Three types of partnership are available under UK law: the general partnership; the limited partnership (English and Scottish varieties) ("LP"); and the limited liability partnership.

A LP is essentially the same as a general partnership registered under the Partnership Act 1890, except that it has two categories of partner. Each LP will have one or more general partners who have responsibility for managing the LP's business and have unlimited liability for the firm's debts and obligations. It must also have one or more limited partners who will invest capital in the LP, will not take an active role in the LP's operation, and will have limited liability up to the amount of capital that they have contributed.

The main advantage of a LP therefore is that it allows the limited partner to participate in the profits of the partnership without him incurring unlimited liability. Partners can be bodies corporate meaning a general partner, who has unlimited liability, can be a company. Thus, if set up properly, an individual creating the structure can insulate himself from unlimited liability. As well as the advantage of limited liability, another important reason to use a LP is the tax transparency that it offers.

A LP must be registered with Companies House in accordance with the Limited Partnership Act 1907, and must carry on a business in common with a view of profit. English and Scottish LPs differ in that a Scottish LP has a separate legal personality whereas an English one does not.

Despite the age of the governing legislation, LPs have important modern uses. They have a light statutory and regulatory regime compared with companies; they can vary in size from two partners to much larger LPs for complicated structures; and can be particularly useful in wealth management structures.

This case study looks at how a LP was recently used for wealth management purposes.

Case study

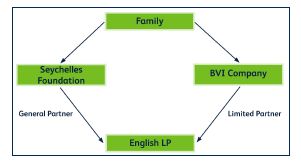

Recently, Jordans was asked to advise on the possibility of registering a UK entity for a non-UK resident family, through which to conduct an investment business.

The family wished to place the business within a reliable and respectable legal environment, and were of the view a UK company or partnership entity would provide such an environment.

The family provided three specifications for the chosen entity:

- Registration at Companies House in the UK

- No UK tax liability at entity level

- No publication of the accounts of the entity or the family

In this case Jordans registered an appropriately structured English limited partnership to achieve the family's aims.

Solution

Comment

- The English LP (ELP) is registered under the Limited Partnerships Act 1907 at Companies House with a unique registered number. The ELP must nominate a principal place of business in the UK to the Registrar of Companies. Provided that trading or investment activities are conducted outside the UK, as will be the case in this example, the designated UK place of business will not have significance from a UK tax perspective.

- The ELP is 'fiscally transparent', so there is no UK taxation at the entity level. In this case the income of the ELP is non-UK source, so the non-UK-resident partners of the ELP do not experience UK taxation on their profit shares.

- The normal position relating to UK accounts disclosure is that an ELP need not prepare or publish statutory accounts unless all the general partners are limited companies. The relevant legislation is The Partnerships (Accounts) Regulations 2008.

- These Regulations are potentially problematic for clients wishing to use corporate partners to protect the identities of the ultimate beneficial owners of ELP 'shares' or partnership interests. The exclusive use of corporate general partners triggers onerous UK statutory accounts production and disclosure requirements.

- However, the use of a Seychelles foundation as one of the general partners avoids the provisions of the UK's Accounting Regulations for this ELP for technical reasons relating to the construction of the statutory rules.

- This ELP would also be equally effective in avoiding a UK

statutory accounts production and public filing requirement if any

general partner of the ELP is , if not a Seychelles foundation as

in the instant case:

- a Jersey foundation

- a UK LLP

- an offshore LLP

- a US LLC

- The accounting rules in this area are, however, complex and professional accounting and tax advice should be taken before proceeding. Jordans Trust Company can provide this advice.

- It is anticipated that the family members will receive dividends from the limited partner of this ELP in order to participate in the profits of the ELP.

- Typically, Scottish limited partnerships (SLPs) are registered by international clients wishing to use UK limited partnerships. This is because SLPs have separate legal personality whereas ELPs do not. For some non-UK-resident clients the separate legal personality of the SLP can result in advantageous hybrid tax treatment under conflicts of laws.

- Legal personality is the only differentiator between ELPs and SLPs. Otherwise, their tax treatment under UK law and limited liability status (for limited partners only) are identical. However, an ELP was chosen in this case due to the uncertainty surrounding Scotland's political future and status at the time of the registration of the partnership, prior to the referendum on Scottish independence held on 18th September 2014.

Conclusion

ELPs as well as SLPs will be of interest to lawyers and accountants advising fund promoters and entrepreneurs wishing to operate through a well-established legal framework that is also tax efficient.

Jordans can support existing and new ELP and SLP structures in managing their financial disclosure strategies . We can register and administer ELPs and SLPs and provide supporting tax and accounting advice.

ELPs and SLPs may be of interest to Russian and other nationals wishing to structure their business and family affairs tax efficiently and securely.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.