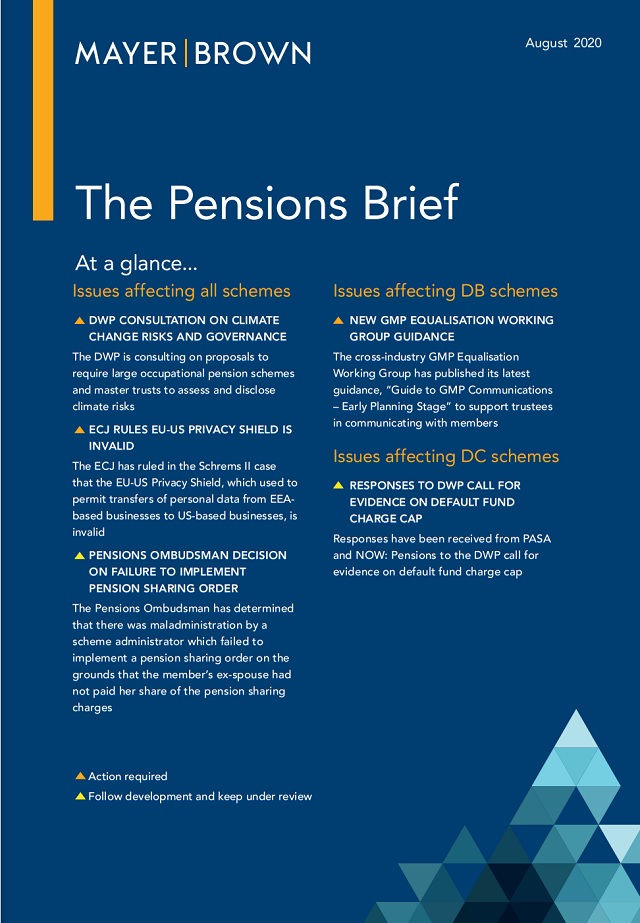

Issues affecting all schemes

DWP consultation on improving governance and reporting of climate risk

The Department for Work and Pensions (DWP) published a consultation, "Taking action on climate risk: improving governance and reporting by occupational pension schemes" on 26 August 2020. This consultation seeks views on proposals to require trustees of occupational pension schemes with £5 billion or more in assets, authorised master trusts and authorised collective money purchase schemes to:

- put in place effective governance, strategy, risk management, and accompanying metrics and targets for the assessment and management of climate risks and opportunities (to take effect from 1 October 2021); and

- disclose the above in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

It is proposed that among the activities required would be calculating the 'carbon footprint' of pension schemes and assessing how the value of the schemes' assets or liabilities would be affected by different temperature rise scenarios, including the ambitions on limiting the global average temperature rise set out in the Paris Agreement.

The TCFD disclosure report would need to be published on the scheme's (or sponsoring employer's) website and referenced in the scheme's annual report and accounts and in member benefit statements. These requirements would have to be met within seven months of the end of the scheme year which is underway on 1 October 2021, or by 31 December 2022 if earlier.

Although the current consultation relates to schemes of £5 billion or more in assets, the DWP is also proposing that schemes with assets of £1bn or more will be subject to the requirements from 2023 and that (after consultation) they would be extended to all occupational schemes in 2024.

The consultation follows on from amendments to the Pension Schemes Bill (see our February 2020 Pensions Brief) which allow regulations to be made imposing governance and disclosure obligations on pension scheme trustees in relation to the effects of climate change.

Action

Trustees should monitor developments in this area. Any responses to the consultation must be made by the closing date of 7 October 2020.

ECJ preliminary ruling in Schrems II case: EU-US Privacy Shield invalid

On 16 July 2020, the European Court of Justice (ECJ) gave a ruling that that the use of the Privacy Shield for transfers of personal data from the EEA to the United States of America (US) is invalid.

The case was brought by Mr Schrems, who made a complaint to the Irish Data Protection Commissioner that the US does not offer sufficient protection for personal data transferred to that country. His key concern related to the transfer of his personal data to the US because of the ability of the US security agencies to require internet service providers to provide them with information.

The General Data Protection Regulation (GDPR) prohibits the transfer of personal data from the EEA to non-EEA countries unless the transfer meets specific safeguards. These include where there has been an "adequacy decision", i.e. the transfer is to countries recognised by the European Commission as offering an adequate degree of protection for personal data (the level of which is in line with that of the GDPR). The Privacy Shield was one of such adequacy decisions adopted by the European Commission in 2016 which used to allow personal data transfers between EEA-based businesses to US businesses in specific sectors if they had selfcertified under the Privacy Shield framework.

In the Schrems case, the ECJ decided to overturn the adequacy decision for the Privacy Shield on the grounds that it fails to protect unnecessary and disproportionate access to EU personal data by US intelligence agencies.

The ECJ also considered whether the use of standard contractual clauses (SCCs) continued to be a valid means of transferring personal data to non-EEA countries. SCCs act as an enforceable contract between the data exporter and the data importer imposing prescriptive obligations on the parties and offering data subjects direct recourse against the data exporter and data importer in case their personal data is not adequately protected.

In the Schrems case, the ECJ ruled that SCCs can be a valid mechanism for the transfer of personal data from the EEA to non-EEA countries. However, the judgment suggests that data exporters and data importers should carefully consider whether the SCCs might be in conflict with local laws and whether it is possible to continue with the proposed data transfer to a

third country in light of the wording of the SCCs and any applicable local laws, especially relating to any access by public authorities (including intelligence agencies) of that third country to the personal data transferred.

Further details are in the briefing from our Cybersecurity and Data Privacy practice.

Action

Some pension scheme service providers transfer members' personal data to the US and so Trustees should be aware of this development.

https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2020/08/pensions-brief_aug20.pdfTo read the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.