As the end of the year approaches, many employers are preparing for the annual office holiday party. This occasion presents an opportunity for employers to express appreciation for the hard work performed by staff all year. In turn, many employees appreciate the chance to interact with their coworkers outside the hectic workday.

While it might sound like a simple task, preparing for a workplace holiday event is surprisingly complicated. As we have detailed in prior articles over the years (such as here and here), there are numerous legal and practical concerns that should not be overlooked. For example, employers should be thoughtful in selecting decorations, menus, party locations, activities, and guest lists. In addition, there are tax considerations that come into play when employers give gifts to staff—and a host of other complications that can arise when employees exchange presents.

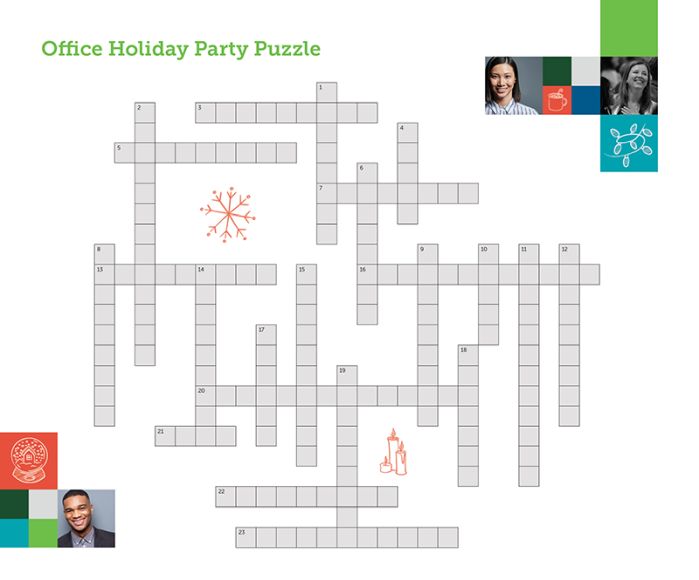

This crossword puzzle reviews some of the issues surrounding this festive holiday tradition. Answers can be found in the footnotes—but no peeking! Readers interested in clues, and more information about holiday party planning considerations, may wish to read our prior articles.

|

ACROSS |

DOWN |

|

3 One reason your food gift might fail to impress1 |

1 Requests submitted a lot this time of year, which must be handled in a consistent and fair manner10 |

|

5 Federal law protecting employees from discrimination and harassment2 |

2 A good way to limit alcohol consumption11 |

|

7 May be owed to hourly employees if required to attend the party3 |

4 Fun to share with staff – but can carry tax consequences12 |

|

13 Ground rules keep these swaps simple and fun for coworkers4 |

6 An appropriate holiday theme13 |

|

16 Type of beverage that should be offered5 |

8 Not an appropriate party themen |

|

20 It's a good idea to remind employees about this policy beforehand, especially if alcohol is served.6 |

9 Someone who serves (but doesn't over serve) drinks14 |

|

21 Never excludable as a "de minimis fringe benefit"7 |

10 Employees assigned to post about the party on social media should be_____.15 |

|

22 Describing employee attendance at the holiday party8 |

11 Be careful how you post, comment, and share, here!16 |

|

23 What should be festive, but inclusive?9 |

12 Decoration no-no17 |

|

14 Alternative party theme to promote inclusiveness18 |

|

|

15 Generally not excludable as a "de minimis fringe benefit"19 |

|

|

17 If invited, these guests can help keep the party in check.20 |

|

|

18 What type of guests should be limited for safety and security?21 |

|

|

19 Sorry about your brownies...but still banned federally!22 |

Footnotes

1 Allergies. Food gifts are extremely popular for the holidays but should be chosen with care. Many people have food allergies, dietary concerns, or religious food restrictions. Gifts of alcohol also can be problematic, as employees abstain from drinking alcohol for many reasons, such as pregnancy, substance abuse issues, medical conditions, religious principles, and personal preferences.

2 Title VII. Of course, state laws and local ordinances may offer broader protections, including coverage for smaller employers or for additional protected characteristics, such as an employee's gender identity or status as a survivor of domestic abuse.

3 Overtime. Under the federal Fair Labor Standards Act, non-exempt employees working more than 40 hours per week generally are entitled to overtime compensation. If attendance at the holiday event pushes such an employee over that 40-hour threshold, overtime may kick in. Note that state laws also may entitle employees to overtime in various situations.

4 Exchanges. If an employer allows employees to conduct a gift exchange, it should ensure that participation is optional. It should also insist that all gifts are appropriate and encourage a reasonable price limit.

5 Nonalcoholic. Alcohol consumption can quickly transform an otherwise innocuous party into a minefield of unintended consequences. Common claims that stem from such parties include sexual harassment and discrimination, as well as complaints due to injuries suffered both by attendees and third parties. Nonalcoholic options should be available—and food is also a good idea if alcohol will be offered.

6 Antiharassment. Employers with holiday parties approaching should consider reviewing and reiterating antiharassment policies, as well as any additional policies relating to employee conduct at company-sponsored events. Now might be a good time to conduct further antidiscrimination and antiharassment training and to remind employees that such policies continue to apply at the event.

7 Cash. Any amount transferred from an employer to an employee, or for the benefit of an employee, generally is considered part of an individual's gross income—even if a gift. While the Internal Revenue Code includes an exception for "de minimis fringe benefits," which might cover some holiday gifts, cash gifts are not excludable.

8 Voluntary. Unless an employer intends to pay its employees to participate in the holiday fun, attendance cannot be required. Employers may not penalize any employee who declines the holiday party invitation, no matter the reason. Relatedly, employers may want to avoid using the holiday party as a venue for business-related speeches, distributing gifts or bonuses, or the announcement of awards or promotions—all of which could imply that employee attendance is mandatory.

9 Decorations. It can be tempting to select a religious theme for a holiday party. But for nearly all employers, the purpose of the holiday gathering is not to celebrate any specific religion—it is to celebrate the employees and the organization. Accordingly, employers should be inclusive with party themes, messages, and decorations.

10 Time off. This time of year, many employers will notice an uptick in requests for time off. Employees may want to use leave time to finish up shopping, prepare for hosting the family get-together, or travel. Employers should pay extra attention through the end of the year on timekeeping and recordkeeping. In addition, employers must also make sure that they are granting time off requests fairly. All requests should be handled in a non-discriminatory manner, consistent with any existing policies or procedures governing such requests.

11 Drink tickets. If alcohol will be served at an event, there are several simple ways to reduce the likelihood that attendees overindulge. For example, employers can issue employees a limited number of drink tickets. A cash bar might also discourage excessive drinking.

12 Gifts. The Internal Revenue Code does not recognize "gifts" by employers, rendering some holiday gifts taxable income for employees. As noted earlier, the Code excludes de minimis fringe benefits, but only if: (1) an item is small in value; (2) the item is infrequently provided; and (3) it is administratively impracticable for the employer to account for it. The determination of whether a gift constitutes a de minimis fringe benefit will depend on all of the facts and circumstances.

13 Seasonal. With gingerbread houses, ugly sweaters, festive wreaths, twinkling lights, and piles of snow (in some places, at least!), there are plenty of fun seasonal themes and activities for an office holiday party. Employers could choose events based on a local sports team or tradition, or could coordinate a charitable or volunteer project for the event as means of giving back to the community.

14 Religious. While the holidays are centered around several major religious feast days, parties and gifts should generally be secular in nature. Religious themes are likely inappropriate and potentially offensive to employees and guests—which defeats the purpose of gathering in good cheer! For example, invitations should not refer to a "Christmas party" when the event is more accurately described as a "holiday party" or "end-of-the-year celebration." Employers should refrain from decorating the workplace with religious imagery, such as nativity scenes or menorahs.

15 Bartender. Along with the ideas mentioned earlier, hiring a third-party bartender can help manage alcohol consumption at an office holiday party. Employers might also limit the types of alcohol offered to beer and wine. To ensure everyone gets home safely, employers may wish to coordinate designated drivers or sponsor rides as needed.

16 Sober. If an employer wishes to post about the event on its own social media accounts, it should arrange for one very sober, very sensible employee to handle that task. Employers should keep in mind that, depending on that social media guru's job classification, the employee may need to be paid for performing such duties at the party.

17 Social media. Employers should also anticipate that employees will post comments or pictures from the holiday party. This digital attention can be positive, but it can also lead to public embarrassment for employers and attendees alike, along with other complications. With that in mind, employers should encourage employees to interact with each other, rather than their screens. Providing an optional, structured activity or entertainment at the party might help keep employees engaged. Employers should also instruct employees not to photograph, record, or post about other party guests without their permission.

18 Mistletoe. It really goes without saying...but skip the mistletoe at the office or any work function!

19 New Years. Some employers plan parties occurring in the new year, which further distances the event from any underlying religious connotations and offers a diversion during the post-holiday doldrums. This approach also can be much easier on organizations that are busy at the holidays, as well as less expensive.

20 Gift cards. As discussed above, the Internal Revenue Code treats cash as income, even if intended as gift. Moreover, cash equivalents (i.e., gift cards) are also generally not excludable as de minimis benefits, "even if the same property or service acquired (if provided in kind) would be excludable." 26 C.F.R. § 1.132-6(c). For example, if an employer gave employees a certificate once a year during the holidays that could be exchanged only for a turkey, that gift likely would be excludable as a de minimis fringe benefit. But if the same employer handed out $20 gift cards to the local grocery store for employees to buy a turkey, that benefit would not be considered de minimis.

21 Family. Some employers find that inviting employees to bring their partners and/or children to the holiday event helps keep the atmosphere family-friendly.

22 Outside. On the other hand, holiday events—especially if hosted at the office—should not be an open house. While no one wants to be a Grinch, it can become difficult to monitor the activities of non-employees, who may not be recognized, wandering around the office. Remember that inviting non-employees into the workspace grants them proximity to employees, as well as files, computers, and potentially confidential or proprietary material.

23 Marijuana. Because marijuana is legal for adult recreational use in several states, employees in such jurisdictions may feel it is appropriate to bring the drug, in one form or another, to a holiday party. This development may make employers, and employees, uncomfortable for a variety of reasons. It also poses serious safety risks. Despite the legality of possession in some states, employers still have the authority to ban pot from the holiday potluck—and from their premises generally. Employers that maintain drug-free workplaces do not need to alter their policies, although now might be a good time to remind employees in affected jurisdictions that their drug-free policy stands and will be enforced.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.