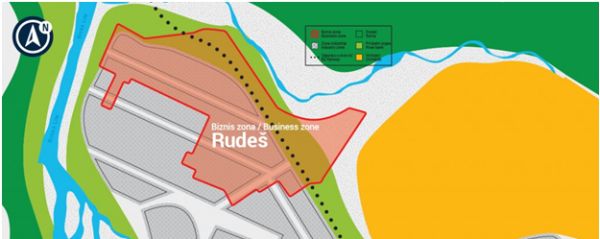

Business zones

Business zones are important growth-generators of the Montenegrin economy. Their aim is to increase exports and employment, and improve the balance between the manufacturing and services sectors as well as stimulate activities that will be a support to the production capacities developed.

Business zones currently exist in the following municipalities: Berane, Bijelo Polje, Cetinje, Kolasin, Mojkovac, Niksic, Podgorica and Ulcinj.

Step-by-step guide to opening a LLC company in Montenegro

Foreign legal and natural persons have the right to establish a company under the same conditions as nationals in Montenegro.

The most common forms of companies are:

- LLC – limited liability company

- JSC – joint stock company

The timeline for registration of an entity is maximum 10 working days. The registration application is submitted at the premises of the Central Registry of Legal Entities (the body governed by the Tax Administration Office of the Government of Montenegro).

The process of establishment of an LLC company is defined in the Law on Business Organizations.

To successfully submit a registration application to the Central Registry, the following documents are required:

- Articles of incorporation

- Decision on establishment of the entity

- Incorporation agreement

- Payment of the fees for registration of the LLC and publishing of the decision in the Official Gazette of Montenegro

- Decision and agreements (certified and stamped by the Notary office)

- The extract from the Central Depository Agency

- A copy of ID card or passport

- Registration of the name of the company

- Properly filled application form – registration form

- Additionally the company can submit at the same time a registration for VAT or excise duty

This process of submission and preparation of the documents can be processed with a Power of Attorney. After the decision has been completed, the Central Registry will issue a certificate of registration.

Furthermore, after the certificate of registration is issued, new businesses need to:

- Create a company seal

- Open a bank account

- Register employees at the Tax Administration Office

The minimum founding capital, in accordance with the Montenegrin law, is EUR 1.00. The shared capital in the company is defined at the beginning in the Incorporation agreement, Statute and Decision.

We advise businessmen interested in registering a business in Montenegro to find a reliable and experienced accounting and payroll associate with adequate knowledge in both international business and local rules and regulations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.