The Covid-19 pandemic has contributed to a significant crash in the oil price. This article focuses on the impact this plummeting oil price may have on Loss of Production Income claims in energy insurance claims and whether the fixed barrel price incorporated into these policies requires more flexibility.

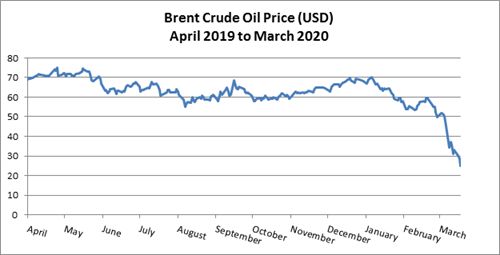

The demand slump caused by the Covid-19 pandemic, in addition to a supply surge resulting from the collapse of the Saudi-Russian oil pact, has led to a significant crash in the oil price, with Brent Crude falling to a 17-year low of US$26 per barrel. Analysts have predicted that prices could fall as low as the teens in the coming weeks, which is a far cry from the US$70 per barrel that oil and gas companies were enjoying at the start of the year.

This article focuses on the impact this plummeting oil price may have on Loss of Production Income ("LOPI") claims and considers the benefits and risks associated with providing a policy indemnity which is calculated based on a specific formula rather than indemnifying an insured's true actual loss.

The JR 2005/003A Loss of Production Income wording (the "Wording") was released in 2005 and is widely used in the London market. Subject to the policy limits, the Wording provides that an insured recovers a fixed unit price per barrel of oil multiplied by the number of lost barrels. The Wording is aimed at protecting an insured's balance sheet and cash flow, instead of putting the insured back in the position it was in before the loss.

This fixed unit price per barrel is agreed at inception of a policy and is generally un-amended throughout the policy period. The fixed unit price will be applied to calculate a LOPI claim occurring any time during that policy period and for the full duration of the recovery period (generally 12, 24 or 36 months). The mismatch between market oil prices and the agreed policy indemnity can be significant. For example, a policy which incepted on 1 January 2020 may have incorporated an agreed unit price of US$70. Despite the current barrel price of US$26, were a loss to occur tomorrow, the insured's indemnity (potentially for the next several years) would be set at US$70 per barrel.

Benefits of the fixed formula

There are significant benefits to this measure of indemnity:

- Simple calculation which rarely requires the involvement of forensic accountants, in contrast to the complicated gross profit calculations necessitated by other types of business interruption coverages.

- Provides certainty to an insured for financial planning purposes, including hedging arrangements.

- Fewer instances of underinsurance and overinsurance because production levels are the only variable, whereas pricing remains fixed and premium is charged accordingly.

- Risk is carried by both insurers and the insured as the oil price can move both ways – insurers take the benefit where the unit price is fixed low and the oil price spikes post-inception.

Disadvantages of the fixed formula

The fundamental, inherent risk with the fixed formula is the fact that a major market event could leave the agreed unit price significantly out of step with the current market price.

Whilst the price can go up and down, a global pandemic which results in a crash in the oil market, such as the current Covid-19 pandemic, means that policy indemnities being paid for LOPI claims are providing insureds with a much higher income than they would be able to obtain if they were producing. In other words, after exhaustion of the waiting period, the insured benefits from a production shutdown. This has happened before on previous occasions where the oil price has dropped but the position is exacerbated currently by the fact that this price slump is expected to be so prolonged.

The mismatch between the market price and the fixed unit price creates a possible moral hazard risk. LOPI claims are triggered by insured physical damage losses and the LOPI period of indemnity generally runs until the insured business returns to pre-loss production levels following repair of the damage (or to the end of the maximum recovery period, whichever is earliest). LOPI insurers will already be concerned that Covid-19 is going to extend repair periods due to the unavailability of personnel or materials and other operational restrictions. Consequently, the period within which an insured could reasonably have carried out a repair with due diligence and dispatch will undoubtedly be an area of focus in the coming months. Whilst moral hazard is rarely a concern in the heavily regulated oil and gas sector, there is the potential for it to arise where an insured is financially incentivised to delay repairs during their LOPI indemnity period.

Is there a solution?

The obvious solution is for the unit price to be adjusted more regularly. Whilst there is no express provision in the Wording which deals with adjustment of the unit price, any changes can be agreed during the policy period by way of endorsement and consequential adjustment of premium. This relies on pro-active engagement and agreement of both parties to the insurance contract and this can often be overlooked. An alternative would be for the wording to incorporate an automatic right of adjustment e.g. if the oil price changes by more than 10% during the policy period, the unit price will be adjusted within 30 days and premium adjusted pro-rata at final policy adjustment. This is not a straightforward solution and may not be one which is universally appealing because:

- The original unit price may have been set based on various factors which may not have reflected the market price at inception;

- An insured may have hedged or sold forward barrels at the original unit price;

- Would a 10% trigger for review be appropriate in an industry which is notoriously volatile?

- From insurers' perspective, a continual downwards trend would have a significant adverse impact on premium income.

These issues go a long way towards explaining why no unit price adjustments have been made to the Wording since it was issued in 2005. However, we are in new territory and the Covid-19 pandemic combined with the increased supply levels already in existence could be the global disruption event which causes the market to reconsider its willingness to set a fixed and unvariable unit price.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.