In Short

The Situation: In August 2020, the Division of Trading and Markets ("Division") of the U.S. Securities and Exchange Commission ("SEC") approved proposed rule changes by the New York Stock Exchange ("NYSE") to permit primary capital raising in connection with direct listings. However, the approval was stayed in light of a third-party petition for review of the approval order. On December 22, 2020, following a de novo review of NYSE's proposed rule changes, the SEC approved the proposal, finding it to be consistent with the provisions of the Securities Exchange Act of 1934 (the "Exchange Act").

The Result: The SEC's approval of the NYSE rule changes clears the way for companies to sell newly issued primary shares in a direct listing—an SEC-registered offering and initial exchange listing with no intermediary entity serving as an underwriter.

Looking Ahead: While there continues to be a range of divergent views on the advantages and disadvantages of primary capital raising in connection with direct listings, the approval of the NYSE rule changes removes a significant limitation facing companies considering a NYSE direct listing and provides greater flexibility for companies exploring alternative paths to U.S. public company status. In a related development, on December 17, 2020, the SEC instituted proceedings to determine whether to approve an analogous proposed rule change proposed by the Nasdaq Stock Market LLC ("Nasdaq") in September 2020 with respect to its Global Select Market.

On August 26, 2020, the Division approved a proposal by NYSE to permit private companies to raise capital in connection with a direct listing on NYSE. Subsequently, a third party petitioned the SEC to review the Division's approval, and in accordance with SEC rules, the Division's approval was automatically stayed.

On December 22, 2020, following a de novo review of NYSE's proposal, the SEC determined that NYSE met its burden to show that the proposed rule changes were consistent with the provisions of the Exchange Act and approved the NYSE rule changes.

For information about the details of NYSE direct listing rule changes to permit primary capital raising, see our prior publication relating to the August 26, 2020, proposal.

Noteworthy

The approved NYSE rule changes will allow a private company seeking to list its securities to raise new capital without undertaking a traditional initial public offering ("IPO") process. Specifically, the approved rule changes will allow a private company to satisfy NYSE's market value requirement by selling at least $100 million of stock in the opening auction. Where less than $100 million of primary shares are offered, the aggregate market value of publicly held shares of the company pursuing a direct listing must be at least $250 million.

The NYSE rules will continue to mandate that generally applicable initial listing requirements be satisfied at the time of completion of the direct listing, including the requirements to have 400 round lot holders, 1.1 million publicly held shares outstanding, and a price per share of at least $4.00.

A few specific elements of the procedures that will apply for primary offering direct listing auctions are noteworthy insofar as they could potentially impact pricing and execution flexibility. For any NYSE primary direct listing:

- The issuer must identify the primary shares it seeks to sell by placing an irrevocable, unmodifiable issuer direct offering order ("IDO Order") with a "limit" price equal to the low end of a price range specified on the issuer's effective registration statement.

- The auction price, which would be determined by a designated market maker, must fall within this price range, and both the IDO Order and all better-priced sell orders must be satisfied at such price—i.e., an auction would not be conducted if the auction price would be outside of the range (higher or lower), or if there was insufficient buy-side interest to satisfy the IDO Order and all better-priced sell orders in full.

- In a direct listing where the auction price is equal to the lowest end of the range, the issuer's IDO Order has execution priority; in a direct listing where the auction price is within the range, the issuer's IDO Order (as a limit order with the low end of the range as its "limit") will be a better-priced offer and will receive execution priority.

In approving the NYSE rule changes, the SEC rejected arguments raised by the third-party petitioner and others suggesting that the rule changes would increase risks for investors by circumventing traditional IPO due diligence processes and potentially undermine shareholders' legal rights under Section 11 of the Securities Act of 1933 (the "Securities Act"). In assenting to NYSE's position, the SEC agreed that the Securities Act does not require the involvement of an underwriter in registered offerings, noted that the Securities Act's broad definition of "underwriter" would create a potential liability specter that would create incentives for robust due diligence, and reiterated the important role of other parties subject to securities law liability (e.g., issuers, directors, and accountants) in assuring that disclosures are materially accurate and complete. The SEC also noted that the NYSE rule changes offer benefits to investors, including potentially improving efficiencies in pricing and allocation mechanisms. In light of these considerations, among others, the SEC found that on balance, the rule changes were consistent with the purposes and provisions of the Exchange Act.

The NYSE rule changes provide desirable flexibility for companies exploring potential IPOs in the United States. However, companies considering a direct listing or a traditional IPO process should carefully consider the tradeoffs, costs, and benefits of each approach.

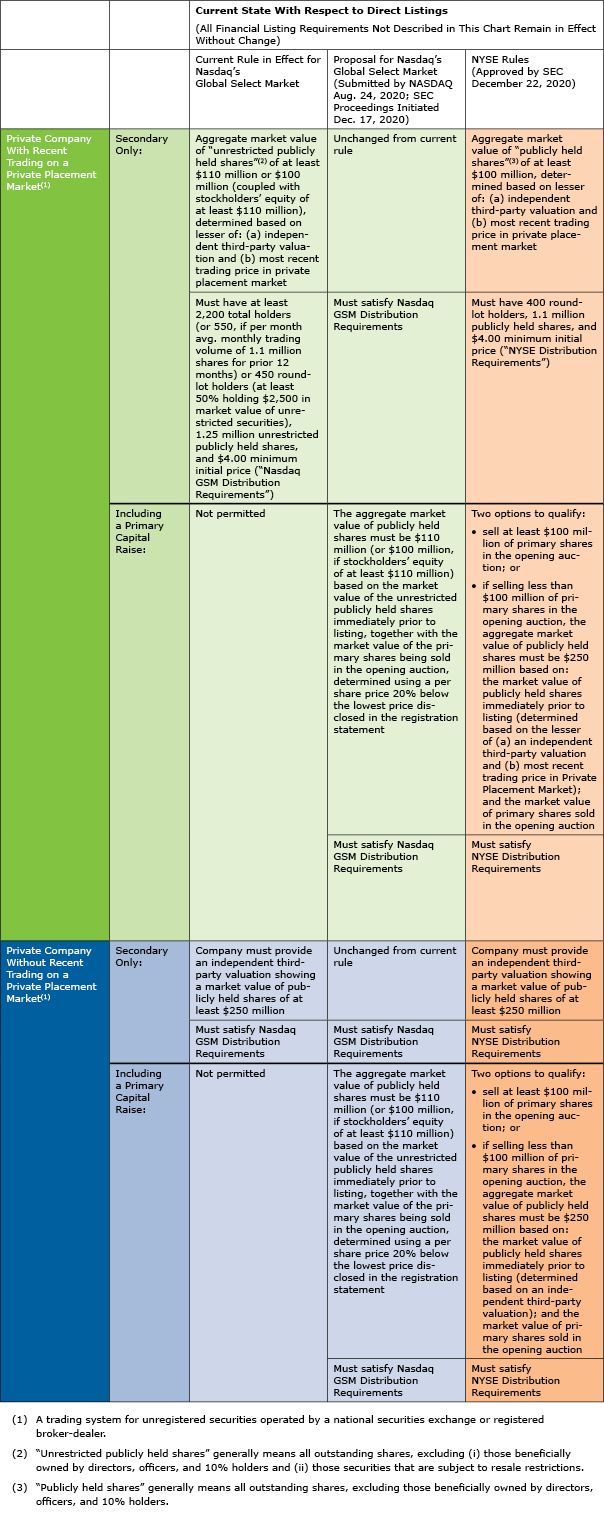

The following table highlights key aspects of the newly approved NYSE rule changes, together with the proposed rule changes for Nasdaq's Global Select Market that are currently subject to SEC proceedings, with respect to listing requirements for direct listings.

Two Key Takeaways:

- The SEC's approval of NYSE rule changes permitting primary offering direct listings provides greater optionality to issuers and is sure to increase interest in this novel path to an IPO and capital raising.

- Companies considering an IPO should, in consultation with legal counsel and investment banking advisors, carefully evaluate which approach—a primary offering direct listing or a traditional IPO—best serves the company's specific goals and needs.

Originally published January 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.