Key findings:

- Sentiment on disposable income is stronger than at any time since Q3 2011.

- UK household conditions remain stable in the first quarter of 2013.

- The consensus is for the recovery to gain traction as 2013 progresses.

- Despite a slight improvement compared to Q1 2012, spending remains subdued.

- Looking ahead consumers remain concerned about rising utility prices.

2013 got off to an encouraging start with consumer confidence in disposable income improving for the fifth consecutive quarter.

The first quarter of 2013 has confirmed that the necessary conditions to reinvigorate consumer optimism are starting to emerge. In 2012 there were tentative signs of improvement: inflation fell which in turn helped to fuel a slight increase in discretionary spending. However, consumers remained cautious and continued to deleverage and save in anticipation of rising food and utility prices.

The latest Deloitte Consumer Tracker shows that in Q1 2013 confidence regarding disposable income is at its highest since the Tracker began in Q3 2011. There is less pressure on consumers' ability to spend as market uncertainty subsides and key macroeconomic indicators such as housing prices and retail sales start pointing in the right direction.

Moreover, consumers have healthier balance sheets, having worked hard to pay down some of their debt since the beginning of the economic slowdown. They are also reluctant to take on more debt, making the uptrend in consumer expenditure since the first quarter of 2012 even more significant. Recent Bank of England figures show that secured lending has fallen over the last four years, and although this reflects a drop in the number of housing transactions, it is also a sign that consumers are changing their attitude to debt. The consumer environment is also starting to improve. Although real earnings growth remains weak, and below inflation at just 0.3 per cent in 2012, it is better than the 1.7 per cent average annual contraction since 2008.

The question remains whether low debt interest and expectations of improving credit availability will be sufficient to give consumers enough confidence to continue to increase their spending in 2013. However with inflation forecast to rise in the next few months confidence could remain fragile.

Consumer confidence

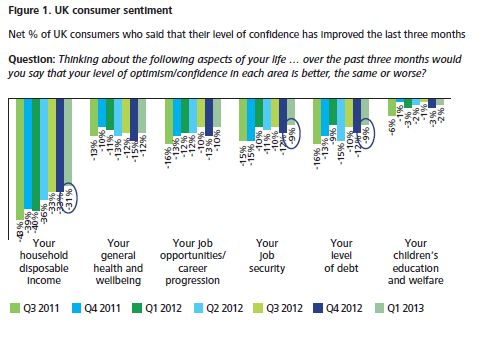

Sentiment on disposable income is stronger than at any time since Q3 2011.

While household disposable income remains the main area of concern for consumers, it has continued to improve since the launch of the Deloitte Consumer Tracker in Q3 2011, showing a nine percentage point improvement compared to a year ago (from -40 per cent to -31 per cent).

- Sentiment improved on all measures compared to the previous quarter.

- Sentiment surrounding job security improved by three percentage points this quarter, the fastest rate since Q1 2012. Similarly debt levels at -9 per cent have nearly halved since the Tracker began in 2011.

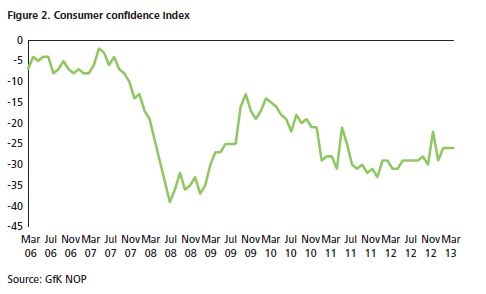

- Consumer confidence stabilised in Q1 2013 and is five points higher than at the same time last year, according to the GfK NOP consumer confidence index.

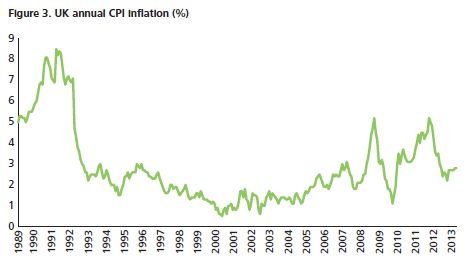

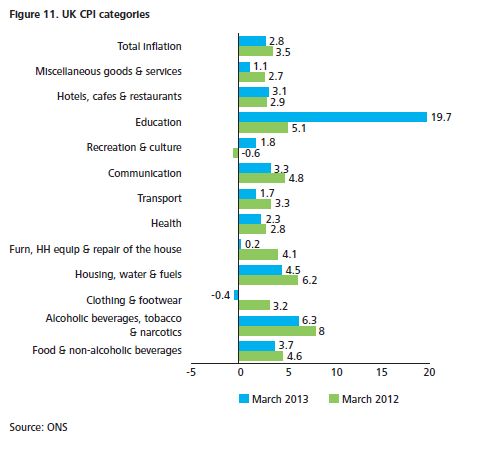

After falling steadily in 2012, consumer price inflation has edged up over the last three months reaching 2.8 per cent in February and remaining at that rate in March. The Bank of England expects that in the second half of this year inflation could rise above 3 per cent due to increasing energy prices and higher import costs.

Household disposable income

UK household conditions remain stable in the first quarter of 2013.

- While 14 per cent of UK households saw a reduction in income in the first quarter of 2013, the same proportion of households received a pay rise or bonus.

- People who received a pay rise or a bonus were twice as likely to be high income earners. In contrast those who saw a reduction of income were more likely to be from less affluent income groups.

- This polarisation is reflected in the good performances reported by retailers at each end of the retail market.

- Real earnings growth remained weak and below inflation, at just 0.3 per cent in 2012. However it is better than the average 1.7 per cent annual contraction since 2008.

- In the final quarter of last year real spending was buoyed by rising prices in energy, food and drink, and clothing.

- Overall real consumer spending has grown in each of the past five quarters by a total of around 2 per cent.

Economic outlook

The consensus is for the recovery to gain traction as 2013 progresses

- There is still a risk that the economy could enter a triple dip recession, but the consensus is for the recovery to gain traction as 2013 progresses.

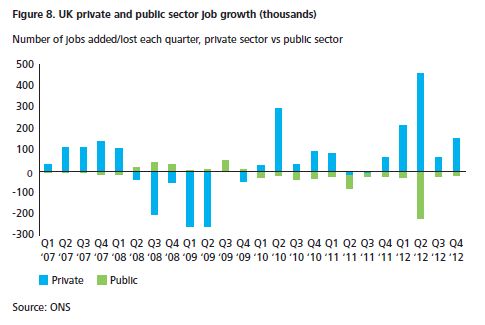

- Recent official figures indicated that the labour market's recovery stalled for the first time in 16 months as employment fell.

- Encouragingly, the latest Deloitte CFO Survey shows a strikingly broadâ€'based rise in confidence as British businesses look set to benefit from a less risky, and improving, global economic backdrop

Spending behaviour in the last quarter

Despite a slight improvement compared to Q1 2012, spending remains subdued.

- Consumers spent more on utilities in Q1 2013 as a result of increased energy prices, while spending in discretionary categories continued to ease compared to a year ago.

- Although clothing and footwear are showing an improved performance year on year, there was a deterioration in Q1 2013 following the coldest March on record.

- Spending on main household appliances increased in Q1 2013, a sign that consumers are starting to consider buying bigger ticket items.

- After four consecutive months at 2.7 per cent, despite food inflation easing, higher energy prices and the inclusion of student fees pushed inflation to 2.8 per cent in February. Inflation remained stable in March at 2.8 per cent.

- According to consensus forecasts, inflation is likely to rise above 3 per cent in the second half of 2013 and fluctuate around this level into 2014.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.