In its recent report "Holistic Review of the March Market Turmoil" (Report), the Financial Stability Board (FSB) notes that "[t]he March [2020] turmoil has reinforced the need to better understand interconnections and amplification channels in the financial system and to consider the nature of vulnerabilities in non-bank financial intermediation (NBFI) in relation to the liquidity stress and the implications of central bank liquidity support, and draw lessons about overall resilience of the NBFI sector."1 The Report also notes the need "for further work to increase the resilience of NBFI."2

The Report also notes that "non-bank financial entities – comprising investment funds, insurance companies, pension funds and other financial intermediaries – have different structures and are subject to distinct regulatory frameworks within and across jurisdictions. Their asset share has increased to almost half of global financial assets, compared to 42% in 2008, due to both inflows and valuation increases. One factor behind this increase has been the growth of investment funds, whose assets have expanded from roughly US$21 trillion in 2008 to US$53 trillion in 2018."3

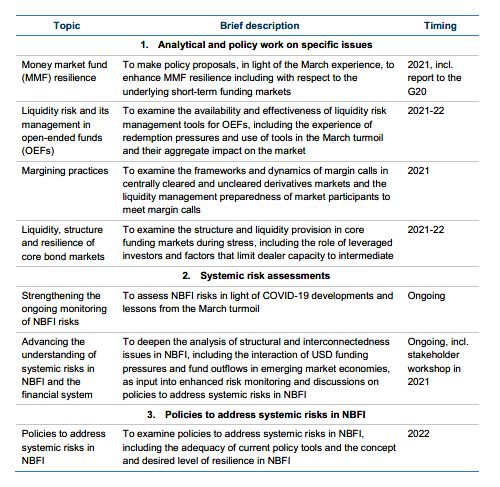

The Report states that "[t]he FSB will coordinate the international regulatory community's assessment of identified vulnerabilities and the appropriate financial policy response, working closely with standard setting bodies and member authorities. As part of this review, the FSB published a comprehensive NBFI work programme covering the key issues at a high level."

The FSB work plan is shown in the table at the end of this Legal Update (from page 3 of the Report).

The Report also recommends that, based on the FSB's analysis, the international efforts to boost the resiliency of NBFI focus on three main areas:

1. In the short term, working to examine and, where appropriate, addressing individual risk factors and specific markets that contributed to amplification of the March market shock. This includes analyzing whether mitigants put in place after the 2008 financial crisis have worked as intended and assessing implementation progress on related G20 reforms;

2. Enhancing the understanding of systemic risks in NBFI and the financial system as a whole, including the interactions between banks and non-banks, the resilience of the NBFI sector and cross-border spill-overs; and

3. Assessing policies to address systemic risks in NBFI, including the adequacy of policy tools and the concept and desired level of resilience in NBFI. These efforts to strengthen resilience in the NBFI sector should not compromise the resilience in other parts of the system or the important role that NBFI plays in financing the real economy.

This is an ambitious and complicated plan and will challenge all regulators involved to develop and use appropriate regulation to manage systemic risk without stifling innovation capital flows. All affected market participants should closely follow work done under the FSB plan and its international implementation by affected regulators.

Footnotes

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.