In a nutshell

- A new Financial Reporting Standard for Medium-sized Entities (FRSME) is proposed. " UK corporate reporters will be in Tier 1, 1s, 2, 2s or 3.

- The new regime may come into force by mid 2013.

- Revised SORPs and more guidance for public benefit entities are likely to be issued.

- This will have wide-reaching implications for UK reporters as it will affect not only the financial statements, but also business areas such as tax, banking arrangements, systems and performance management.

On 29 October 2010 the UK Accounting Standards Board (ASB) issued its Financial Reporting Exposure Draft ('the FRED') setting out its vision for the future of reporting in the UK and Republic of Ireland – a tiered reporting structure with publicly accountable entities using full IFRSs, small private entities continuing to use the FRSSE and those in between using something new. Within this broad structure, entities may opt to move to a higher tier and subsidiaries may benefit from reduced disclosure.

The journey

In 2002 the ASB concluded that 'in the medium term, there is no case for using two different accounting frameworks in the UK'. Following a number of discussion papers and public meetings, it issued in August 2009 a consultation paper 'Policy Proposal – The Future of UK GAAP' which outlined proposals to eliminate standalone UK accounting standards for all but small companies, and to introduce a new single standard based on the IFRS for SMEs (IFRS for Small and Medium-sized Entities).

Current UK reporting

UK law permits companies to prepare their financial statements under one of two frameworks, 'IAS Accounts' and 'Companies Act Accounts'. Listed companies and companies with securities traded on AIM are required to prepare consolidated IAS Accounts. Almost all other groups and companies may choose to prepare either IAS or Companies Act accounts.

An entity has public accountability if:

- as at the reporting date its debt or equity instruments are traded in a public market or it is in the process of issuing such instruments for trading in a public market; or

- as one of its primary businesses it holds assets in a fiduciary capacity for a broad group of outsiders and/or it is a deposit taking entity for a broad group of outsiders.

Public accountability

The definition of public accountability in the FRSME is broad. Some respondents to the August 2009 proposals expressed concern that it might be difficult to determine whether or not entities met the definition and hence would be required to use full IFRSs. The FRED adds valuable application guidance here. Entities that the FRED deems to have public accountability include:

- pensions schemes and employee benefit trusts;

- banks, building societies and credit unions;

- entities that undertake the business of effecting or carrying out contracts of insurance (including general and life assurance entities); and

- investment trusts, investment companies, venture capital trusts, mutual funds, exchange traded funds, unit trusts, open-ended investment companies, custodian banks and stockbrokers.

Relief from applying full IFRSs is proposed for small publicly accountable entities that are prudentially regulated (as referred to in company law). To qualify for this relief, such an entity must satisfy all three of the Companies Act's size criteria for a small company or small group.

The proposed new regime

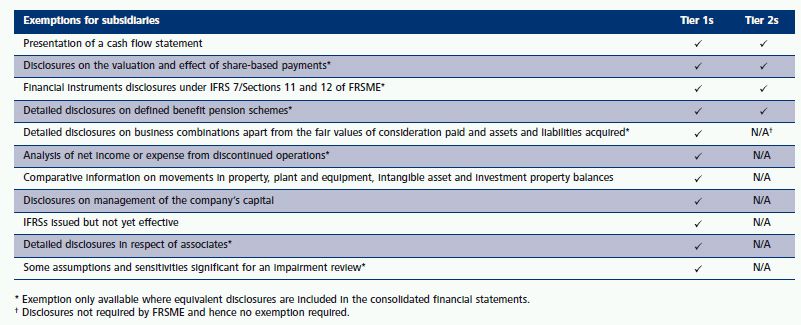

The three tiered reporting structure proposed in August 2009 remains. However, two sub-tiers have been introduced allowing subsidiary undertakings (using either Tier 1 or Tier 2) to benefit from reduced disclosure. The new structure is illustrated below.

Reduced disclosures for subsidiaries

In response to the August 2009 proposals, several listed companies noted that applying the same recognition and measurement requirements in consolidated and subsidiary accounts would be beneficial but that the extensive disclosure requirements of full IFRSs made this impracticable for groups with large numbers of subsidiaries.

The ASB agreed and now proposes that qualifying subsidiaries, being undertakings that do not have public accountability and whose parent undertakings prepare publicly available consolidated financial statements in which that subsidiary is included, may prepare financial statements using the same measurement and recognition requirements (be that full IFRSs or the FRSME) as used in those consolidated accounts but with a reduced level of disclosure. The specific disclosure exemptions were arrived at by considering disclosure exemptions currently permitted by UK GAAP and looking at those areas that are typically managed on a group basis.

In addition, consolidated financial statements using the FRSME will not be required to include a company only cash flow statement.

Public benefit entities

The ASB proposes to develop a standard for public benefit entities (PBEs) following overwhelming support from respondents to the initial idea put forward in the August 2009 Consultation. The standard will be a 'differences only' standard which addresses areas relevant to PBEs but not covered in the FRSME. Development of a PBE standard is a significant task and so it will not follow the same timeline as the FRED. The ASB anticipates its completion in 2011.

What about tax?

The tax chapter of the IFRS for SMEs is based on an IASB exposure draft to replace IAS 12 Income Taxes, which is not being taken forward at this time. This raises concerns over using these requirements in the FRSME. The FRED, therefore, proposes replacing them with the current text of IAS 12, with no simplifications or reductions in disclosures.

There are tax implications of the FRED which go beyond tax accounting. The tax impacts of transitioning to full IFRSs or the FRSME are complex and need careful evaluation by entities. Cash tax implications will arise including the taxation of transitional adjustments. As full IFRSs and the FRSME include more fair-valuing of balance sheet items, cash tax volatility may increase where the adjustments are taxable as booked. Tax teams may face increased work in applying complex areas of tax law such as the Disregard Regulations (which create a hedging regime for tax purposes in certain situations). Tax planning, transfer pricing, thin capitalisation positions and iXBRL filings may also be affected.

When will this happen?

The ASB initially proposed that the new regime should apply to periods beginning on or after 1 January 2012. This has slipped. The FRED is open for consultation until 30 April 2011. If this FRED is supported by respondents, the earliest date for mandatory adoption, taking into account an 18 month period between publication of the final standard and mandatory adoption, could be periods beginning on or after 1 July 2013 (as illustrated below). It is proposed that entities will be free to adopt the new regime at an earlier date.

Will this happen at all?

The development of the FRSME has been contentious. The FRED includes an alternative view from one member of the ASB. It is also well known that the Department for Business, Innovation and Skills has had concerns over the costs of the change (in this context, the FRED includes a lengthy Draft Impact Analysis).

The ASB has made it clear that it will carefully consider all feedback to the FRED before deciding the next steps and it is noteworthy that the Preface encourages respondents to consider whether alternative proposals might be better.

Deloitte comments

Deloitte will be responding formally to the FRED. In a public letter to the ASB in August 2010, Deloitte:

- highlighted the presentation and disclosure issues arising for entities having to comply with both the detailed accounting rules in company law and the proposed FRSME;

- urged the ASB to secure that the IFRS for SMEs may be used directly or, if that cannot be achieved, to develop an approach to manage the impact and cost for UK companies;

- suggested a more direct route for Tier 1s subsidiaries to benefit from reduced disclosures; " asked the ASB to re-examine the possibility of allowing medium-sized entities to use the FRSSE; and

- recommended that the ASB provide an integrated offering combining all the law and accounting standards needed to produce financial statements (as currently demonstrated in the FRSSE).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.