In 2015 and 2016, liberalisation of the energy sector removed a key concern for the Turkish energy sector. Turkey had started a significant liberalisation process in the energy sector in 2001, with the electricity sector taking a leading role. With the liberalisation process, the Turkish energy sector has become more competitive, attracting more investors in all fields of energy. However, the targeted extent of liberalisation has not yet been achieved. This is largely the reason why Turkey enacted a new petroleum law, a new electricity market law and is about to introduce significant amendments to its natural gas market law, all shortly after the tenth year of the initial market laws of 2001 and 2003.

Turkey enacted the new Electricity Market Law (the "EML") and the new Turkish Petroleum Law (the "TPL") in 2013. In line with Turkey's substantial demand potential and its renewable energy targets, Turkey has also introduced the Regulation on Generating Electricity without a Licence; the Regulation on Documentation and Support of Renewable Energy; the Regulation on Technical Evaluation of Solar Energy Based Licence Applications; the Communiqué on Wind and Solar Measurements for Preliminary Licence Applications; the Contest Regulation on Pre-Licence Applications Regarding Generation Facility Based on Solar and Wind Energy; and the Regulation on Renewable Energy Resources For Electricity Generation.

Although Turkey had taken remarkable steps in liberalising its energy market, these steps were not sufficient to reduce foreign dependency. With this main focus, Turkey aims to stop being an energy importer and start exporting energy. Following the general elections held in November 2015, Mr. Berat Albayrak was appointed as the new Energy and Natural Resources Minister and he declared that in the long run, Turkey aims to (i) increase its general energy storage capacity; (ii) increase storage obligation rates on import from 10% to 20%; (iii) use different energy storage options; and (iv) support investments in the energy sector, with a particular focus on renewable energy. In the past decade, Turkey increased its installed capacity from 39,800MW to 74,000MW, while Turkey's energy consumption increased from 160 billion kWh to 264 billion kWh. As announced by Minister Albayrak, Turkey is further planning to make an investment of 15 quadrillion Turkish Liras to strengthen the infrastructure of its electricity supply system network in the coming years.

In order to achieve these targets, several significant developments affecting the Turkish energy market and its players occurred in late 2015 and 2016. As per the Energy Market Regulatory Authority's electricity sector report prepared for the year 2015, electricity generation has increased to 259.69 TWh with a growth rate of 3.07%.

SIGNIFICANT LEGISLATIVE DEVELOPMENTS

Recent changes in the Natural Gas Market Law

The principal piece of legislation governing the natural gas market is the Natural Gas Market Law (the "NGML"). The NGML was amended in June 2016. This change introduced a new competition-related restriction for distribution licence holders, whereby these licence holders can now have distribution licences in only two Turkish cities. In addition, the Energy Market Regulatory Authority ("EMRA") decided to set the storage requirement for import licence holders at 6% of the annual gas import amount. This percentage was 10% prior to November 2016.

Draft Nuclear Liability Law and Draft Nuclear Law

Turkey recently has taken important steps for the construction of two nuclear power plants in Akkuyu and Sinop. However, Turkey still needs to adopt the necessary legal framework, including an independent regulatory authority. To this end, the Ministry of Energy and Natural Resources (the "MENR") prepared two draft laws: the Draft Nuclear Energy Law and Draft Nuclear Liability Law.

The Draft Nuclear Energy Law provides for the establishment of a new regulatory body: the Nuclear Regulatory Authority ("NRA"). NRA will conduct licensing and oversight activities. It will not be attached to the MENR, making it an independent authority. This law will also set forth the activities which require a licence or a permit from NRA.

The second draft law, the Draft Nuclear Liability Law, will govern third party liability in the field of nuclear energy. The MENR stated that this draft was prepared in line with the 2004 Additional Protocol to the Convention on Third Party Liability in the Field of Nuclear Energy, and will extend the limitation period for actions regarding loss of life and personal injury to 30 years. This law will also require operators of nuclear power plants to have and maintain insurance to cover their liabilities.

Omnibus Law & Electricity Market Licence Regulation

The primary pieces of legislation governing the electricity market, the EML and the Electricity Market Licence Regulation (the "Licence Regulation"), came into force in 2013. Since their enactments, both legislations have been amended a number of times. More recently, in June 2016, the Turkish parliament passed the Law on Amendment of the Electricity Market Law and Certain Laws, an omnibus law amending numerous areas of Turkish law (the "Omnibus Law"). Among others, the Omnibus Law and recent changes in the Licence Regulation brought new additional share transfer restrictions within the preliminary licence and generation licence terms, and changed the renewable energy support mechanism.

In 2013, EMRA introduced the Regulation on Generating Electricity without a Licence, which dictates that generation facilities with an installed capacity of up to 1MW based on renewable energy resources are exempt from the requirement to obtain a generation licence. Moreover, if a company generates more electricity than it consumes, the surplus may be sold in the same distribution region in which it is generated, within the scope of the renewable energy support mechanism. Recently, certain amendments to the Regulation on Generating Electricity without a Licence came into force on 23 March 2016 and 22 October 2016. According to these amendments, a maximum capacity of 1MW per transformer centre can be allocated to individuals or legal entities generating solar or wind energy (excluding rooftop installations), regardless of the number of consumption facilities owned by that individual or legal entity. When calculating the 1MW limit, both the individual or legal entity and entities in which such persons have direct or indirect control are considered as the same person.

RECENT DEALS

Recent privatisations and privatisation news1

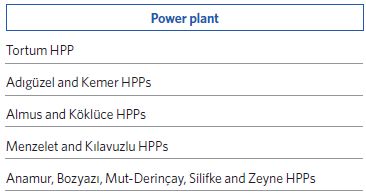

After completing the privatisation of all state owned electricity distribution companies, previously owned by Türkiye Elektrik Dağıtım Anonim Şirketi in 2013, Turkey started to place more importance on the privatisation of state owned electricity generation assets. In late 2015 and 2016, several electricity generation assets owned by Elektrik Üretim Anonim Şirketi ("EÜAŞ") have gone into different stages of privatisation. Below is a summary of privatisations that have been completed as of 1 April 2017:

Below is a summary of privatisations that are still waiting for approval or the parties' signatures as of 1 April 2017:

In addition to the privatisation of electricity generation assets the Mayor of the Istanbul Metropolitan Municipality, Mr. Kadir Topbaş, has announced that an initial public offering may be initiated for İGDAŞ, Istanbul's natural gas distribution company. According to Mayor Topbaş's statement, İGDAŞ's shares will first be offered to the natural gas consumers in Istanbul. The public offering to be held for İGDAŞ's 51% shares was approved by the Istanbul Metropolitan Municipality Council in December 2015. The tender for the privatisation of İGDAŞ has not yet been announced. İGDAŞ is the greatest natural gas distribution company of Turkey, with approximately 6 million customers. 94.5% of İGDAŞ's total share capital is held by the Istanbul Metropolitan Municipality.

On 28 December 2016, the Privatisation Administration approved the privatisation of TP Petrol Dağıtım A.Ş., a petroleum distribution company, for an amount of TRY 490 million.

Private deals

As per PwC's Energy Deals 2015 Annual Review, 2015 was exceptional in terms of the breakdown of public and private deals. With the decrease in privatisation deals, the share of private deals increased from 18% in 2014 to 63% in 2015. According to PwC's Energy Deals 2016 Annual Review, the number of deals changed from 44 in 2015 to 30 in 2016 but the total deal value decreased by 59% from US$4.8 billion to US$2.0 billion. 2016 over-compensated the exception of 2015 in terms of the public-private deals breakdown. With the recovery in privatisation activity, the share of private deals decreased from 63% in 2015 to 43% in 2016.

There have been a number of takeovers in Turkey's energy market in 2015 and 2016. SOCAR, BP and BOTAŞ signed the Shareholders Agreement for the Trans Anatolian Natural Gas Pipeline Project Company, which will operate the TANAP Pipeline transporting natural gas produced from Azerbaijan's Shah Deniz II field in the Caspian Sea to Turkey and then to Europe through Turkey. The signing ceremony for the Shareholders Agreement was held on 13 March 2015. BP's accession to the Shareholders Agreement, by way of acquisition of a 12% stake in TANAP from the Southern Gas Corridor company (SGC), is considered quite critical for the project implementation.

Other notable transactions were Goldman Sachs' acquisition of a 13% stake in SOCAR Turkey Enerji for US$1.3 billion and Total Oil's sale of its fuel retail arm in Turkey to Demirören Group, for US$356 million. In addition, Doğan Group acquired 50% of Aytemiz Petrol and returned to the oil and gas sector after the sale of its Petrol Ofisi shares to OMV.

In February 2016, OMV announced it would sell up to 100% of its wholly owned subsidiary Petrol Ofisi, the leading company in the Turkish oil products retail and wholesale market. OMV signed the share purchase agreement with VIP Turkey Enerji AS, a subsidiary of Vitol Investment Partnership Ltd., on 3 March 2017. Vitol has agreed to acquire OMV's shares in Petrol Ofisi, subject to certain conditions precedent and relevant regulatory approvals. The total purchase price was announced as approximately €1.368 million.

Another notable transaction by a foreign investor was the sale of 51% shares in the Turkish fuel retailer Citypet, to the Lebanese oil trading company BB Energy.

SIGNIFICANT OTHER MARKET DEVELOPMENTS

EPİAŞ

One of Turkey's targets was the establishment of an energy stock exchange, which would create a whole new market of its own and become a significant investment opportunity. The EML introduced the "market operation activity", to be conducted by a newly incorporated company, namely EPİAŞ. EPİAŞ was incorporated in March 2015. Türkiye Elektrik İletim Anonim Şirketi ("TEİAŞ") and Borsa Istanbul ("BI") each hold 30% of the corporation's total shares, with the remaining 40% held by various private energy companies. Under this shareholding structure, TEİAŞ and BI hold Class A and Class B shares, whereas the private energy companies hold Class C shares.

Renewable energy

In January 2011, the Law on Utilisation of Renewable Energy Resources for the Purpose of Generating Electrical Energy (the "RER Law") underwent a significant set of amendments, in which feed-in tariffs and other incentives were introduced. With these amendments the RER Law established a renewable energy support mechanism ("RERSM"). In order to achieve Turkey's 2023 target of increasing the share of renewable energy sources to 30%, the EML and the RER Law were also amended recently, on 4 June 2016. In addition to these amendments, the Regulation on Certification and Supporting of Renewable Energy Resources (the "RERSM Regulation") was amended on 1 May 2016.

Before the amendments, power plants within the scope of the RERSM Regulation were subject to a system in which the generated energy was sold to the market operator without a generation limitation or a risk regarding the price or amount of energy generated. In addition, power plants were free of obligations regarding the balance mechanism. Therefore, they did not have to pay any imbalance expenses. The RER Law guaranteed the prices in terms of US cents, and access to loans were relatively easy due to predictable cash flows. Power plants operating under the RERSM portfolio system could sell all of their products to a market operator and they did not have to engage in any market activity. With the amendments in the RERSM Regulation, power plants within this regulation's scope may now sell the generated energy directly to the free market.

Floating LNG

In 10 March 2016, EMRA permitted floating LNG storage and regasification unit investments, categorising these activities as "storage", to secure its gas supply and reduce its reliance on Russian gas. EMRA issued the first floating LNG licence to Etki Liman İşletmeleri, a subsidiary of Limak Group.

Shale gas

The MENR estimates that approximately 551 bcm of recoverable shale gas potential is available in Turkey, notably in the south-east (particularly the Anatolian Basin and the Diyarbakir Basin) and in the north-west (particularly in the Thrace Basin and in the Sivas and Tuz Gölü Basins). Recently Norwegian Statoil and Canadian exploration company Valeura Energy Inc. signed an agreement to explore the shale gas potential in the European north-west of Turkey.

To read this Chapter in full, please click here.

Originally published in European Energy Handbook, Legal Guide Tenth Edition, by Herbert Smith Freehills.

Footnote

1. Information under this section is obtained from the Privatisation Administration's website.

© Kolcuoğlu Demirkan Koçaklı Attorneys at Law 2017

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.