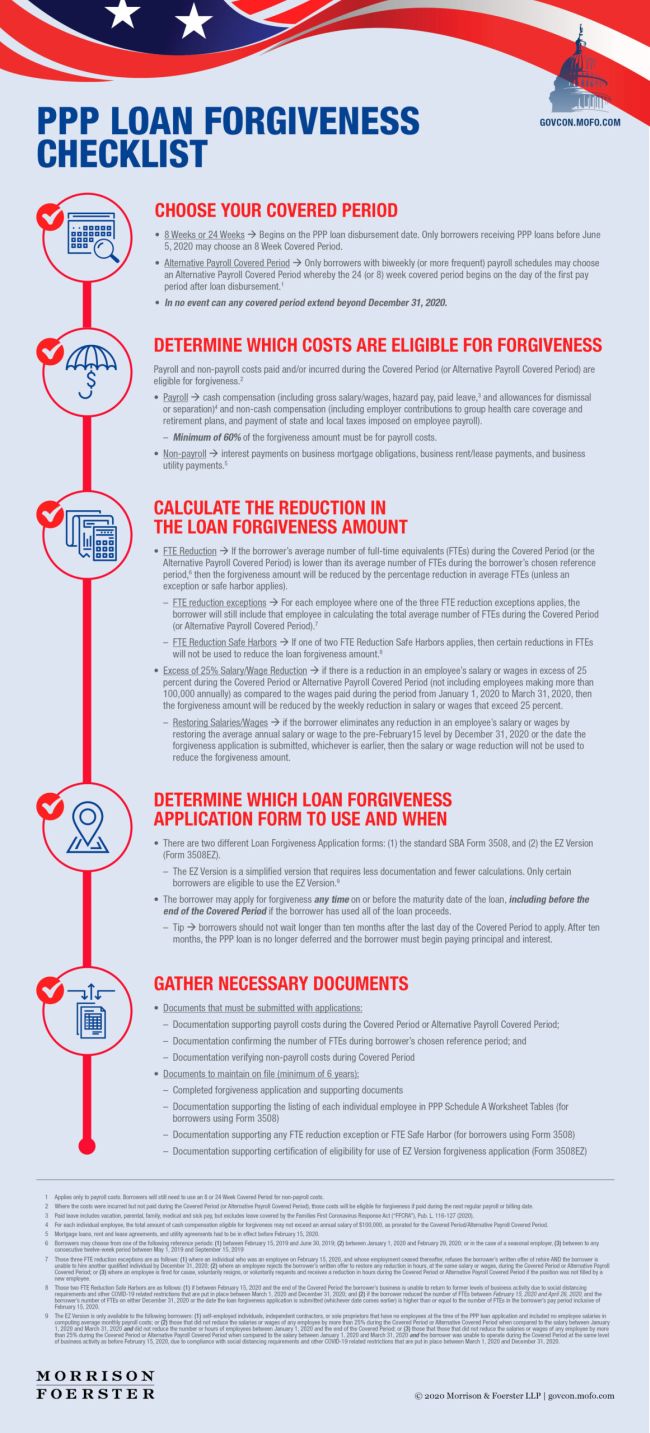

The Paycheck Protection Program (PPP), which is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, provides aid to qualifying small businesses in the form of loans with terms favorable to borrowers, including, in particular, provisions that allow potentially the entire loan amount to be forgiven if the proceeds are spent on payroll and other qualifying expenses. This infographic provides an overview of the issues borrowers must analyze, and documents to gather, when preparing their loan forgiveness applications.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved