On 28 January 2020 the Federal Trade Commission (FTC) released the annual jurisdictional adjustments for premerger notification filings made pursuant to Section 7A of the Clayton Act, known as the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act), as well as for Section 8 of the Clayton Act. The new filing thresholds for HSR notification will become effective 27 February 2020 (30 days after publication in the Federal Register), while the revisions to Section 8 became effective immediately upon publication in the Federal Register.

Civil penalties for violations of the HSR Act, which are assessed per day for each violation, increased to US$43,280 effective 14 January 2020.

HSR notification thresholds

Under the HSR Act, certain acquisitions of assets, voting securities, or interests in noncorporate entities (such as partnerships or limited liability companies) are subject to preclosing filing (with the U.S. antitrust agencies) and waiting period requirements if the applicable jurisdictional thresholds are satisfied and no exemption applies.

Each year the FTC adjusts the HSR jurisdictional threshold tests based on changes to the U.S. gross national product. The threshold changes do not affect the amount of the applicable HSR filing fees to be paid, but do affect the threshold levels applicable to each of the filing fee levels.

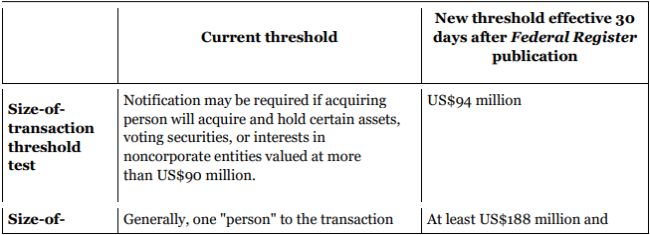

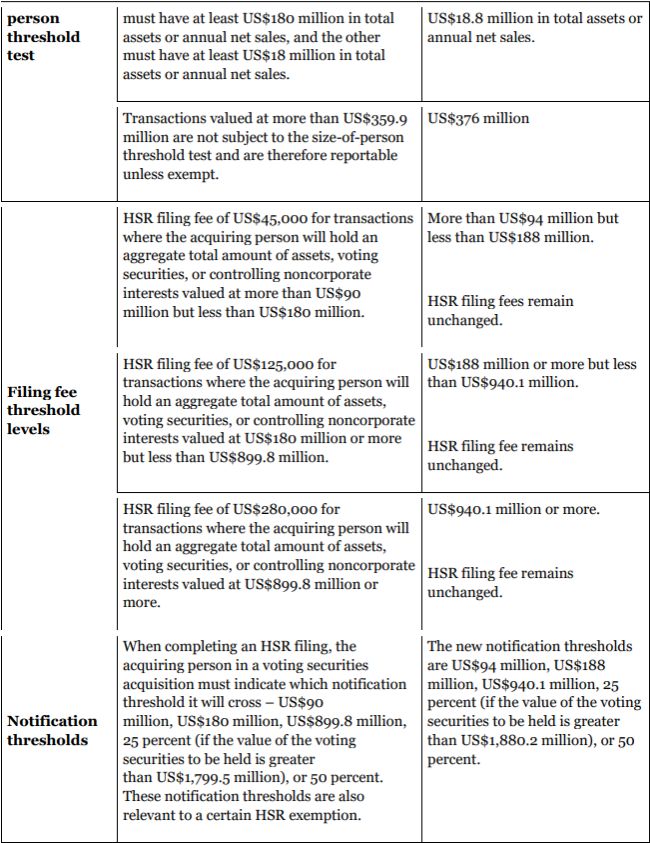

The principal changes to the HSR jurisdictional thresholds will be as follows:

Interlocking directorates threshold

Section 8 of the Clayton Act prohibits a person from serving as a director or officer of two competing corporations if certain thresholds are satisfied and no exemption applies. The FTC is required to adjust annually certain thresholds related to Section 8 based on changes to the gross national product.

Under the new thresholds, which became effective 21 January 2020 upon publication in the Federal Register, a person may not serve as a director or officer of competing corporations if each corporation has capital, surplus, and undivided profits aggregating more than US$38,204,000, unless one of the corporations has competitive sales of less than US$3,820,400. Previously, a person was prohibited from serving as a director or officer of competing corporations if each corporation had capital, surplus, and undivided profits aggregating more than US$36,564,000 unless one of the corporations had competitive sales of less than US$3,656,400.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.