In a recent decision (HMRC v McQuillan), the Upper Tribunal (UT) held that Entrepreneurs' Relief (ER) was unavailable on a company sale due to a class of shares carrying no dividend rights. The UT acknowledged the sellers as the kind of entrepreneurs for whom the relief was devised, but the existence of nil dividend shares had diluted their holdings below 5%.

The decision serves as a reminder to those thinking of disposing of their shares to ensure that they satisfy the requirements of ER, which are too often taken for granted. You can view our handy guide to ER here.

What is Entrepreneurs' Relief?

ER, if available on the disposal of a business or company, potentially reduces the rate of capital gains tax from 20% to 10% on gains of up to a life time limit of £10 million.

To claim ER on a share sale, an individual must:

- be an officer or employee;

- hold at least 5% of the ordinary share capital of the company;

- have at least 5% of the voting rights; and

- The company or group must be trading.

These conditions must be satisfied for the 12-month period leading up to the disposal.

The McQuillan case and ordinary share capital

The decision in the McQuillan case focused on the definition of 'ordinary share capital'. The target company being sold had share capital of 100 ordinary shares and 30,000 redeemable shares.

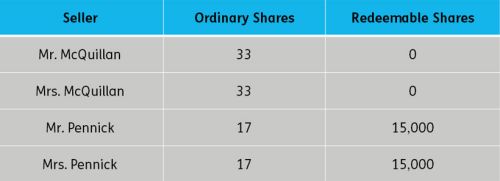

The redeemable shares had been converted from a loan at the request of an investor. They had no voting rights attached and no right to share in the profits of the company. The shares were held as follows:

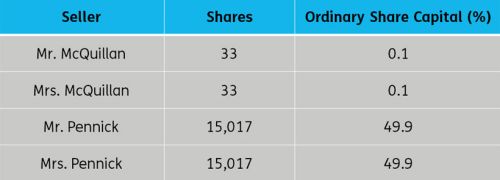

The question before the tribunal was whether Mr and Mrs McQuillan held 5% of the ordinary share capital.

Definition of "ordinary share capital"

'Ordinary share capital' is defined for ER purposes as all issued share capital of a company, unless: (1) the holders have a right to a dividend; (2) that dividend is at a fixed rate; and (3) there is no other right to share in the company's profits.

The UT held that the redeemable shares were ordinary shares because they carried no dividend right and could therefore not meet the exclusion from ordinary share capital. The UT considered that having no right to a dividend was not the same as a right to a dividend at a fixed rate of 0%.

The McQuillans therefore could not claim ER because the redeemable shares diluted them below 5% of ordinary share capital.

The UT did admit that their decision would result in deserving cases failing to qualify for the relief but the legislation made it clear what shares needed to be considered when assessing the 5% test.

Lessons to be learnt

The decision highlights the impact that different share classes can have on ER. Even if "junk" shares exist for bona fide commercial purposes, they can trigger unintended tax consequences. Carrying out a proper ER health check can help stop these problems before they arise.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.