The International Standards Boards (IASB) issued a second Exposure Draft (ED) in June 2013. The ED was developed to improve the transparency of the effects of insurance contracts on an entity's financial position and financial performance and to reduce diversity in the accounting for insurance contracts.

The ED's key proposals are discussed below with highlights of the feedback received from constituents in 194 comment letters.

Adjusting the contractual service margin (CSM)

The measurement of an insurance contract has two components (building-block approach):

Measurement of

the amount, timing and uncertainty of the future cash flows that

the entity expects the contract to generate as it fulfils the

contract (these cash flows will include the present value of future

cash flows and the risk adjustment 1)

CSM

that represents a current estimate of the profitability that the

entity expects the contract to generate over the coverage period

(i.e. the CSM will prevent day one profit)

Differences between the current and previous estimates of the present value of future cash flows related to future coverage and other future services are added to, or deducted from, the CSM, subject to the condition that the CSM should not be negative. Differences between the current and previous estimates of the present value of the future cash flows that do not relate to future coverage and other future services are recognised immediately in profit or loss.

Feedback

There is wide support for unlocking the CSM.

Some argue that changes in the risk adjustment relating to future periods should also unlock the CSM.

Participating contracts (PCs)

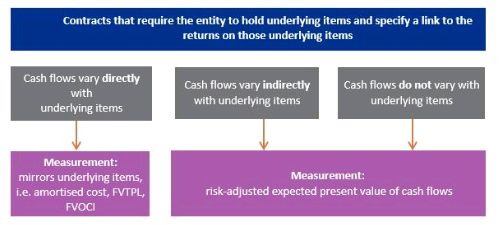

An entity should apply a measurement and presentation exception to PCs as follows:

This 'mirroring approach' aims to reduce accounting mismatches by aligning the measurement of contracts with that of the underlying items.

Feedback

Overall criticism about the operationally and complexity of the proposals:

- It is difficult to separate and separately measure part of the probability-weighted estimates of cash flows without taking into consideration all the cash flows expected from the contract

- Any decomposition of cash flows (i.e. into cash flows that vary directly, indirectly or not with underlying items) is arbitrary

- The approach to decomposition of cash flows described does not align with the way that many insurers view their products. Respondents were concerned that the scope of the proposals would apply to a limited number of PCs.

Therefore some PCs will be measured according to the 'mirroring approach' and others according to the building-block approach. Some recommend that the application of the proposals should be optional.

Presenting insurance contract revenue

Insurance contract revenue presented in profit or loss would depict the transfer of promised services arising from the insurance contract in an amount that reflects the consideration that the entity would expect to be entitled to in exchange for those services.

Insurance contract revenue would be based on the initial expected pattern of claims and benefits, revised to reflect revisions in estimates.

An entity should exclude from insurance contract revenue, presented in the statement of profit or loss and other comprehensive income, any investment components, defined as amounts that an insurance contract requires the entity to repay to a policyholder even if an insured event does not occur (for example deposit component).

Feedback

Mixed feedback on this proposal.

Some are concerned about the exclusion of the deposit component as it is an integral part of the insurance contract.

Others suggest a reconciliation between premiums due and insurance contract revenue in the statement of profit or loss and OCI.

Presenting interest expense and the effects of changes in discount rates

An entity should recognise in:

- profit or loss, interest expense determined on an amortised cost basis (at locked-in discount rate)

- OCI the difference between the carrying amounts of the insurance contract measured using the locked-in discount rate and the current discount rates.

These proposals segregate the underwriting performance from the effects of the changes in the discount rates that unwind over time.

Feedback

Many indicate that the use of OCI to present the effects of changes in discount rates should be optional. Some believe that these effects should be presented in profit or loss.

Accounting mismatches may arise as financial assets held to fund insurance liabilities could be measured at fair value through profit or loss.

Transition

An entity should apply the proposals retrospectively when practicable.

When impracticable, simplifications for the discount rate at initial recognition and the CSM on transition are proposed.

When retrospective application is impracticable, an entity would determinate the CSM (at initial recognition) by estimating:

- the expected cash flows at the date of initial recognition at the amount of the expected cash flows at the beginning of the earliest period presented, adjusted by cash flows that are known to have occurred between the date of initial recognition and the beginning of the earliest period presented; and

- the risk adjustment at the date of initial recognition at the same amount of the risk adjustment that is measured at the beginning of the earliest period presented.

- Determining the discount rate at initial recognition (if retrospective application is impracticable) would be done as follows:

- If there is an observable yield curve that approximates the yield curve as determined in accordance with the proposals in the ED for at least three years before the date of transition, then the entity would use the observable yield curve

- If such an observable yield curve does not exist, then the entity would apply the spread (averaged over the last three years before the date of transition) to an observable yield curve.

Feedback

Retrospective application is widely supported. There are concerns that the simplifications would overstate the CSM and understate retained earnings at the date of transition.

Respondents note operational complexities such as the availability of information in early periods.

Final standard?

The IASB is deliberating on the feedback received. The final standard is not expected to be issued before the end of this year. The effective date is estimated to be no earlier than 1 January 2018.

Footnote

1 The compensation that an entity requires for bearing the uncertainty about the amount and timing of the cash flows that arise as the entity fulfils the insurance contract.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.