The most important Turkish competition law development in May was the Draft Proposal to Amend the Competition Law (the "Draft Bill"), which is covered below.

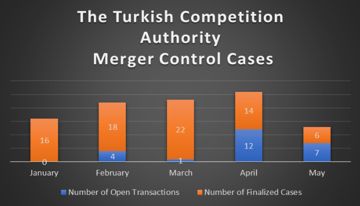

With regards to merger control activity, May was the month that the effects of the global recession started to be felt in Turkey. The chart below shows the decline in the number of merger control decisions issued by the Turkish Competition Authority ("TCA") and the number of new transactions notified to the TCA. This is mainly due to the global and national decline of M&A activity.

In order to keep pace with the digital economy, on 8 May 2020 the TCA published an announcement regarding the strengthening of its already existing Strategy Development Department by expanding its authorities. We examine this important reorganisation for the digital economy in this article.

Amendments to Turkish Competition Law proposed to parliament

The Draft Bill to amend Turkish the Competition Law, which was recently submitted to the president of the Turkish parliament, aims to introduce many new concepts to Turkish competition law that are already in embedded in EU competition law. If the Draft Bill is enacted as proposed, Turkish competition law will be more in line with EU legislation.

Among its important proposals, that the Draft Bill aims to replace the current dominance test for merger control with the Significantly Impeding Effective Competition test (the "SIEC") that is also applied by the EU.

The Draft Bill would also formally introduce the remedies mechanism to Turkish law. Under the proposed rules, the TCA would be able to impose behavioural and/or structural changes on undertakings in order to cease anti-competitive behaviour and re-establish competition in the relevant market. Structural remedies can be imposed if behavioural remedies are insufficient. The TCA currently enjoys such powers through the interpretation of the current rules, but the Draft Bill introduces a clearer framework that is akin to EU Competition Law.

Another concept to be introduced by the Draft Bill if approved is the de minimis doctrine. Under this principle-similar to the implementation of the de minimis doctrine in the EU-agreements of minor importance would not be pursued by the TCA. Details such as market share and turnover thresholds will be set by the TCA via a new communiqué on this issue after the Draft Bill has been enacted.

Lastly, the Draft Bill would introduce the commitment and settlement procedures that are currently lacking in Turkish law:

- Similar to EU law, undertakings can voluntarily offer some structural or behavioural measures by addressing competition concerns, in which case the TCA shall not establish infringement and close the proceedings.

- With regards to the settlement procedure, undertakings that confirm a violation after initiation of formal proceedings and settle with the TCA will be granted a 25% reduction of the administrative monetary fine that is applied by the TCA. The settlement procedure can be initiated ex officio by the TCA or at the undertaking's request.

Investigation against 29 undertakings for excessive pricing

After a series of harsh statements, in May the TCA initiated investigations against 29 undertakings regarding excessive price increases implemented after the COVID-19 outbreak. The undertakings subject to the investigation are operating in the sectors of food production, organised retail (supermarkets) and manufacturing of cleaning/hygiene products. The TCA indicated that it has been gathering evidence on anticompetitive behaviour for over one month and is planning to conclude the investigation as quickly as possible.

Merger control

The TCA approved the following merger control filings in May at the Phase I stage:

- Acquisition of sole control of Neova Sigorta A.S. by Kuveyt Türk Katilim Bankasi A.S.

- Acquisition of sole control of Fio Gaz Sanayi ve Ticaret A.S. by Pietro Fiorentini S.p.A.

- Acquisition of sole control of LLC NTC Intourist, SSC Touroperator Intourist and ITC Enterprises Limited by AX Girisim Danismanligi A.S.

- Establishment of a joint venture between Mitsubishi UFJ Lease & Finance Company Limited and ALD S.A. managing by Societe General S.A.

- Establishment of a joint venture between Warner Bros Home Entertainment, ultimately under the full control of AT&T Inc., and Universal City Studios Productions LLLP, ultimately under the full control of Comcast Corporation.

- Acquisition of joint control of Linde Severstal LLC, solely controlled by Linde Aktiengesellschaft, by PAO Severstal.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.