1. LEGAL AND TAX SYSTEM

- Malta is a member of the EU with the Euro (€) as the official currency.

- The Maltese Business Laws are based on the English model and English is one of the official languages, meaning that all official documentation is published in English.

- The most common form of a legal entity used is the Malta Private Limited Liability Company.

- There is limited liability to the shareholders.

- Nominee shareholders can be used to ensure anonymity of the ultimate beneficial owner.

- Proper accounting records must be maintained and audited Financial Statements must be prepared annually.

MALTA LEGAL SYSTEM

- Companies incorporated in Malta are considered to be tax resident in Malta and foreing-incorporated companies may also be treated as tax-resident in Malta if their management and control is exercised in Malta.

- Worldwide profits of Tax Resident Companies are liable to corporation tax in Malta, but tax refunds apply for trading activities, reducing total tax rate to 5% which is the lowest in all Europe.

- Losses can be carried forward for 5 years and set off against future profits.

- Re-organisations, mergers, de-mergers, exchange of shares, transfer of assets are made without any taxation.

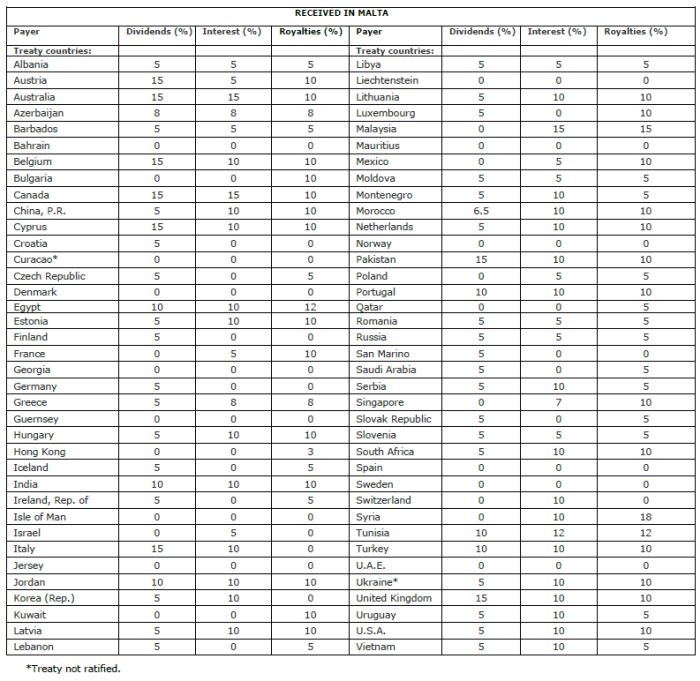

- Unilateral tax credits are granted on any tax paid abroad to any foreign country, irrespective of whether Malta has a Double Taxation Treaty or not.

TAX

2. TAX STRUCTURES AND PRODUCTS OF MALTA

- Dividend income is exempt from Corporation tax.

- Any profits made from the sale of shares is exempt from corporation tax.

- No withholding taxes on payment of dividends from Malta to a non-resident shareholder.

HOLDING COMPANIES

- Profit is taxed at 35% but shareholder may claim refund of 6/7th of tax paid, resulting in a tax leakage of 5% for trading activities, which is the lowest effective tax rate in Europe.

- Example computation:

- Total Profit €100,000

- Tax paid @35% (€35,000)

- Dividends availble for distribution €65,000

- 6/7th tax refund claimed by shareholder €30,000

- Effective tax paid €5,000 (i.e. 5% of original profit)

- No withholding taxes on payment of dividends from Malta to a non-resident borrower.

TRADING COMPANIES

- Gaming Companies - obtain a license in Malta in order to be able to offer online Betting / Casino Games

- Shipping Companies - register a ship under a Malta Flag and benefit from exemption from Malta tax

- Payment Service Providers - set-up a lisenced company to be ableo to process and provide payment services

- Electonic Money Institutions - and engage in a number of regulated activities and be able to issue electronig money and provide 'e-wallet' services by obtaining an EMI license

- Captive Insurance - set-up an 'inhouse' regulated and licensed insurnace company specifically tailored for the client's business

- Yacht Leasing Companies - benefit from an advantageous VAT rate for pleasure yachts

3. INTERNATIONAL TAX PLANNING

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.