With time running down to the 4 April 2018 deadline for those employing 250+ to submit their gender pay gap reports, a few insurers have now broken cover and submitted their reports ahead of the expected stampede in the run up to the April deadline.

While too few to draw any statistically significant conclusions, the figures nevertheless do provide some very interesting snippets.

Before delving into these, it is important to remember that a gender pay gap does not necessarily equate to unequal pay – colloquially the "easyJet problem" – where the preponderance of highly paid male pilots compared to the preponderance of lower paid female cabin attendants led to a near 52% average pay difference between men and women despite easyJet having equal pay scales for each role. All this demonstrates is a slew of one gender rather than the other in specific roles of varying seniority.

So what do the statistics reported so far tell us?

- That 57% of the insurers reporting so far paid bonuses to a greater number of women than men.

- Of the amount paid in bonuses, men got significantly more than women. This ranged from 45% to 66% more on average.

- Basic pay for men is on average between 18% and 30% more than for women.

That women outnumber men at getting a bonus certainly runs contrary to some accepted beliefs and will be a surprise to many. Even delving down into the actual percentages, typically 90%+ of both genders get a bonus but with the number of women generally a few percentage points ahead of the number of men.

Less surprising is that men on average got a much larger bonus amount than women, being at least 45% and, on average, they got at least 18% more by way of hourly pay.

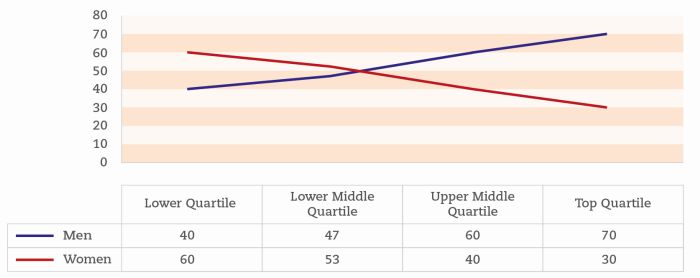

However does that tell the whole story? Remember the differences above are across the whole business, from the cleaner via the CUO to the Chief Executive and can easily be skewed by a few high earning male board members. However the distribution of men and women across the four pay quartiles (and which is likely to be a proxy for seniority) catches the eye:

What is immediately apparent is women make up 30% of the top quartile earners which, for an industry sometimes perceived as being male dominated, may come as a surprise. Similarly, in the middle two quartiles the distribution is relatively narrow at 13%. However, there can be no mistaking the two principal trends: that as earnings (and by proxy seniority) rise the percentage of women decreases and concomitantly the number of men increases.

It is not possible from the statistics to draw any conclusion on why this occurs. Gender pay more broadly is a furiously complex and often misunderstood subject and has many factors that influence it. While in some cases gender discrimination will inevitably play a part, so do other considerations such as life choices (e.g. whether to apply for a promotion), the relative attraction of each gender to particular job functions (e.g. male actuaries v female marketers or put another way female construction operatives v male midwives) and the value a business places on certain functions (e.g. higher paid pilots v lower paid cabin attendants).

However while the underlying reasons will vary, it is nevertheless undisputable that a much greater proportion of men than women progress to senior leadership based on the earnings quartiles and many in the insurance sector will think long and hard about why this is the case and what to do about it. Nevertheless of the statistics reported so far, already 30% of the top earners are women and which is a good platform from which to build.

Notably, all the insurers reporting so far have included detailed voluntary explanations around their own statistics. While the figures cannot be changed overnight, setting out the measures they are taking to address any imbalance is critical together with how they intend to encourage more women into senior roles and this will increasingly be something that prospective employees consider in deciding whether or not to join.

What these statistics do is to highlight pay differentials between the genders. While this does not necessarily equate to an equal pay problem, as can be seen from the ongoing furore at the BBC and the £4bn equal pay claim against Tesco, these issues are here to stay and eyewatering claims for equal pay across the private sector may only be in their infancy.

Gender Pay Reporting In The Insurance Sector

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.