As the staffing industry continues to

benefit from a positive operating environment across most industry

sectors, owners continue to capitalize on their strong financial

performance by realizing value through either a company sale or

recapitalization transaction.

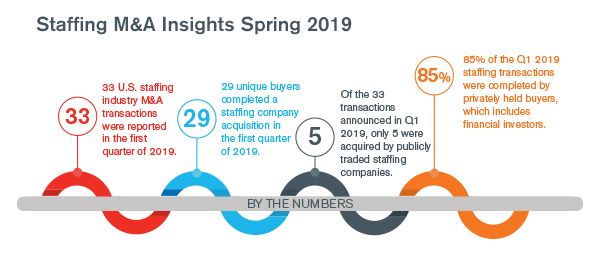

Noticeably absent from recent M&A activity are most of the

public staffing companies, as staffing industry acquisition

activity remains primarily driven by lesser-known, privately-held

buyers.

Strategic buyers accounted for 94% of the staffing industry

acquisitions in Q1 2019, with private equity funds (financial

buyers) investing in a new platform acquisition accounting for the

other 6% of transactions.

– Financial investors acquired two new platform staffing

investments in Q1 2019, following the 28 new investments in each of

2018 and 2017.

Professional staffing companies (including IT, digital / creative,

healthcare and life sciences) continue to see the most widespread

demand from buyers and investors.

Buyers continue to have very specific criteria as they evaluate

acquisition targets. Acquirers desire companies with a strong blend

of both recurring revenue growth and profitability, with

significant attention paid to customer diversification and the

gross margin impact of potential acquisitions. Proven management

teams desiring to stay on post-transaction also remain highly

sought after.

Staffing Industry Insights – Spring 2019

Sources: SEC filings, S&P Global Market Intelligence, Mergermarket, company press releases and various news sources (e.g., Staffing Industry Analysts, American Staffing Association, The Deal, The Wall Street Journal)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.