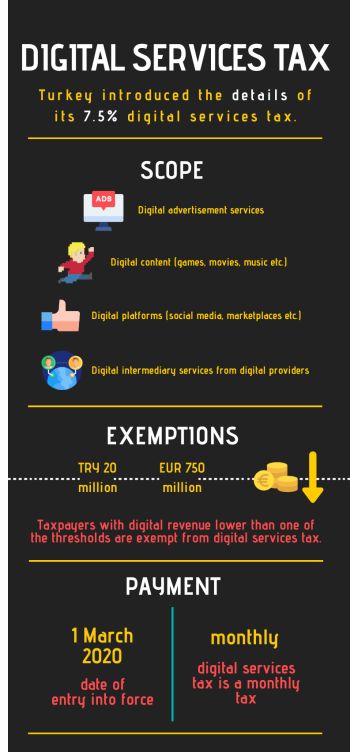

Turkey, who recently introduced digital services tax by following the footsteps of other European countries, published the secondary legislation regulating the implementation of digital services tax. Various issues ranging from the types of services subject to taxation and the exemption regime are covered by the Communiqué on the Implementation of the Digital Services Tax.

On 7 December 2019, Turkey published the Act No. 7194 which introduces a digital services tax to be effective as of 1 March 2020. Digital services tax that is adopted with the Act No. 7194 covers a wide range of services relating to digital ecosystem, and is levied at a rate of 7.5% of the revenues generated from these services. While the Act No. 7194 reflected similarities with the draft EU Directive on Digital Services Tax, secondary legislation was expected by many to clear the air. To fulfill this need, Revenue Administration published its Draft Communiqué on the Implementation of the Digital Services Tax (Draft Communiqué) on 5 February 2020 for public opinion. After detailed discussions on the Draft Communiqué, the Revenue Administration finalized its works and published the Communiqué on the Implementation of the Digital Services Tax (Communiqué) on 20 March 2020, to be effective from 1 March 2020. The Communiqué regulates many issues on digital services tax including exemptions, declaration and payment, and details the scope of the digital services tax with examples.

Which type of services are covered by digital services tax?

The Act No. 7194 regulates that the revenue generated from the services listed below, and intermediary services provided on digital platforms for the provision of the below services, is subject to digital services tax:

- All kinds of advertisement services,

- Sale of any audio, visual or digital content on digital platforms, and digital services offered to listen, watch, play or record these contents in electronic media or use them in electronic devices.

- Provision and operation of digital platforms where users can interact with each other.

The Communiqué details the types of services that are considered within scope of the above services with examples.

Search engine ads, banners, digital ads that are played with the content or video, ads automatically showed via software on electronic devices, pop-ups and similar digital ads are considered within the scope of the advertisement services that are caught by the Communiqué. Furthermore, subject to many critics, Communiqué states that technical and ancillary services related to digital ads are subject to taxation (e.g. ad control and measurement services, data transmission and data management related to digital ads).

Sale of software to be used in electronic devices, digital content (e.g. movies, music, magazines), games, and in-app features are considered within the scope of sale of digital content, hence, subject to taxation according to the Communiqué.

Revenue generated from the establishment and operation of digital platforms where users can interact with each other is also covered by the Communiqué. It shall be noted that Communiqué recognizes online marketplaces as digital platforms where users can interact with each other. According to the Communiqué, sale of services and goods through these digital marketplaces are not subject to taxation under the Act No. 7194, while the services relating to the operation of this marketplace are.

The Communiqué states that the Act. No. 7194 encompasses the digital intermediary services related to these digital service, while exemplifying digital comparison platforms are being subject to taxation.

Are there any exemptions?

Since the digital services tax is introduced as a new type of tax, taxpayer's limited or full liability status before the income tax and corporate tax schemes does not make any difference in terms of digital services tax liability. Hence, anyone generating revenue from Turkey by providing digital services are liable from digital services tax as a taxpayer.

Although income and corporate tax status of the taxpayers is not relevant, there are exemptions to digital services tax. Digital service providers with annual digital revenue in Turkey of less than TRY 20 million (approx. EUR 3.14 million) or with annual digital worldwide turnover of less than EUR 750 million are exempt from digital services tax. If the taxpayer is in a group of companies with consolidated financials, revenue of the entire group generated from digital services is taken into account for the purposes of exemption analysis.

The Communiqué also details the documentation and notification procedures for exemption. Digital service providers located abroad, whose Turkish digital revenue is above TRY 20 million but global digital revenue is below EUR 750 million, can be exempt from the application of digital services tax subject to a detailed documentation procedure. These foreign service providers must document their exemption with a report from an independent auditor who is active in five different countries including Turkey. The report and its translation can be uploaded to Revenue Administration's website for digital service tax (digitalservice.gib.gov.tr) until 30 June following the accounting period.

Apart from the exemption based on the revenue thresholds, there are certain exceptions from the application of the digital services tax (e.g. banking services, payment services, telecommunication services subject to treasury share).

It shall be noted that taxpayers can deduct the payments of digital services tax as expenses in the determination of the net profit for the income tax and corporate income tax calculation.

When and how to pay?

Digital services tax is a monthly tax, and taxpayers are obliged to submit their declarations until the last day of the month following the taxation period. Since the digital services tax is entered into force on 1 March 2020, the first taxation period is March 2020 and the last day for the first declaration is the end of April 2020. Taxpayers are able to send all of their declarations on digital services tax through the Revenue Administration's website for digital service tax (digitalservice.gib.gov.tr). The tax calculated with the rate of 7.5% of the digital revenue can be paid within the declaration period to the tax offices or to the authorized banks. Taxpayers can also make payments on the online system of the Revenue Administration.

Failure to pay may result with access blocking

The Communiqué sets out details on the measures to be taken in case of failure to pay digital service tax. Accordingly, tax authority is vested with powers to notify digital service providers with any means (including e-mails), and to announce the notification on its website. If the taxpayer fails to comply with the notification of tax authority within 30 days, access to websites and services of the taxpayer are blocked by the capacity of Information and Communication Technologies Authority.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.